Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The US Election is not yet “in the books” as we write this issue of “Portfolio Watch”, nor do we expect it to be anytime soon. With widespread, seemingly credible instances of voter fraud and “glitches” in software systems in battleground states, it seems pretty clear that the election outcome will be determined in court.

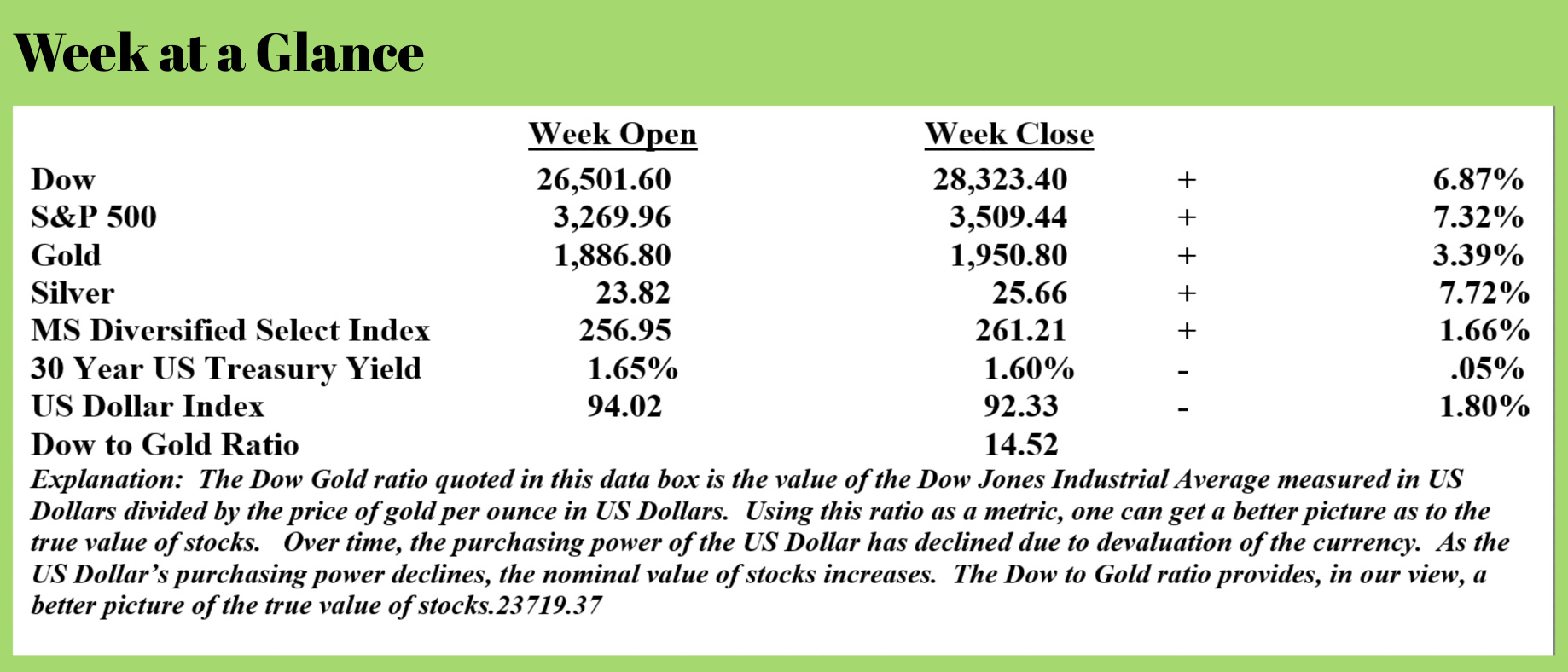

Regardless of how you see things politically, it seems that in the age of blockchain technology, there should be a better way to conduct an election without looking like a banana republic in the process. The rest of the world is watching as the US Dollar took a big hit amidst all the chaos and gold and silver surged, accelerating a trend that we have been forecasting and discussing here, on the weekly webinars and on the radio program.

We fully expect that trend to continue.

While we have our thoughts as to how the election outcome will play out, the one policy that will not likely change is the crazy levels of money creation.

That was confirmed this past week as Federal Reserve Chair, Jerome Powell, went on record stating that more stimulus is needed to help the US economy. Stimulus means money and at this point the only source of more money is the printing press.

This from “International Business Times” (Source: https://www.ibtimes.com/feds-powell-more-stimulus-needed-help-us-economy-3077182):

While the United States has done better than expected economically, the outlook "is extraordinarily uncertain," he (Powell) said.

The Fed chief warned that despite a jump in growth, "the pace of improvement has moderated" and spending has slowed, while the economy has regained just half the jobs lost in March and April.

The support provided by the $2.2 trillion CARES Act "was absolutely essential in supporting the recovery that we've seen so far, which has generally exceeded expectations," he said, but "further support is likely to be needed."

The central bank chief has been increasingly vocal in his calls for Washington to spend more to help support the recovery after most provisions of a massive stimulus measure passed in March expired.

Powell said the Fed has more tools available, however, he did not provide specifics or the certainty some analysts had been hoping to hear.

"We can certainly look at new facilities" if the situation deteriorates, he said.

But "if you want to get the economy back as quickly as possible to where we want it to be, then really it should be all of government working together."

He said the Fed is considering again extending its corporate lending facility beyond the current December 31 expiration date.

It also could ramp up the already massive purchases of government debt and mortgage-backed securities to keep money flowing through the US economy.

Smart investors will dig down on Powell’s statement, “We can certainly look at new facilities if the situation deteriorates.”

What does that mean exactly?

The Fed has already:

-printed money and purchased assets (many of them toxic assets) from member banks

-loaned newly printed money to the US Treasury which has, through the use of SPV’s engaged in purchasing private, corporate bonds

-begun to monetize the US Government’s operating deficit in a roundabout way so has to (possibly) remain compliant with the Federal Reserve Act that forbids the Fed buying newly issued debt directly from the government. The monetization works like this: big banks buy newly issued government debt, the Fed prints money, the Fed uses this newly printed money to buy the newly purchased US Government debt from the big banks.

So what ‘new tools’ might the Fed implement?

While this is pure speculation at this point, there really aren’t too many more places the Fed could go. While this list is not exhaustive, here are some thoughts.

One, while the Fed is not directly engaging in the stock market, SPV’s could be used to buy stock. This would be a parallel move to the bond purchases the US Treasury is making via the aforementioned SPV’s.

Two, negative interest rates could be implemented. Past Federal Reserve Chair, Alan Greenspan has openly stated that negative is ‘just a number”. While this is a possibility, it is more easily implemented with a digital currency.

Three, more ‘helicopter money’ or money distributed directly to the population. The $1200 stimulus checks distributed earlier this year was a form of helicopter money. This could be expanded on.

The point is this.

ALL of the above options or any other options that the Fed might creatively develop will require that the central bank create more money.

Given current circumstances, more money creation seems inevitable. That means that tangible assets and assets related to or tied to tangible assets make sense for investors to consider.

For many years in this publication, on the radio program, and in our monthly, written client newsletter, “The You May Not Know Report”, we have suggested that investors consider the merits of owning physical metals as part of their portfolio. This recommendation has proven itself to be a good one.

It will likely continue to be good advice for the near-term as well.

In the book “Revenue Sourcing”, the idea of using a revised two-bucket approach is discussed in detail. “Revenue Sourcing” suggests the use of a stable asset bucket and an inflation hedge bucket. Assets are divided between the two buckets. The stable asset bucket uses stable assets, often collateralized by tangible assets. It is from this bucket that income can be taken. The inflation hedge bucket contains assets that will tend to perform better in an inflationary environment. Many of these assets are also tangible or tied to something tangible.

As monetary policy evolves and policies change moving ahead, we will work to keep you apprised as to strategies that you may want to consider for your own personal financial situation.

Another less-discussed aspect of money creation is the effect it has on the reported economic data, especially Gross Domestic Product or GDP. GDP is the total economic output.

In the United States, GDP is reported in US Dollars. As US Dollars are devalued, GDP increases even if economic production doesn’t.

Let’s look at this in a bit more detail.

For simplicities sake, let’s say a car company produces 100 cars per year. Fifteen years ago, these cars cost $40,000 apiece. That company’s contribution to GDP was $4,000,000.

Today, after a real inflation rate (or dollar devaluation rate of 7% per year), those same 100 cars might cost $75,000 each. That means the company’s contribution to GDP is now $7,500,000.

The company’s contribution to economic output has nearly doubled. Great progress, right?

Not so fast. When adjusted for the real inflation rate, economic output didn’t change.

When GDP is reported, it is adjusted for the official rate of inflation. The official rate of inflation is vastly different than the real inflation rate. We would define the real inflation rate as the actual experience of a consumer who is engaged in commerce in the economy.

For example, “Portfolio Watch” readers who are also Social Security recipients will receive a cost-of-living adjustment to their Social Security benefits of 1.3%. That 1.3% increase is the official inflation rate. Anyone who has paid a doctor bill or purchased groceries knows that 1.3% annualized inflation rate is a severe understatement.

If the real inflation rate is 7% but the officially reported inflation rate is 2%, that means the reported GDP number grows by 5% each year even though economic output hasn’t changed.

Money printing and the subsequent inflation it causes is not only a tax on savers and investors, but it also leads to skewed economic data.

US Gross Domestic Product is presently just north of $21 trillion annually. Measured in gold at the current price of $1950 per ounce, GDP is about 10.8 billion ounces of gold. In calendar year 2000, GDP was $10.25 trillion. At a gold price of about $280 per ounce, economic output was 36 billion ounces of gold.

Using that metric economic growth has declined.

More on this next week.

This week’s radio program features an interview with investment newsletter publisher, David Skarica. We talk about the investment sectors that David likes presently.

The interview is now available on the podcast which you can access through the RLA app.

If you don’t yet have the RLA app, you can download it by visiting www.RetirementLifestyleAdvocates.com.

The RLA app gives you free access to all our resources.

“Few men have virtue to withstand the highest bidder.”

-George Washington