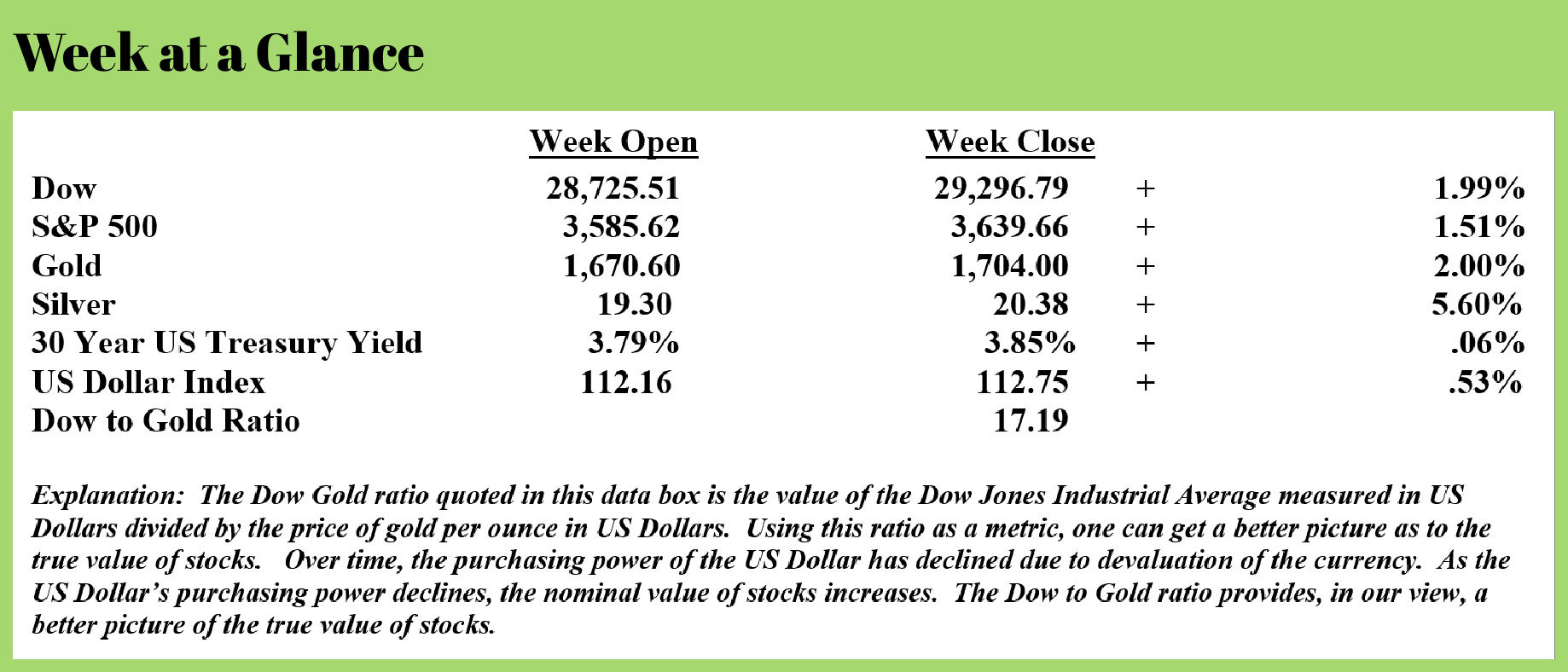

Weekly Market Update by Retirement Lifestyle Advocates

I have long stated my opinion that, at some future point, the Federal Reserve will reverse course and begin to pursue loose money policies again reducing interest rates and once again engage in quantitative easing.

I have discussed the reasons that I believe this will happen in detail in past issues of “Portfolio Watch” so in the interest of brevity, I won’t recite the reasons in detail again but suffice it to say that debt levels are too high to allow for interest rates to be increased to a level that would subdue inflation.

Ultimately, the economic path on which we find ourselves leads to a predictable destination. I have often also quoted Thomas Jefferson who told us that if we put private bankers in charge of monetary policy they would destroy the economy first by inflation and then by deflation.

Inflation, succinctly defined, is an expansion of the currency supply.

Deflation, accurately described, is a contraction of the currency supply.

Price increases are a symptom of inflation while a decline in the price of assets is a symptom of deflation.

At this point in time, we have seen inflation in consumer prices and we’ve seen evidence of deflation as stock prices have collapsed this year.

Now, however, there are more signs of deflation becoming more apparent.

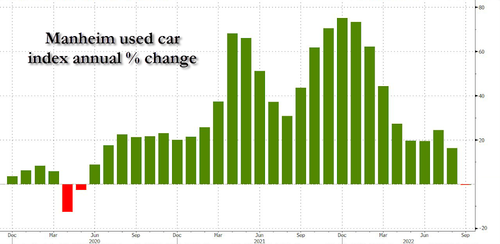

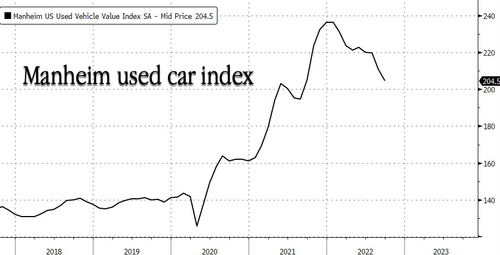

Used car prices are beginning to decline perhaps signaling that deflation is beginning to emerge. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/used-car-prices-record-first-annual-drop-two-years-luxury-car-prices-take-beating):

Used car prices appear to moderate as the latest report from auction giant Manheim found that wholesale used-vehicle prices recorded the first annual drop in more than two years.

Manheim's wholesale used-vehicle prices fell 3% in September versus the prior month. The index declined to 204.5 and is down .1% from a year ago, the first annual drop since May 2020.

Prices are still elevated but down about 13.5% from the all-time high of 236 in January.

In April, we asked the question: "Are Used Car Prices About To Peak For Real This Time?" Followed by a note one month later titled "Used Car Prices Are Crashing At A Near Record Pace." And by August, we found that "Used-Car Market Cools As Prices Plunge To One Year Low."

Unpacking today's report, compact cars had the most significant yearly increase last month at 5.9%, followed by vans and pickups, both of which increased by 0.8%. Increasing demand for smaller, more fuel-efficient cars could be due to consumer shifts away from gas-guzzling SUVs. Meanwhile, midsize car prices were marginally lower, but what caught our eye was the significant decline in luxury vehicles, down 4.8%.

Over the past couple of weeks, I’ve noted that real estate is beginning to show signs of weakness. This week, “The Epoch Times” reported that mortgage applications are at 25-year lows. That’s a remarkable statistic when you consider it. (Source: https://www.theepochtimes.com/mortgage-application-pace-plunges-to-25-year-low-as-housing-recession-deepens_4776637.html)

The pace of mortgage applications has fallen to a multi-decade low amid high housing interest rates, according to the latest data from the Mortgage Bankers Association (MBA).

The Market Composite Index, a measure of mortgage loan application volume, declined by 14.2 percent on a seasonally adjusted basis for the week ended Sept. 30, 2022, compared to a year earlier. The Refinance Index fell 18 percent from the previous week, while the Purchase Index registered a decrease of 13 percent.

Joel Kan, MBA’s associate vice president of economic and industry forecasting, pointed out that overall mortgage application activity dropped to its “slowest pace” since 1997, according to a press release on Oct. 5.

For the week ended Sept. 28, 2022, a 30-year fixed-rate mortgage was 6.70 percent, which is more than double what it was a year ago, at 3.01 percent.

“The current [mortgage] rate has more than doubled over the past year and has increased 130 basis points in the past seven weeks alone,” Kan said.

“The steep increase in rates continued to halt refinance activity, and is also impacting purchase applications, which have fallen 37 percent behind last year’s pace.”

Mortgage numbers were also affected by Hurricane Ian hitting Florida last week, as it triggered widespread evacuations and closures, he noted. Mortgage applications in Florida alone fell by 31 percent.

Construction spending in the country, an indicator of total spending on all types of construction, had fallen for the second consecutive month in August, according to a U.S. Census Bureau report, signaling that the housing market is slipping further into a recession.

In July, the National Association of Realtors (NAR) had warned that the United States was in a “housing recession,” as existing home sales fell by 5.9 percent.

I expect that deflationary forces will soon take over and the fact that the economy is in a recession is a fact that I believe will soon become widely accepted. I also expect the recession to be deeper than anything we’ve experienced in recent memory.

Keith McCullough, who is CEO and founder of Hedgeye Risk Management recently did an interview with “Market Watch” (Source: https://www.marketwatch.com/story/this-stock-market-strategist-says-the-coming-recession-could-be-the-biggest-ever-i-recommend-prayer-11664819562) in which he makes a similar forecast.

Here are some excerpts from the interview:

Recession today is what “transitory” inflation was a year ago. The Fed is as wrong on recession risk as they were on inflation.

I’m about as bearish as I’ve been since 2008. Instead of the economy having a soft landing, I think the landing is going to be hard. The recessionary economic data keeps getting worse, not just in the U.S. but in Europe as well.

Free money forever created behavioral problems and a behavioral bubble for the markets and investors. You believe you’ll have unlimited access to easy money and your behavior, whether you’re building profitless growth companies through storytelling or cryptocurrencies that also are just stories. You’re coming from the mother of all behavioral bubbles that now will be addressed with tighter money. When you’re printing money and the economy is accelerating to the fastest growth rate ever, you’re going to have the mother of all bubbles. Now, GDP is going to slow to zero, and you get the opposite.

Unfortunately, I believe Mr. McCullough is spot on.

This week’s radio program and podcast is an interview with Karl Deninger of market-ticker.org.

I get Karl’s forecast for the economy, real estate, and future monetary policy. You can listen now by clicking on the "Podcast" tab at the top of this page.

“I believe in equality for everyone, except reporters and photographers.”

-Mahatma Gandhi

Comments