Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

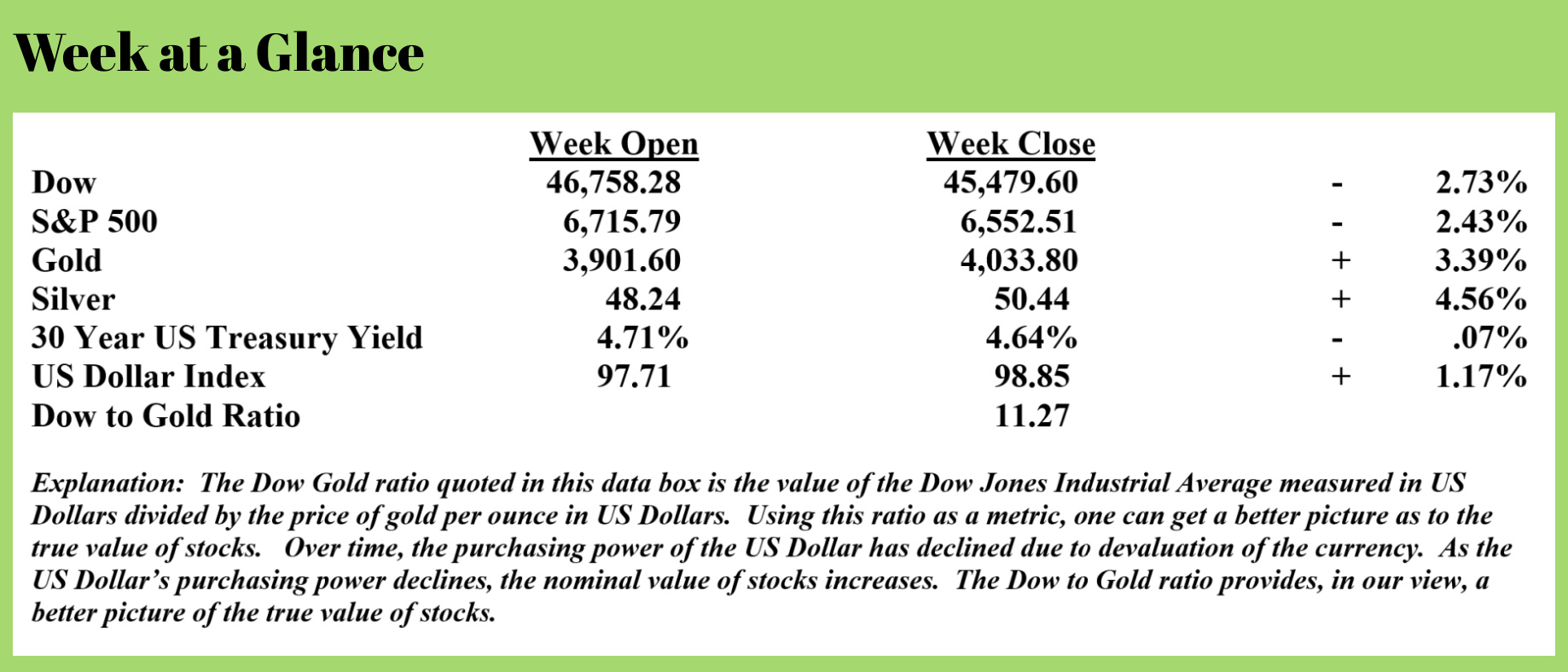

The Real Story Behind the Recent Monster Rally in Precious Metals

In a recent article (Source: https://vongreyerz.gold/the-hidden-history-of-policy-theft-skyrocketing-gold), Matthew Piepenburg offered an on-target perspective on the ongoing rally in precious metals. The link to the article is above.

He offers numerous historical examples of policymakers and politicians who intentionally devalue a currency to pay down otherwise unpayable levels of debt. This currency devaluation pattern is completely predictable because the collective behavior of groups of politicians is predictable.

Policymakers have three choices to eliminate deficits and pay down debt: raise taxes, cut spending, or print currency. When the debt levels become too large, currency creation or devaluation is the policy du jour of the political class.

One of the first recorded instances of this is during the Roman Empire. Over a period of about 250 years, the Roman currency, the Denarius, went from being a coin comprised of about 100% silver to a coin containing no silver. Since paper currency had not yet been utilized, this was the method that the political leaders used to devalue the currency.

This idea of ‘borrowing in dollars and repaying in dimes’ via currency creation was used many times after the Romans first utilized it. In Medieval Europe, gold coins were replaced with copper coins. France in the 18th century printed paper currency to debase the currency twice, once in the early 1700s and once in the late 1700s. Of course, there are more recent examples with which you are undoubtedly familiar, like Weimar Germany after World War I, and even more recently, Zimbabwe and Venezuela.

Now, the US is on a similar course. Debt levels are unpayable. The national debt that is now approaching $38 trillion is dwarfed by the total fiscal gap of the United States, which includes the national debt as well as unfunded liabilities of programs like Social Security and Medicare. The fiscal gap is now more than $200 trillion. It is mathematically impossible to raise taxes to solve that financial problem, and cutting spending to balance the budget and pay down the debt would catapult the country into a deflationary depression.

So, the only remaining option is currency creation. The recent mammoth rally in gold and silver is not reflective of the metals being more valuable – they’re not. An ounce of gold selling for $4,000 per ounce makes the same number of rings as an ounce of gold that sold for $20 per ounce in 1933. The difference is the purchasing power of the currency in which gold is priced, which is, in this case, US Dollars.

This trend will have to continue given the numbers. Have you adjusted your income model and investment allocations accordingly?

Is the Artificial Intelligence Bubble About to Burst?

2025 has been a bit of a bipolar year for the stock market. From January to early April, US stocks fell, but since that time have rebounded nicely.

I recently noted how overcooked this market looks. The Buffet Indicator, which measures total stock market capitalization compared to Gross Domestic Product, is now in the nosebleed 220% range, an all-time high.

Another less discussed fact about the stock market is that the rally since April has not been broad-based; instead, much of the rally can be attributed to AI. “The Financial Times” recently published a piece penned by Ruchir Sharma, who notes that 80% of stock market gains so far in 2025 have come from AI stocks.

Here is one example. OpenAI is a start-up AI company with an estimated current $500 billion valuation according to “Bloomberg,” making it one of the hottest start-up industries of all time. But I’d suggest to you that a trillion-dollar valuation for this sector is sheer lunacy. “Barrons” reports that AI represents 3.4% of the US gross domestic product and about 25% of all non-residential private investment. Here’s the rub: the AI sector has large and growing losses – the numbers just don’t make sense.

I’m giving away my age here, but this reminds me of the dot-com technology bubble of the late 1990s. The dot.com technology was real and is now part of everyday life, just like AI will almost certainly be, but the stock prices were just plain crazy for companies that had never made a profit. To quote Mark Twain, history may not repeat itself, but it most certainly rhymes.

Here’s the question for you to consider: What does your portfolio look like when the AI bubble pops, taking the rest of the market with it?

Predictable Economic Cycles and Where We Are Now

In my book “New Retirement Rules”, I describe the predictability of the economic conditions that follow currency creation, a.k.a. quantitative easing. Currency creation is initially followed by a prosperity illusion (a period of prosperity that doesn’t last), which is followed by inflation, which is followed by deflation and a contracting economy.

In today’s economy, since the Federal Reserve has only one play left in its playbook – pursuing easy money policies, the deflation part of this predictable cycle may have us experiencing deflation in real terms while we continue to see inflation in nominal terms. Here is what I mean by that. Priced in what has always been real money, gold, we are seeing asset prices fall, while these same assets priced in dollars have us seeing nominal increases (as opposed to real increases). A nominal increase is reflective of currency devaluation.

During the deflationary part of the cycle, debt has to be purged from the system once the system has reached its capacity for debt accumulation. Seems we may now be entering that part of the cycle. Auto loan debt is now more than $1.66 trillion, and defaults, delinquencies, and repossessions are approaching levels not seen since just before the financial crisis of 2008. That’s according to The Consumer Federation of America. Credit card debt is at $1.2 trillion with a delinquency rate of 7% to 8%. These are levels last seen at the time of the financial crisis. Chapter Seven bankruptcies are up 15% from the same period in 2024, and home foreclosure sales are up 22.5%.

RLA Radio

The RLA radio program this week features a ‘best of’ interview that I did with Mr. Martin Armstrong of Armstrong Economics. The podcast is available by clicking the "Podcast" tab at the top of this page.

Quote of the Week

“Never have children, only grandchildren.”

-Gore Vidal

Comments