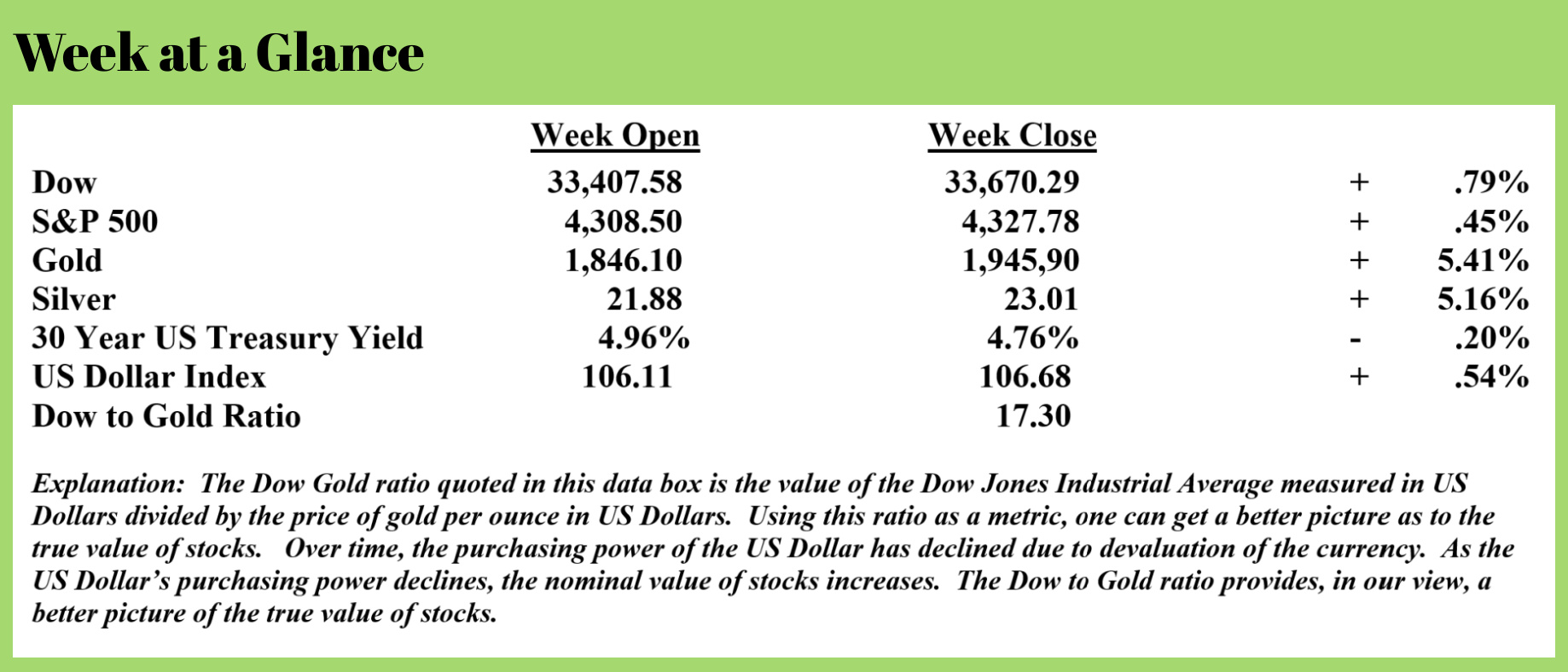

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

It’s no secret that I have been forecasting stagflation – defined as a contracting economy (recession) and rising consumer prices.

There are those who disagree with me.

There are also those who are attempting to put a good spin on the current situation. Count Nobel Prize-winning economist Paul Krugman among this group.

As one who leans toward the Austrian school of economics, I’ve never been a big fan or follower of Krugman. After Mr. Krugman’s latest comments, I feel validated in my opinion.

follower of Krugman. After Mr. Krugman’s latest comments, I feel validated in my opinion.

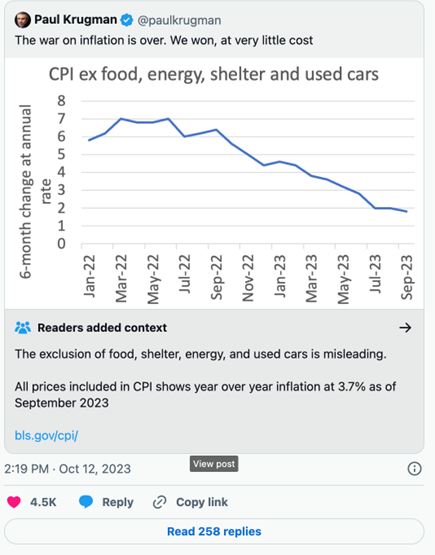

Mr. Krugman recently posted on X (formerly Twitter). I’ve republished his post here.

Note that Mr. Krugman states that if one excludes the cost of food, energy, shelter, and cars, we have already won the battle against inflation! (?)

In other words, if one just excludes the things that we all must buy, there is no inflation.

Jim Bianco, President of Bianco Research, was one of the many analysts who called out Krugman. (Source: https://www.businessinsider.com/paul-krugman-inflation-chart-food-energy-gas-housing-prices-economy-2023-10).

“A totally ridiculous measure,” Bianco said of Krugman’s post. “It excludes 55% of the index.”

The reality is that Americans are still feeling the effects of inflation.

While the rate of inflation has slowed, prior price increases are still baked into current prices, and existing inflation compounds those already elevated prices.

“Statista” discovered in a survey that the average American has found that modest pay increases have not kept up with inflation, leaving them left with less than they had previously. This from “Zero Hedge”. (Source: https://www.zerohedge.com/personal-finance/how-americans-responded-inflation-crisis)

For large parts of the past two years, inflation has been a major concern for millions of Americans,  as the significant increase in prices for many day-to-day purchases has eaten away at their buying power.

as the significant increase in prices for many day-to-day purchases has eaten away at their buying power.

As Statista's Felix Richter notes, not only has inflation neutralized any pay increases, but many Americans were actually left with less than before as wage growth couldn’t keep up with surging prices for essential goods and services, including food, gas and rent.

As a response, many Americans have had to cut back on non-essential spending or find other ways to save some money.

According to findings from a joint survey of Statista Q and We Are Social conducted in April 2023, 64 percent of U.S. adults said they spent less on non-essentials, while an equally high share of the 1,009 respondents said they paid more attention to bargains or deals. Only 11 percent of respondents said they didn’t change their behavior at all, showing how universal the impact of inflation has been.

Interestingly, while Krugman says the inflation battle is over, nearly 2 of 3 Americans say they are spending less on non-essential items and also shopping for deals.

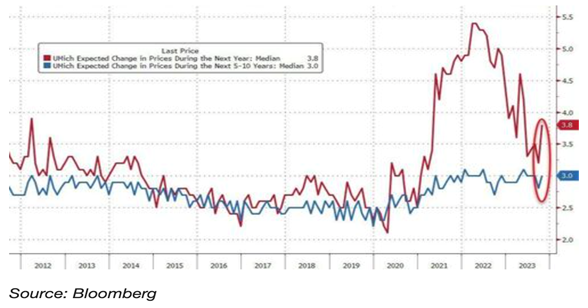

The University of Michigan’s latest consumer sentiment survey found that consumers expect more inflation in the future. This from “Zero Hedge” (Source: https://www.zerohedge.com/personal-finance/inflation-expectations-explode-higher-october-umich-sentiment-slumps):

expect more inflation in the future. This from “Zero Hedge” (Source: https://www.zerohedge.com/personal-finance/inflation-expectations-explode-higher-october-umich-sentiment-slumps):

UMich inflation expectations soared in preliminary October data, with the year-ahead inflation expectations rose from 3.2% last month to 3.8% this month. The current reading is the highest since May 2023 and remains well above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations edged up from 2.8% last month to 3.0% this month...

More evidence that consumers disagree with Mr. Krugman.

Meanwhile, US Government debt continues to balloon, and balloon quickly. This from “RT” (Source: https://www.rt.com/business/584657-us-national-debt-surge-record/):

US national debt surged by more than $500 billion in just 20 days to reach $33.5 trillion, according to data provided by the Treasury Department last week.

On September 18, the Treasury reported that the amount of money borrowed by the federal government to cover operating expenses stood at $33.04 trillion. It took Washington three months to drive it from $32 trillion to the current level.

The debt ceiling, which was legally set at $31.4 trillion, was surpassed in January 2023.

The total output of the US economy was only $25.46 trillion, meaning that the economy would have to grow by 33.5% to cover the national debt.

The numbers speak for themselves.

U.S. Government debt grew by half a trillion in less than three weeks!

The debt accumulation trajectory is reaching a level that will, in my view, have to result in the Federal Reserve resorting to more currency creation. That will further fuel the inflation that has altered the lifestyle of all but 11% of the American population (see article above).

Meanwhile, in other news, the government of Zimbabwe has introduced a digital currency backed by gold. Interesting that a country that once destroyed its currency by currency creation is now floating the concept of a gold-backed currency. This from “Coin Telegraph”. (Source: https://cointelegraph.com/news/crypto-zimbabwe-gold-backed-digital-token-payment-method)

The Reserve Bank of Zimbabwe first introduced its new project in April, with each issued digital token backed by a physical amount of gold held in the bank’s reserves.

On Oct. 5, the gold-backed digital token called, Zimbabwe Gold (ZiG), officially launched as a payment method. The launch was announced by the Reserve Bank of Zimbabwe (RBZ).

The RBZ introduced its new project in April 2023, highlighting that every issued digital token would be backed by a physical amount of gold held in the bank’s reserves. The RBZ first started issuing physical gold-backed tokens in 2022, claiming their successful adoption.

The mission behind both physical coins and the newly introduced ZiG is to persuade local investors to put their money into national assets and not United States dollars, which is not an easy task in a country with triple-digit inflation. RBZ Governor John Mangudya stated:

“The issuance of the gold-backed digital tokens is meant to expand the value-preserving instruments available in the economy and enhance divisibility of the investment instruments and widen their access and usage by the public.”

The digital tokens can be stored in either e-gold wallets or e-gold cards and are tradeable for peer-to-peer and business transactions.

History teaches us two things about fiat currencies (currencies with no backing by gold or silver):

- Fiat currencies always fail. The failure rate of fiat currencies historically is 100%. We are not debating the ‘what,’ only the ‘when.’

- When fiat currencies fail, a hard money system, typically gold or gold and silver, emerges to replace the failed fiat currency.

This time will be no different in my view.

Got gold?

The radio program this week features an interview that I conducted with Kerry Lutz, founder of the Financial Survival Network.

Kerry and I discuss his outlook for the US economy and the financial markets moving forward.

Jeremy Bolker interviews me as well.

It’s an information-packed program that is available today by clicking on the "Podcast" tab at the top of this page or at most podcast resources.

“If printing money created wealth, there would be no poverty left on earth.”

-Ron Paul

Comments