Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

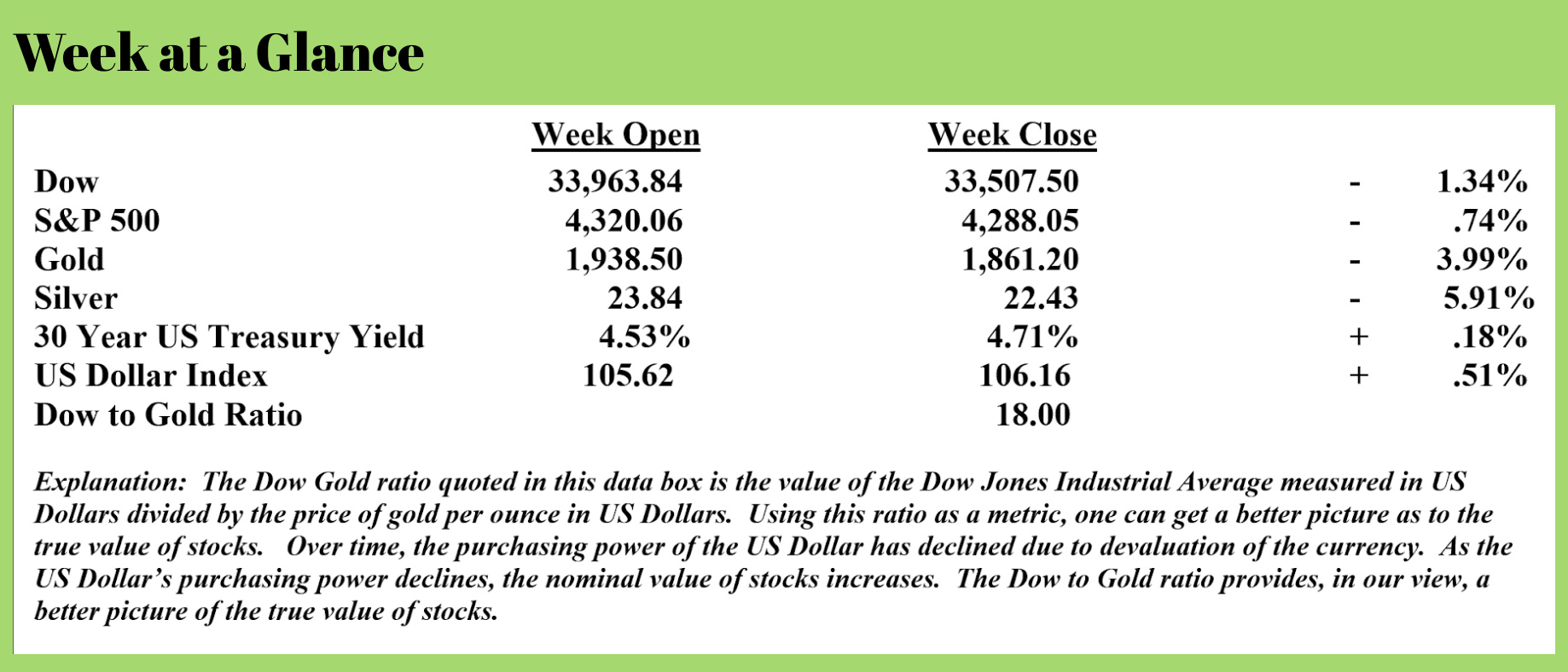

As I have been noting, stocks appear to be in the early stages of an Elliott Wave theory ‘wave three’ down. Here is an updated chart. (For an explanation of an Elliott Wave three down, visit www.RetirementLifestyleAdvocates.com and see the “Portfolio Watch” newsletter dated September 25, 2023.)

A large decline in stocks would not be surprising here, given the negative seasonal bias of fall and given the signs that the US economy is continuing to weaken.

A large decline in stocks would not be surprising here, given the negative seasonal bias of fall and given the signs that the US economy is continuing to weaken.

Author Michael Snyder recently commented on this as well, citing signs the US economy may be reaching a “pivot point.”

First, consumer confidence is waning. The Conference Board, a business research group, reported its consumer confidence index fell to 103 in September, down from 108.7 in August. Consumers are expecting that interest rates will remain high and continue to be a drag on the US economy.

Additionally, the Conference Board’s future expectations index fell below 80, which is significant.

Historically speaking, any reading below 80 has resulted in a recession.

Secondly, sales of homes hit a wall in August, falling 8.7% from the level seen in July. Redfin, a real estate data reporting firm, noted that there were more than 60,000 deals that fell through in August.

This strong decline isn’t shocking since the interest rate on a 30-year mortgage is now north of 7%.

For perspective, it’s important to remember that the recent (15-year) bull market in housing and in stocks was largely driven, at least in my view, by artificially low-interest rates and super-easy money policies.

Now, the interest rates are more normal; the already fragile economy is showing signs of breaking.

It’s also important to remember that mortgage interest rates are still below the average interest rate since the US Dollar became a fiat currency in 1971. In an unmanipulated interest rate environment, mortgage rates will likely move higher than these levels.

Thirdly, banks are getting more conservative. This means credit conditions are tightening. Snyder reports that American consumers are worried about access to credit amid persistently higher interest rates and tighter standards at banks. That’s according to a New York Federal Reserve Bank survey recently conducted.

60% of survey participants said that it is more difficult to get loans, credit cards, and mortgages than it was just one year ago. That is the highest percentage that held that view of the credit markets since ten years ago in 2013.

Fourth, banks are racking up credit card losses at the fastest pace since The Great Financial Crisis. This from Snyder’s piece (Source: https://www.zerohedge.com/economics/10-numbers-which-prove-us-economy-has-hit-major-pivot-point):

Credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis, according to Goldman Sachs.

Credit card losses bottomed in September 2021, and while initial increases were likely reversals from stimulus, they have been rapidly rising since the first quarter of 2022. Since that time, it’s an increasing rate of losses only seen in recent history during the recession of 2008.

It is far from over, the firm predicts.

Fifth, and this one is extremely ironic, the Federal Reserve is laying off 300 workers.

It’s true. The same organization that is forecasting a ‘soft landing’ for the US economy is actually laying off workers. This from Snyder’s piece:

For the first time in over a decade, the US central bank announced it would cut about 300 people from its payroll this year, a rare reduction in headcount for an organization that has grown steadily since 2010 – after all, it takes, if not a village (with its own police force), then certainly thousands of workers to come up with catastrophically wrong economic forecasts and to keep the money printer primed and ready to pump out a few trillion at a moment’s notice.

Sixth, the number of bankruptcy cases in the United States has increased on a year-over-year basis for 13 consecutive months. This again from Snyder’s piece:

Data released Tuesday showed that Americans filed more than 39,000 bankruptcy cases in Aug. 2023, an 18 percent increase from the same time last year.

The data released by Unusual Whales details how, along with personal bankruptcy filings, there were more than 41,600 new bankruptcy cases recorded in August, including for businesses. This marks the thirteenth consecutive month that bankruptcy filings have shown a year-over-year increase under the Biden administration’s embarrassing and dangerous economic policies.

Seventh, America’s strategic petroleum reserves have hit a 40-year low. This again from Snyder’s piece:

America’s emergency oil stockpile has plunged to 40-year lows. The shrinking Strategic Petroleum Reserve is limiting Washington’s ability to shield consumers from the fallout of Saudi Arabia’s aggressive supply cuts, according to Goldman Sachs.

“At this point, US energy policy has fewer bullets left. It has less levers left in its policy toolkit,” Daan Struyven, head of oil research at Goldman Sachs, told CNN in a phone interview.

That’s one reason Goldman Sachs expects oil prices to stay high, averaging $100 a barrel this time next year. Triple-digit oil would boost already-high prices at the pump, worsening inflation and potentially influencing the 2024 race for the White House.

Eighth, there are many credible forecasts for oil hitting $150 per barrel.

Doug Lawler, the CEO of Continental Resources, a shale-drilling company, told “Bloomberg” news that crude prices are set to remain elevated and could push to $150 per barrel without new production.

$150 per barrel oil would be potentially devastating for an already weak US economy.

Finally, a recent NBC poll found that 71% of Americans think the country is on the wrong track.

As I have been stating, the biggest problem with the world economy is excessive debt.

When there is too much debt to be paid, it simply won’t be paid.

The Great Financial Crisis of 15 years ago was caused by debt excesses. Since that time, world central banks have been attempting to ‘paper over’ the excessive debt problem via currency creation.

While it may have initially seemed that the Federal Reserve and other world central banks were successful, it is now becoming ever more apparent that they simply kicked the can down the road.

What was once a worldwide debt problem of $100 trillion has no grown to more than $300 trillion as a result of this ‘can kicking’.

Moving ahead, I believe the debt will lead to a contracting economy and falling real estate and stock prices. I also believe the Federal Reserve and other world central banks will respond using the only tool they have left – the printing press.

That will likely lead to the worst possible economic outcome – stagflation.

Are you ready?

The radio program this week features an interview that Jeremy Bolker did with me and an interview that I did with author Simon Popple.

Jeremy and I drill down on my bearish stock forecast, and Simon and I talk about economic health and the future of gold investing.

You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“No, that is the great fallacy: the wisdom of old men. They do not grow wise. They grow careful.”

-Ernest Hemingway

Comments