Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Dow to Gold Ratio Update

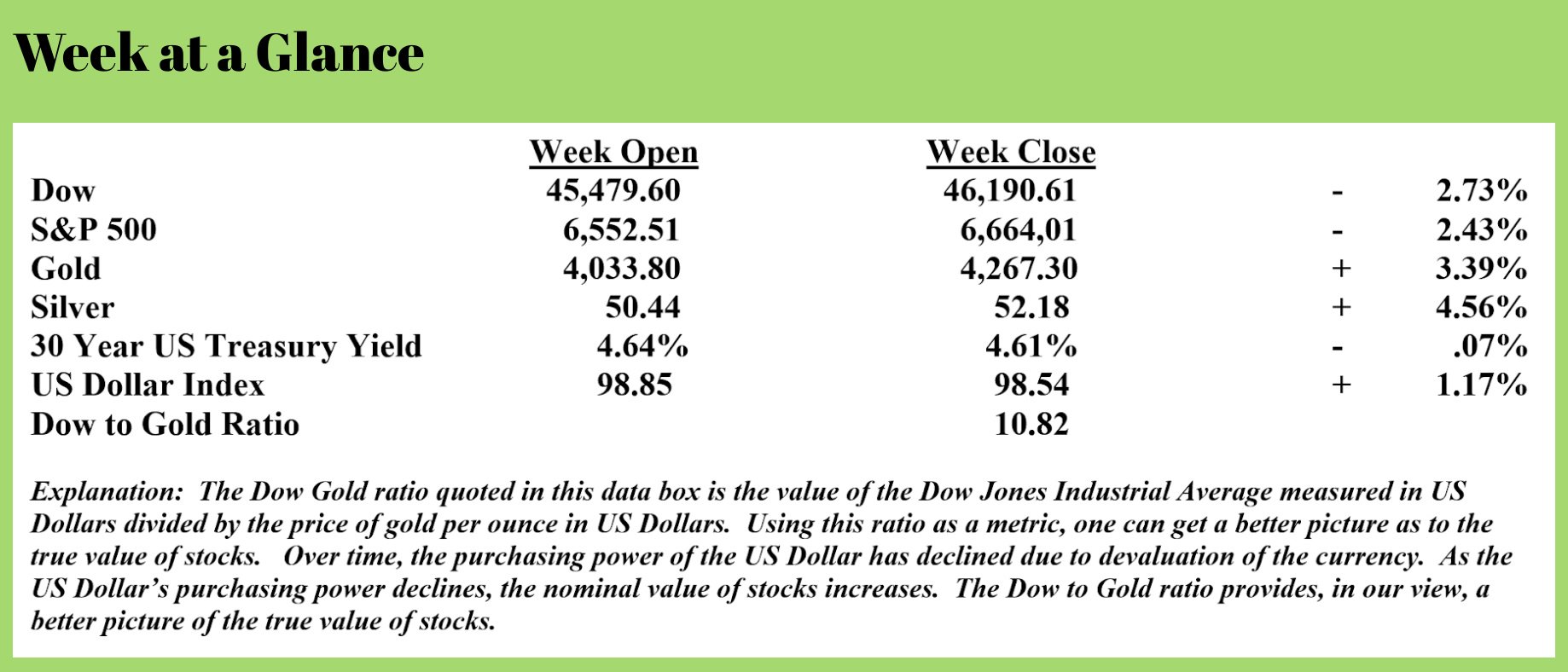

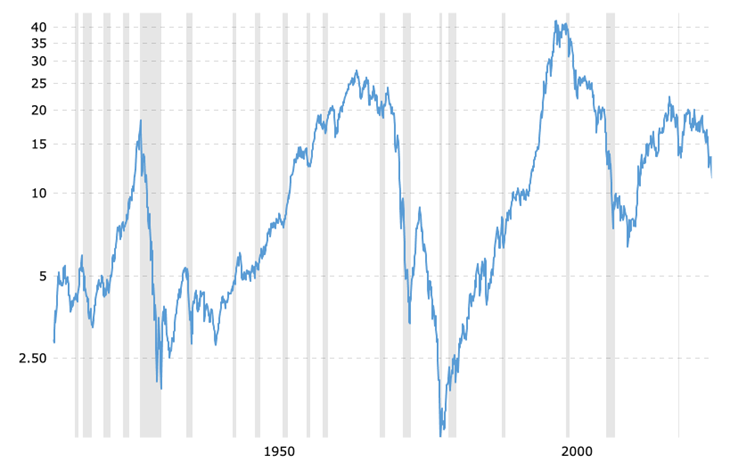

Historically speaking, the relationship between stocks, or more specifically the Dow Jones Industrial Average, and the price of gold per ounce in US Dollars has been predictive over longer time frames.

The chart here illustrates the Dow to Gold ratio going back to 1915. The ratio is calculated by taking the value of the Dow Jones Industrial Average and dividing by the price of gold per ounce.

The chart here illustrates the Dow to Gold ratio going back to 1915. The ratio is calculated by taking the value of the Dow Jones Industrial Average and dividing by the price of gold per ounce.

Notice from the chart that at the stock market bottom in the 1930’s that the Dow to Gold ratio fell to about 2. At the market bottom in the 1970’s the ratio bottomed at about 1.

At the market peak in 1929, the Dow to gold ratio reached about 19. During the 1960’s at the market’s top, the ratio climbed to approximately 27. In 1999, at the tech stock bubble peak, the Dow to gold ratio hit 43.

The 120-year pattern is clear, higher highs and lower lows in the ratio. This historical pattern is one of the reasons that I have long been predicting the Dow to gold ratio would eventually get back to at least 1, meaning the Dow and gold would be at the same level. It wouldn’t be surprising given the higher high and lower low pattern that the ratio would fall below 1.

This week, with the continued advance in gold, the ratio has fallen below 11. I fully expect this trend to continue over the long-term. However, given how overbought metals are a period of consolidation or a pull back in price is probable.

Homebuilders Becoming Increasingly Desperate

The National Association of Homebuilders publishes a ‘traffic index’ that gauges interest among potential homebuyers. For perspective, at the beginning of 2021, the traffic index peaked at 77. Not coincidentally, the 30-year mortgage rate bottomed at less than 2.75% at about that same time.

By October of 2023, the average 30-year mortgage rate had increased to 7.62% and the traffic index fell to 26. That’s a logical correlation. (Source: https://mishtalk.com/economics/38-percent-of-home-builders-cutting-prices-68-percent-offering-incentives/)

Presently, the average 30-year mortgage rate is about 1.3% lower than two years ago in October 2023. The bad news for homebuilders is that the traffic index is still falling, sitting at 25 currently.

Homebuilders are reacting in an attempt to jump-start sales. 38% of builders reported cutting home prices in October. The average price reduction in October was 6%. Additionally, 65% of homebuilders offered incentives to purchase during the month of October.

The real estate market continues to cool. John Burns Research and Consulting reports that after two years of heightened demand for land, this year has seen demand for land collapse by two-thirds. (Source: https://jbrec.com/insights/land-prices-set-to-decline/)

Thinking about buying land or real estate? It may pay you to be patient and do your homework.

Banking Shares Plummet

On Friday, the 17th of October, the Standard and Poor’s Regional Banking Index fell by more than 6% in just one day. Zions Bank and Western Alliance Bank were the worst performers with Zions Bank shares falling about 13% in one day and Western Alliance stock price declining about 11%. (Source: https://halturnerradioshow.com/index.php/news-selections/national-news/boom-it-has-begun-again-regional-bank-stock-values-plummet-6-in-one-day)

According to Reuters (Source: https://finance.yahoo.com/news/us-bank-stocks-plunge-investors-225548218.html), Zions Bank disclosed it would take a $50 million loss in the third quarter on two commercial and industrial loans from its California division. Western Alliance reported the bank had initiated a lawsuit alleging fraud by Cantor Group V, LLC.

I have been suggesting we would see further problems in the banking sector and I believe that this is just the beginning. Since banks have debt as assets, when debt goes unpaid or underpaid, banks suffer.

Another Reason Silver Is Rocketing Higher

Physical silver supplies are running low as demand for the metal increases. Mike Maharrey reports (Source: https://www.moneymetals.com/news/2025/10/14/could-india-be-the-straw-that-broke-the-silver-camels-back-004409) that in India demand for physical silver is now outpacing supply. India had a surplus of silver imports in 2024 but recent demand has seen that surplus evaporate. Indian silver buyers began to source silver from Hong Kong, but more recently began to look toward the London market to source physical silver. Silver supplies in London were already in short supply, down 75% largely due to the increased demand for silver exchange traded funds. Increased demand from Indian silver investors has simply exacerbated the silver shortage.

As a result of shortages in physical silver, one major silver fund in India has ceased accepting new investors.

Silver has had a supply gap for the past four years with industrial demand exceeding mining output. Looks like this year will make it five consecutive years with a supply shortage. (Source: https://www.moneymetals.com/news/2025/04/17/silver-market-records-fourth-straight-supply-deficit-amidst-record-industrial-demand-003994)

Our metals company does have some physical silver available. Call the office at 866-921-3613 and talk to Mark about availability and pricing.

RLA Radio

The RLA radio program this week features an interview that I did with Mr. Simon Popple on the topic of gold investing. The program is posted and available by clicking on the "Podcast" tab at the top of this page.

Quote of the Week

“Genius may have its limitations but stupidity is not thus handicapped.”

-Elbert Hubbard

Comments