Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

It’s an often-overlooked point: currency devaluation makes reported economic data appear better than it really is.

Stated differently, when the measuring stick or metric used to measure anything is changed, reported data changes by virtue of a changing metric regardless of the actual data.

Let me give you an example that I often use when speaking on this topic.

One of my favorite recreational activities is fishing in the Florida Keys. (Yes, I am an unapologetic meat eater who appreciates nice, fresh seafood as well as a prime cut of beef. Despite the fact that the consumption of quality meat is now frowned upon by many global elites, I have no intention of changing my dining habits. While that is a mini-rant that digresses from my point, I appreciate you tolerating it.)

One of the fish that I like to catch in the waters off Florida is a type of Snapper that has the whitest, best-tasting, borderline decadent fillets. To be a legal catch, this Snapper needs to be 12 inches in length.

When fishing, it’s easy to determine if a fish is a keeper or not a keeper by simply measuring its length against a standard one-foot ruler.

The ruler here is the measuring stick or the metric used to measure my fishing output.

Now, imagine that I cut down my 12-inch ruler to 9 inches and renumber the ruler so it still reads 12 inches.

Even though my ruler reads 12 inches, by the old standard, it’s only 9 inches. Now, when fishing, I will have more keepers, and my reported fishing output will increase.

Anyone comparing my fishing output prior to this change in the length of the ruler to my fishing output after the ruler length was changed would conclude that I became a much better fisherman from one year to the next year, even though the statistical improvement had nothing to do with my fishing ability and everything to do with the change in the metric.

That fishing example is, in a nutshell, the problem with any data reported in US Dollars. As the US Dollar is devalued, it’s the equivalent of me shortening my 12-inch ruler to 9 inches to make my fishing data look better.

Here is an example that many long-time readers of “Portfolio Watch” will recognize.

In 1971, when the US Dollar was backed by gold, foreign investors could redeem their paper US Dollars for gold at a redemption rate of $35 per ounce.

Then, on August 15, 1971, then-president Richard Nixon changed the rules and suspended (temporarily) the redemption of US Dollars for gold. Those redemptions have never resumed.

That change allowed massive currency creation that continues and has accelerated to this day. That devaluation has been the equivalent of cutting down the metric to make the reported economic data look better.

From 1971, when the median price of a new home in the United States was about $25,000, one would say that real estate has been a good investment, healthily appreciating to the present time since the current median value of a home is a bit more than $400,000.

But has that really been the case?

Or, has the US Dollar just devalued at a rate that the metric or measuring stick has changed dramatically?

I would argue the latter.

The median home in 1971, priced in gold, would have cost 700 ounces of gold to purchase. Today, the same 700 ounces of gold would purchase almost four median homes, providing conclusive evidence that the metric has changed.

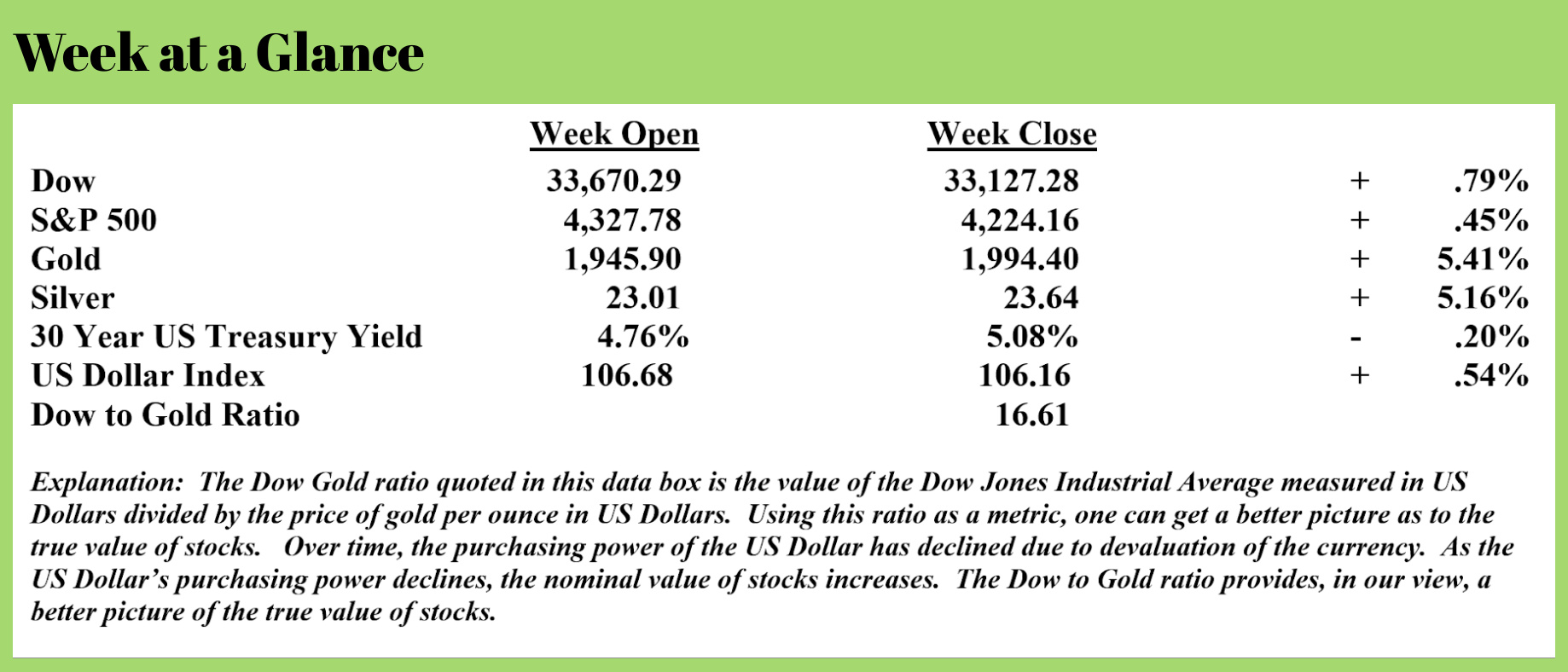

One could make the same argument for stocks.

In calendar year 2000, the Dow Jones Industrial Average stood at about 18,000. Today, the Dow stands at just over 33,000. For comparison purposes, let’s round that off at almost double.

That means stocks have been a good investment over the past twenty years, right?

Perhaps not.

In calendar year 2000, the price of an ounce of gold stood at about $300 per ounce.

If we took the value of the Dow Jones Industrial Average in 2000, which stood at 18,000, and divided that value by the price of gold per ounce of $300, we get 60 ounces of gold needed to buy the Dow.

Today, with gold prices at just under $2,000 per ounce, it takes just under 17 ounces of gold to buy the Dow.

Still, more evidence that appreciation in the value of another asset may have more to do with currency devaluation than any other factor.

Currency devaluation affects any asset or any data set reported in US Dollars.

Gross Domestic Product, the most common measure of economic output, is reported in US Dollars.

Presently, US GDP stands at about $27 trillion. Priced in gold at roughly $2,000 per ounce, current economic output is about 13.5 billion ounces of gold.

Turning the clock back to calendar year 2000, GDP was about $10 trillion. Priced in gold, GDP in calendar year 2000 was 33 billion ounces of gold.

Arguably, GDP in real terms (priced in gold) has not increased.

The fact that currency devaluation causes flawed data reporting is indisputable. This is even true, ironically enough, with inflation reporting. This from Peter Schiff, a past guest on RLA Radio (Source: https://schiffgold.com/peters-podcast/peter-schiff-the-unsinkable-american-consumer-is-drowning-in-debt/) (emphasis added)

Every time retail sales come in higher than expected, the mainstream media breathlessly reports this as proof that the American consumer is strong and resilient. In his podcast, Peter Schiff explained that these retail sales numbers aren’t a sign of a strong economy. They just reflect Americans paying more for less. And what’s worse, they’re burying themselves in debt to do it.

Retail sales were indeed stronger than expected in September, increasing by 0.7%. The expectation was for a 0.3% gain. Year-over-year, retail sales are up 3.8%.

The media hyped the report. CNN said it was a sign that consumers “aren’t tapping out just yet.” But Peter said the report was not actually good news.

First, it’s important to remember that retail sales data is not inflation-adjusted.

Everything costs more. Everything you buy is a lot more expensive. So, assuming that you don’t buy less, and of course, some people are buying less, but if you just buy the same stuff and everything costs a lot more, well, of course, retail sales are going to go up.”

But this doesn’t indicate that the economy is thriving, and it doesn’t mean Americans are on a spending spree buying more stuff.

In many cases, they’re buying a lot less. They’re just paying more. And they’re buying fewer of the things that they want because they’re paying more to buy the things that they need.”

If you adjust the annual retail sales increase of 3.8% by the CPI, it drops to 0.1%. In other words, almost the entirety of the retail sales increase was due to rising prices. Nevertheless, the raw retail sales data creates the impression that Americans are happily spending money. Peter said you can’t necessarily draw that conclusion.

Americans aren’t happy that their grocery bill went up, and they’re probably not eating more or eating better. In fact, they’re probably trading down into lower-quality stuff. They’re just paying more.”

For instance, restaurant sales were up big. But if you’ve eaten out recently, you know the cost of everything on the menu has gone up dramatically. Even if you eat out less, you’re still spending more. Peter emphasized that none of this is a sign of a strong economy.

It is a sign of inflation. And that’s all this retail sales number is reflecting — inflation. It’s not about a strong economy, but about rising inflation.”

The radio program this week features an interview that I conducted with best-selling author Harry Dent. Harry and I discuss, in detail, his forecast for stocks and real estate.

I give you my take on how banks’ tightening lending standards will affect the economy and your investments moving ahead.

It’s an information-packed program that you can listen to now by clicking on the "Podcast" tab at the top of this page.

“The difference between stupidity and genius is that genius has limits.”

-Albert Einstein

Comments