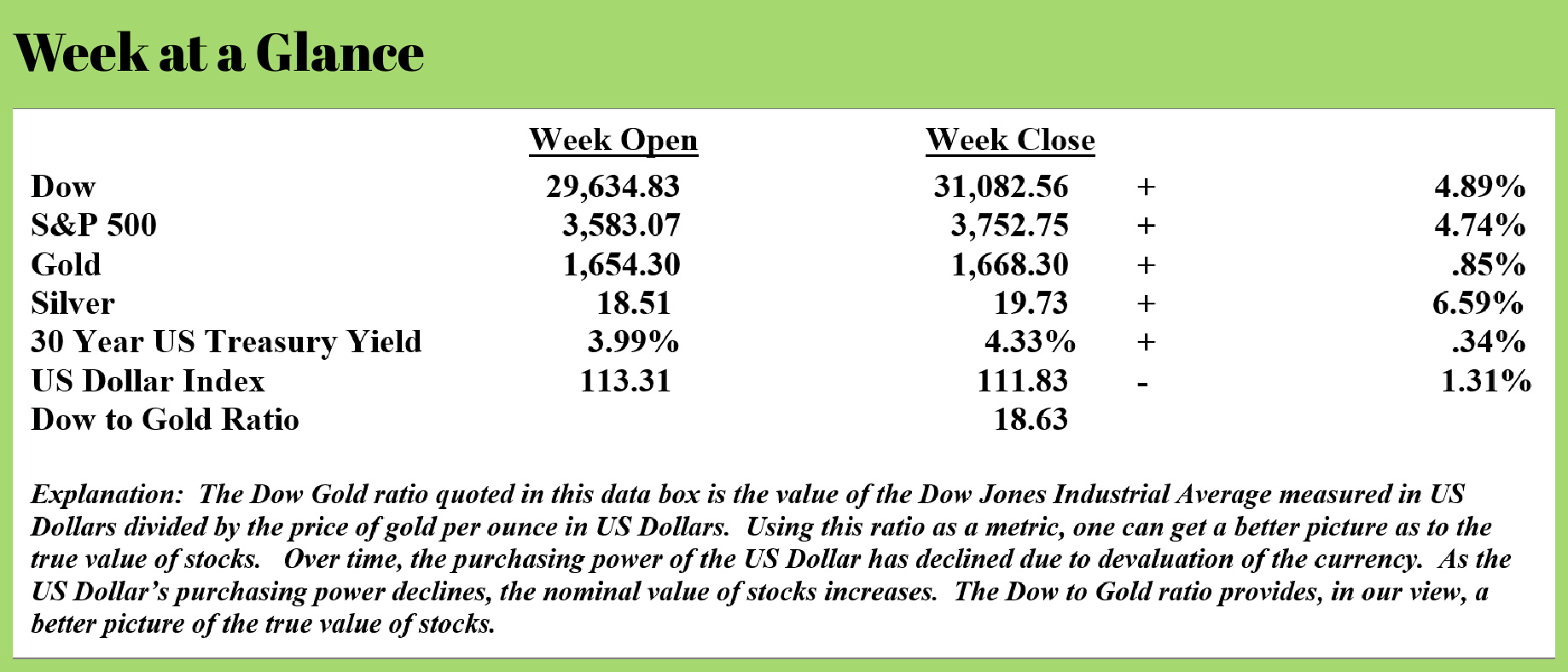

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Stocks staged a strong rally last week on a percentage basis. There could be more upside in this rally that I view as a countertrend, but there doesn’t necessarily have to be. I expect that there is more downside for stocks ahead. Likely, eventually a lot more downside.

I have often discussed the relationship between margin debt and stock performance. Accumulating margin debt can drive stock prices higher and declining levels of margin debt can forecast a stock price decline.

Wolf Richter recently commented on this topic. (Source: https://wolfstreet.com/2022/10/21/margin-debt-is-still-far-from-calling-a-bottom-for-stocks/):

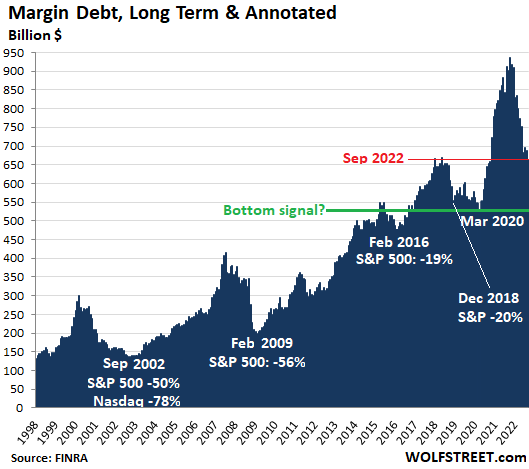

Increases and decreases in leverage, when large enough, drive markets up or down. The only summary data on stock-market leverage that we can get is margin debt, reported monthly by FINRA, which obtains the data from its member brokers. There is a lot more leverage in the market, but we don’t get a summary figure of it. Margin debt is our stand-in for overall stock market leverage.

Margin debt data that was released last November, for the month of October, nailed the top in the stock market, as margin debt had nailed prior tops. More on that in a moment, including my annotated long-term chart. Now we’re looking for signs of a bottom. But as of the latest release of margin debt, we’re far from any bottom.

Margin debt fell by $24 billion in September from August, to $664 billion. But it is still very high, 39% above the March 2020 low. The drops in margin debt in January and February 2020 showed that there was already concern that Covid might be tearing up the markets, and some investors prepared by reducing their leverage. At the current level, margin debt has a lot more room to fall – and the process can take years as we’ll see in a moment – before it signals a bottom in the stock market.

In the chart above, you can see that the summer rally was doomed to be just another bear-market rally because margin debt didn’t jump with it; it barely ticked up a little and then fizzled.

In the chart above, you can see that the summer rally was doomed to be just another bear-market rally because margin debt didn’t jump with it; it barely ticked up a little and then fizzled.

Leverage is a huge factor in the direction of any market. Leverage is the great accelerator on the way up, and on the way down. Big spikes in margin debt led invariably to stock market “events,” and a bottoming out of margin debt either preceded or closely followed the bottom of the sell-off.

The bottom signal occurs when margin debt drops to the lows from a few years earlier and then starts rising again.

In the long-term view of margin debt, it’s not the absolute dollar amounts that matter, but the steep spikes in margin debt before the selloffs and the declines that start with the sell-off, and bottom out at the end of the sell-off.

The long-term chart below of margin debt also shows stock market events. Margin debt will need to fall somewhere near a prior low established several years before the spike in order to give a bottom signal.

When one considers the level of margin debt that still exists in the market, there will probably have to be more downside for stocks moving ahead.

The “Buffet Indicator” a measure of total market capitalization divided by gross domestic product or economic output has us drawing a similar conclusion.

In other news, raging inflation has led to the largest Social Security cost of living adjustment in more than 40 years. In 2023, Social Security benefits will rise by 8.7%. This from MSN (Source: https://www.msn.com/en-us/news/technology/social-securitys-big-cola-increase-for-2023-heres-what-you-need-to-know/ar-AAXasVi)

The cost-of-living adjustment, or COLA, for Social Security benefits next year will be 8.7%, or an extra $146 a month for the average retiree. It's the biggest increase since 1981, when the COLA hit 11.2%, and reflects ongoing inflation in the US.

"A COLA of 8.7% is extremely rare and would be the highest ever received by most Social Security beneficiaries alive today," Senior Citizens League policy analyst Mary Johnson said in an earlier statement.

In fact, the annual adjustment has risen above 7% only five times since 1975, when it was introduced. (The 2022 COLA was 5.9%.).

The 401(k) contribution limit was also raised as it is indexed to the official, headline inflation rate as well. The 2023 contribution limit to a 401(k) plan will be $22,500 if a plan participant is under age 50. Participants age 50 and older can contribute $30,000.

The same limits apply to participants in a 403(b) plan.

The radio program and podcast this week features an interview with Mark Jeftovic, the publisher of “The Crypto-Capitalist Letter”. I chat with Mark about the possibility of a central bank-issued cryptocurrency becoming a reality. You can listen to the show now by clicking the "Podcast" tab at the top of this page.

“Study the past if you would define the future.”

-Confucious

Comments