Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Stocks continued their rally last week, with many indexes making new all-time highs by the slimmest of margins.

I noted last week that the ‘gaps up’ on the daily price chart are most often closed by falling prices. This is still a possibility, but last week’s price action muddies up the waters from a technical analysis perspective.

We will need to see how this week’s price action plays out and assess where we are.

By now, clients and subscribers have received the October issue of the “You May Not Know Report”. In it, I offer an analysis of gold, silver, and oil relative to the expansion of the money supply.

I offer that explanation here again for context before discussing a recent article published by Mr. Egon von Greyerz that validates this analysis using a completely different method of analysis. I hope you find it interesting.

This is from the October “You May Not Know Report”:

I’ve had conversations with many readers, radio show listeners, and clients about the recent decline in the price of precious metals. Those conversations always lead to two topics of discussion. One, where should the price of precious metals be from a fundamental viewpoint? And, two, why is the current reality not reconciling with the fundamentals?

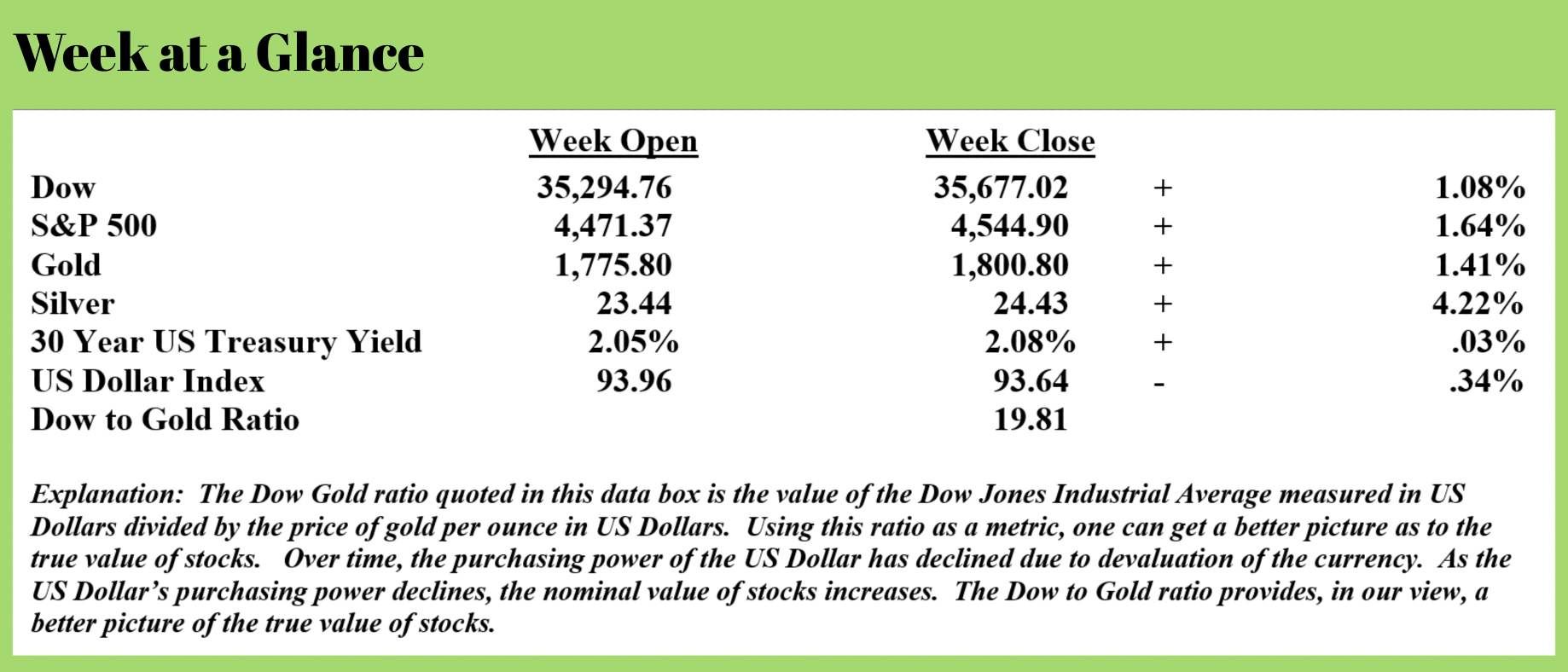

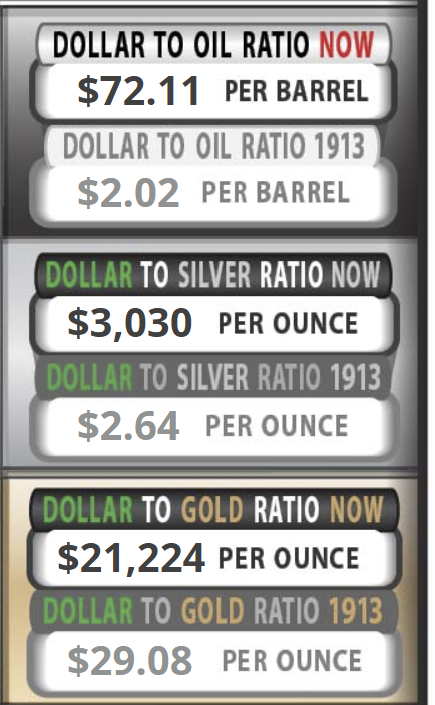

In this update, I’d like to address both topics. Let’s begin with the fundamentals. I’d like to have this conversation from the perspective of the expansion of the fiat money supply and then compare the expansion of the money supply to the price of gold, silver, and another commodity – oil. This comparison is easy to do when visiting usdebtclock.org. The screenshot on this page is taken from that website.

Notice from the screenshot that the dollar-to-oil ratio, the dollar-to-silver ratio, and the dollar-to-gold ratio in 1913 are all noted.

Notice from the screenshot that the dollar-to-oil ratio, the dollar-to-silver ratio, and the dollar-to-gold ratio in 1913 are all noted.

The ratio is calculated by taking the total increase in the money supply and dividing it by the yearly production of either oil, silver, or gold depending on the commodity one is examining. For example, the dollar to oil ratio in 1913 was calculated by taking the total increase in the money supply and dividing it by the total world oil production. A review of the history of oil prices concludes that the actual price of oil per barrel in 1913 closely tracked the price forecast using this simple formula.

The same conclusion is reached when looking at the formula-derived prices in 1913 and the actual prices. Gold was $20 per ounce in 1913 and silver was between $1 and $2 per ounce.

Here’s the point, in calendar year 1913, using the formula of taking the increase in the money supply and dividing by annual world production of oil, silver, or gold; one arrives at a forecasted number that reasonably tracked reality.

Fast forward to September 2021 and one discovers that this forecasting tool seems to have broken for gold and silver but still works for oil. Observe from the screenshot that taking the total increase in the money supply presently and dividing by world oil production, one gets a forecasted estimate of about $72 per barrel. Like in 1913, that tracks reality reasonably closely. The current price of one barrel of oil as this issue goes to publication is about $75.

However, when looking at the forecasted price of silver and gold, one reaches a much different conclusion. The forecasted price of silver is more than $3,000 per ounce while physical silver is presently selling somewhere in the mid-$20 range. The forecasted price of gold is more than $21,000 per ounce while reality has physical gold selling for around $1900 per ounce.

The article in the “You May Not Know Report” goes on to discuss why gold and silver prices have not reacted to the expansion of the money supply like oil prices have, citing one of the reasons as price manipulation via the highly leveraged futures markets.

This past week, as noted above, Mr. Egon von Greyerz looked at this topic from a fiat currency devaluation perspective. Here is a bit from his excellent piece (Source: https://goldswitzerland.com/shortages-hyperinflation-lead-to-total-misery/):

The US annual Federal Spending is $7 trillion and the revenues are $3.8 trillion.

So the US spends $3.2 trillion more every year than it earns in tax revenues. Thus, in order to “balance” the budget, the declining US empire must borrow or print 46% of its total spending.

Not even the Roman Empire, with its military might, would have got away with borrowing or printing half of its expenditure.

The most obvious course of events is continuous shortages combined with prices of goods and services going up rapidly. I remember it well in the 1970s how for example oil prices trebled between 1974 and 1975 from $3 to $10 and by 1980 had gone up 10x to $40.

The same is happening now all over the world.

That puts Central banks between a Rock and a Hard place as inflation is coming from all parts of the economy and is NOT TRANSITORY!

Real inflation is today 13.5% as the chart below shows, based on how inflation was calculated in the 1980s

The central bankers can either squash the chronic inflation by tapering and at the same time create a liquidity squeeze that will totally kill an economy in constant need of stimulus. Or they can continue to print unlimited amounts of worthless fiat money whether it is paper or digital dollars.

If central banks starve the economy of liquidity or flood it, the result will be disastrous. Whether the financial system dies from an implosion or an explosion is really irrelevant. Both will lead to total misery.

Their choice is obvious since they would never dare to starve an economy craving for poisonous potions of stimulus.

History tells us that central banks will do the only thing they know in these circumstances which is to push the inflation accelerator pedal to the bottom.

Based on the Austrian economics definition, we have had chronic inflation for years as increases in the money supply is what creates inflation. Still, it has not been the normal consumer inflation but asset inflation which has benefitted a small elite greatly and starved the masses of an increased standard of living.

As the elite amassed incredible wealth, the masses just had more debts.

So what we are now seeing is the beginning of chronic consumer inflation that most of the world hasn’t experienced for decades.

This is the inevitable consequence of the destruction of money through unlimited printing until it reaches its intrinsic value of Zero. Since the dollar has already lost 98% of its purchasing power since 1971, there is a mere 2% fall before it reaches zero. But we must remember that the fall will be 100% from the current level.

As the value of money is likely to be destroyed in the next 5-10 years, wealth preservation is critical. For individuals who want to protect themselves from total loss as fiat money dies, one or several gold coins are needed.

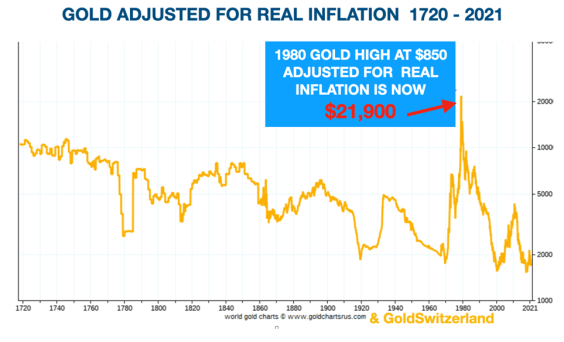

The 1980 gold price high of $850 would today be $21,900, adjusted for real inflation

So gold at $1,800 today is grossly undervalued and unloved and likely to soon reflect the true value of the dollar.

So gold at $1,800 today is grossly undervalued and unloved and likely to soon reflect the true value of the dollar.

While it is difficult to pinpoint timing, from a fundamental perspective, it is my strong conviction that precious metals prices will have to reflect the real value of fiat currencies at some future point.

Holding physical metals with part of your portfolio is critically important for many investors in my view.

This week’s radio program is an interview with commodities analyst, Simon Popple. Mr. Popple is the publisher of the “Brookville Capital Intelligence Report”.

Click on the "Podcast" tab at the top of this page to listen in as Simon offers his view on inflation and uses commodities as a hedge against inflation.

“A German psychologist says women talk more than men because they have a bigger vocabulary. But, it evens out because men only listen half the time.”

-Jay Leno