Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

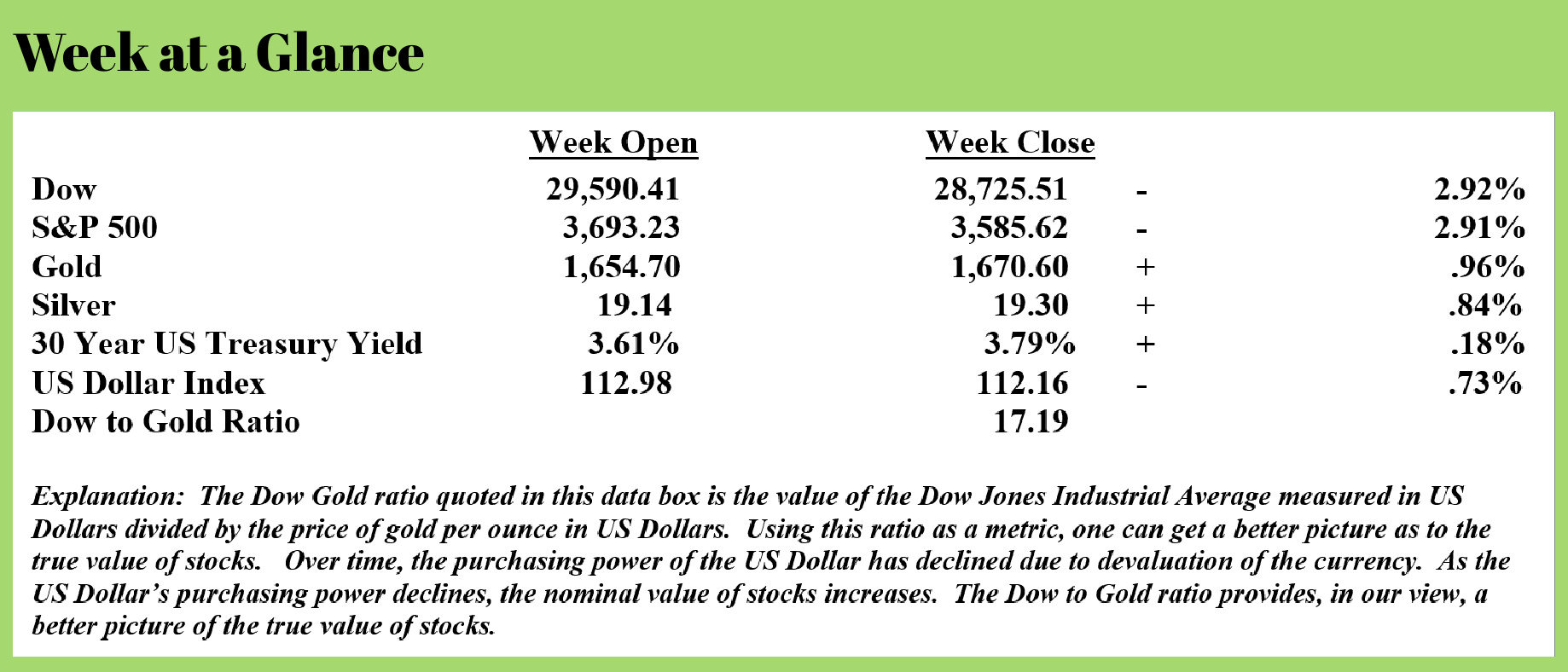

Financial markets continued to reflect a weakening economy last week. Stocks, measured by the Standard and Poor’s 500 are now down nearly 25% year-to-date. This from “Yahoo Finance” (Source: https://ca.finance.yahoo.com/news/asian-stocks-set-fall-global-223134465.html)

US stocks suffered their worst monthly rout since March 2020 after markets were repeatedly pummeled by the Federal Reserve’s resolve to keep raising interest rates until inflation is under control.

The S&P 500 closed a volatile session lower. The index posted its third straight quarter of losses for the first time since 2009. US Treasuries dropped Friday after a late selloff into the month-end, with the benchmark 10-year yield around 3.82%.

Fed Vice Chair Lael Brainard briefly assuaged concerns on Friday after she acknowledged the need to monitor the impact rising borrowing costs could have on global-market stability. But markets continued to be on the edge as investors contended with continued strength in personal consumption expenditure, one of the Fed’s preferred inflation gauges.

Risk assets have been in a tailspin since the central bank delivered a third jumbo hike last week and officials repeatedly warned of more pain to come. UK markets added to the stress this week, after the government unveiled sweeping tax cuts that threatened to exacerbate inflationary pressures, and the Bank of England attempted to manage the mayhem that ensued.

Investors are now awaiting jobs data next week for further clues about the Fed’s rate-hike trajectory. Upcoming inflation and GDP readings will also provide details on whether price pressures are easing meaningfully. All eyes will be on the earnings season, which starts next month, for insight into how companies are managing through headwinds that include a strong dollar, rising expenses and slowing demand. Fears of a global recession are still mounting as the threat of higher rates saps growth.

I find it interesting how perspective has changed over time. The Fed increased interest rates by .75% to 3.25% and it’s called a ‘jumbo’ rate hike. The fact that the S&P 500 is down nearly 25% year-to-date and the Fed Funds rate is just over 3% shows you just how addicted to easy money this market and economy have been.

The Fed narrative is that interest rates are being increased to get inflation under control. But, as I have often noted, it is unlikely that inflation is subdued until we get real positive interest rates. We are still a long way from that and inflation is not yet slowing.

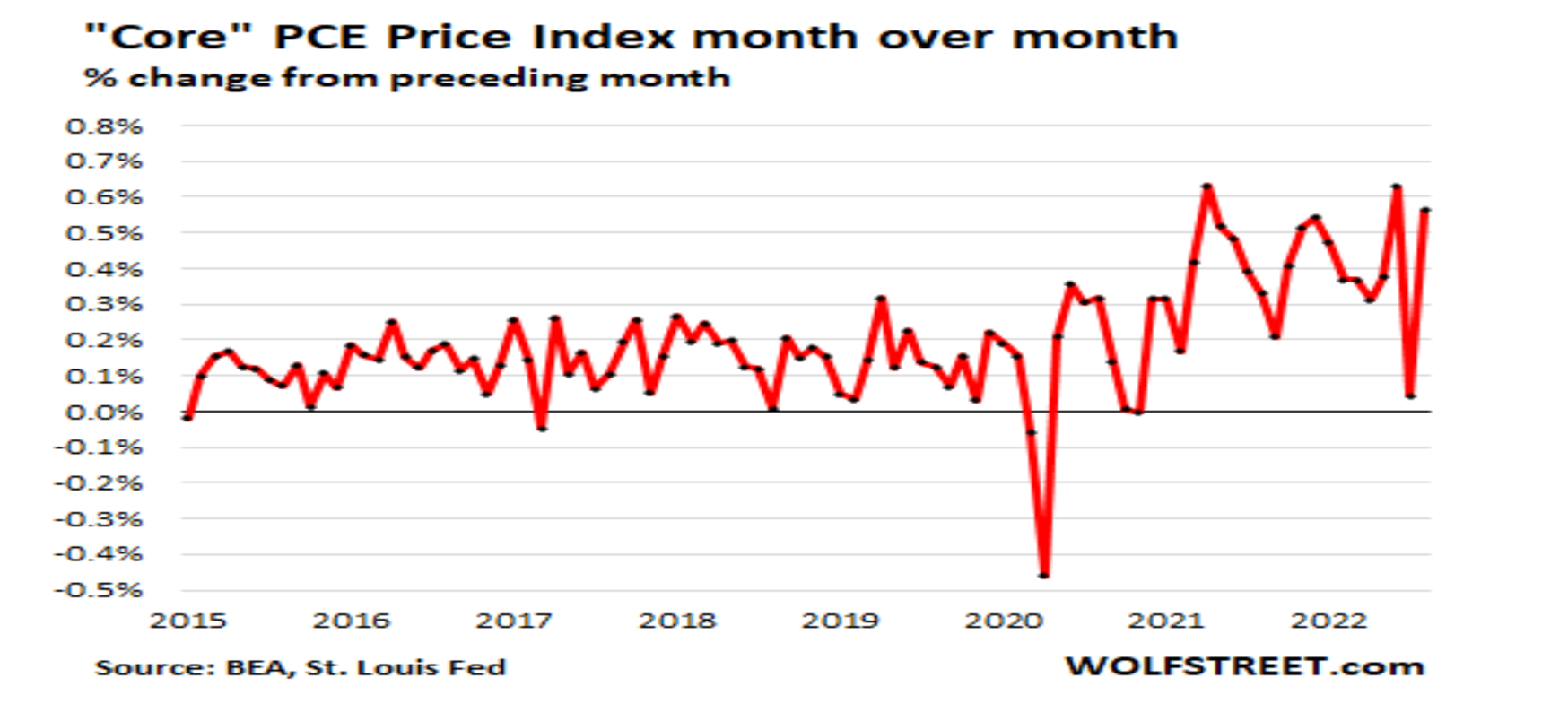

The July reduction in the core inflation rate turned out to be the exception rather than a new, viable trend. This from “Wolf Street” (Source: https://wolfstreet.com/2022/09/30/feds-favored-inflation-index-says-underlying-inflation-just-isnt-slowing-down/):

Just briefly here: The Fed uses the “core PCE” inflation index, released by the Bureau of Economic Analysis, as a yardstick for its inflation target. This “core PCE” index – the overall PCE inflation index minus the volatile food and energy components – is therefore crucial in the current rate-hike scenario, amid red-hot inflation, when everyone wants to know when inflation is finally going to cry, uncle.

Some folks thought that happened in July, when the month-to-month “core PCE” inflation slowed to “0%” (rounded down).

Turns out this much-ballyhooed month-to-month “core PCE” reading in July of “0%” was just a one-off event. In August, according to the BEA today, the core-PCE inflation index jumped by 0.6%, same as the multi-decade records in June 2022 and in April 2021 (all rounded to 0.6%). As Powell had said during the FOMC press conference: Underlying inflation is just not slowing down.

This “core PCE” is the lowest lowball inflation index the US government provides. But it is crucial in figuring out where the Fed’s monetary policy might go, how far the Fed might go with its rate hikes, and when it might pause.

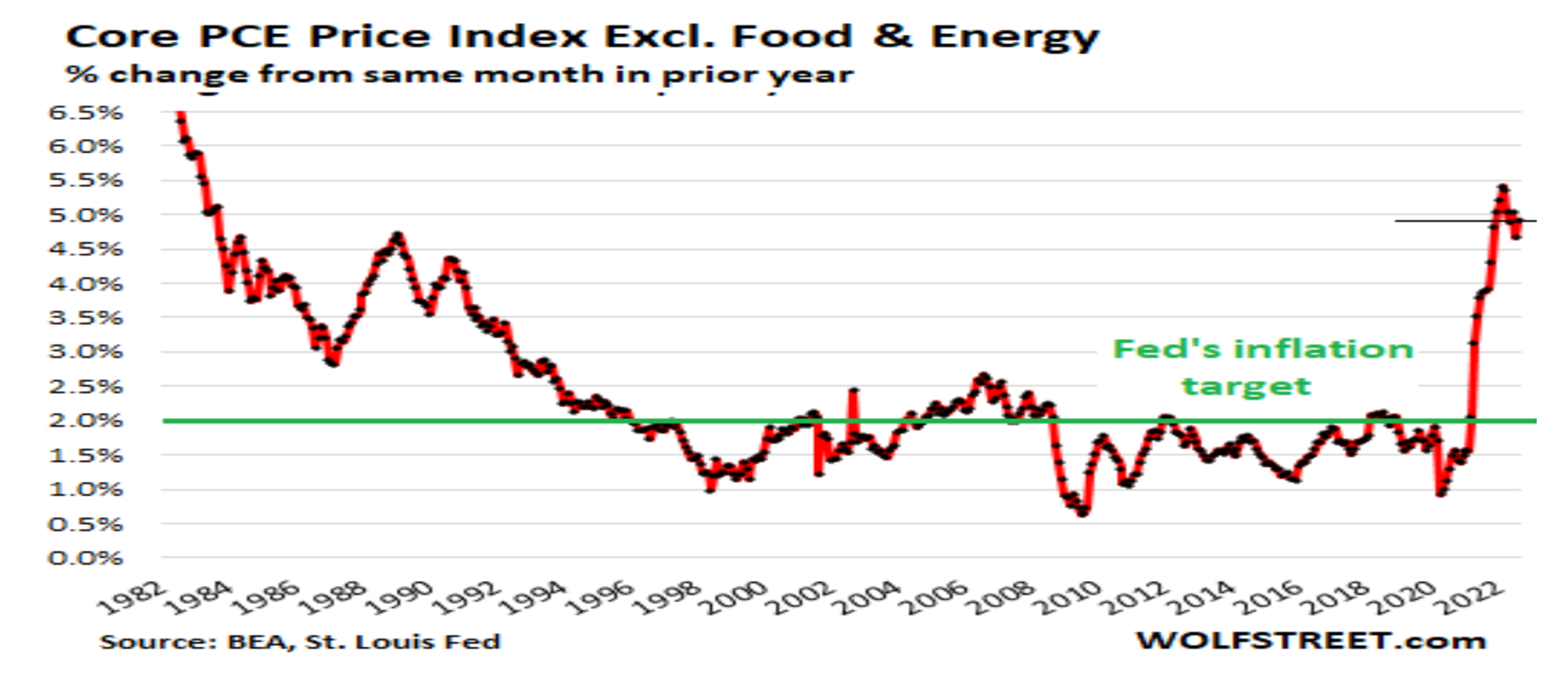

Compared to a year ago, the “core PCE” price index rose 4.9% in August, up from 4.7% in July.

This year-over-year measure is what the Fed uses for its 2% inflation target. But given the huge volatility in inflation last year, Powell said that they would be looking at month-to-month developments to get a feel of where inflation might be headed. They’re looking for “compelling” evidence that inflation is headed back to the 2% target.

Seems we now find ourselves in a place where financial assets are losing value, but inflation is still a huge economic factor. The question remains if the Fed will maintain its resolve to continue to increase interest rates until the 2% target is reached, or if they will capitulate and once again look to support the financial markets and the economy via easy money policies.

Seems we now find ourselves in a place where financial assets are losing value, but inflation is still a huge economic factor. The question remains if the Fed will maintain its resolve to continue to increase interest rates until the 2% target is reached, or if they will capitulate and once again look to support the financial markets and the economy via easy money policies.

I believe the latter is more likely by sometime next year which will likely mean a continued wild ride for financial markets.

The Bank of England just reversed its tightening program, doing an about-face and once again beginning to create currency in order to buy gilts, or bonds issued by the British government.

Past guest on the RLA Radio Program, Alasdair Macleod, had this to say on the topic (Source: https://www.goldmoney.com/research/the-crisis-is-upon-us)

The big news was the collapse of the UK gilt market’s long maturities, which required the Bank of England to intervene, buying £65 bn in long gilts on Wednesday. The situation arose out of pension funds leveraging their gilt portfolios through interest rate swaps and repurchase agreements up to seven times in an attempt to match their actuarial liabilities through liability-driven investing (LDI). With over £1 trillion outstanding, a doom-loop of selling to meet margin calls was an emerging crisis which had to be stopped.

It's been a wake-up call for investors who were not even aware of LDI’s, let alone the Lehman moment they brought about. LDI’s are also common in the EU and the US so the problem is unlikely to be confined to London.

The pension funds in the UK had taken on a lot of leverage to attempt to get returns that would allow them to meet their obligations. Pension funds in the US have done the same thing as I have written about previously.

It would not be surprising to see something similar happen here. That would force the fed to reverse course and begin easy money policies once again. While the crisis even here in the US may not be pensions, there are a number of other crisis-type events that could trigger the Fed’s policy reversal.

While I don’t know what that event might be, I expect it will happen and we will once again see the Fed pursuing easy money policies.

Ultimately, we will not avoid a deflationary event that will be unlike anything any of us have ever seen in my view.

As I write this the sage wisdom of Thomas Jefferson keeps running through my mind (if you’re a long-time reader, you’ve heard this before):

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the very continent their fathers conquered.”

This week’s radio program and podcast is a ‘best of’ program featuring an interview with the President of Jefferson Financial, Mr. Brien Lundin. Jefferson Financial sponsors the New Orleans Investment Conference, the oldest investment conference that is still being held.

I chat with Brien about his forecast for the economy, financial markets, and precious metals. You can listen to the show by clicking on the "Podcast" tab at the top of this page.

“A hero is no braver than an ordinary man, but he is braver five minutes longer.”

-Ralph Waldo Emerson

Comments