Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

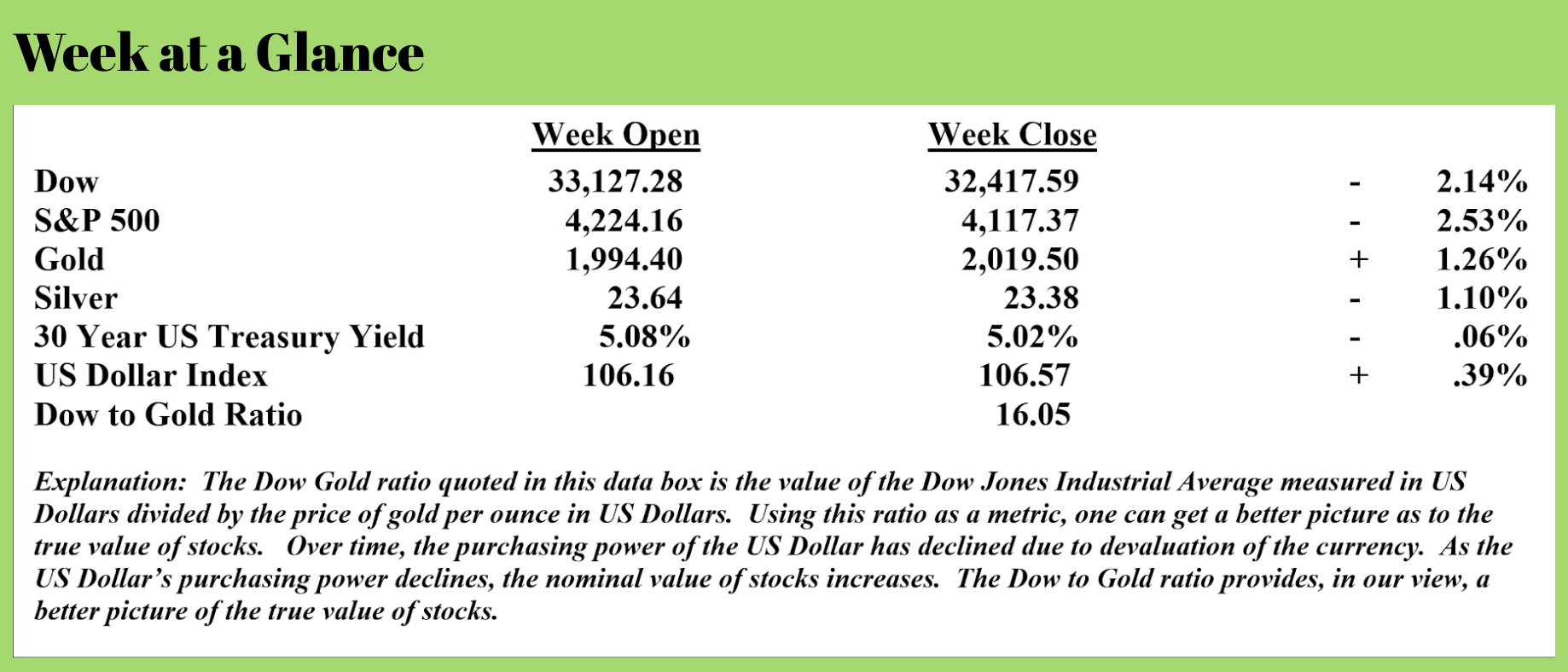

One indication that the US and world economy is not as healthy as many pundits would have you believe is the distribution of wealth – or lack thereof in the younger segments of the population.

For the purposes of this article, a baby boomer is defined as someone born between 1946 and 1964, and a traditionalist is someone born prior to 1946. This from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/broke-millennials-wait-boomer-parents-die-next-great-wealth-transfer):

According to Bank of America Research strategists led by Ohsung Kwon, boomers were in their prime time during this wealth expansion over the last several decades and emerged as the primary beneficiaries. This generation, born between 1946-64, along with "Traditionalists" (or silent generation), hold a whopping two-thirds of total net worth, mostly in financial assets. Kwon said boomers have secured low-rate mortgages while millennials have been left out.

According to Bank of America Research strategists led by Ohsung Kwon, boomers were in their prime time during this wealth expansion over the last several decades and emerged as the primary beneficiaries. This generation, born between 1946-64, along with "Traditionalists" (or silent generation), hold a whopping two-thirds of total net worth, mostly in financial assets. Kwon said boomers have secured low-rate mortgages while millennials have been left out.

Millennials, having fewer years of productivity, understandably control fewer assets than their older counterparts. But, the recent period of artificially low-interest rates, which was the driving force creating the housing bubble that is now peaking, in my view, has disproportionately affected millennials adversely.

This from the same piece quoted above:

This from the same piece quoted above:

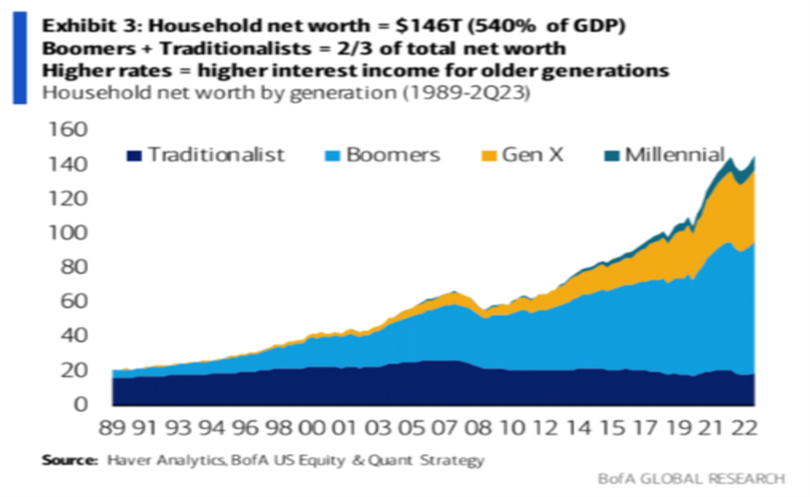

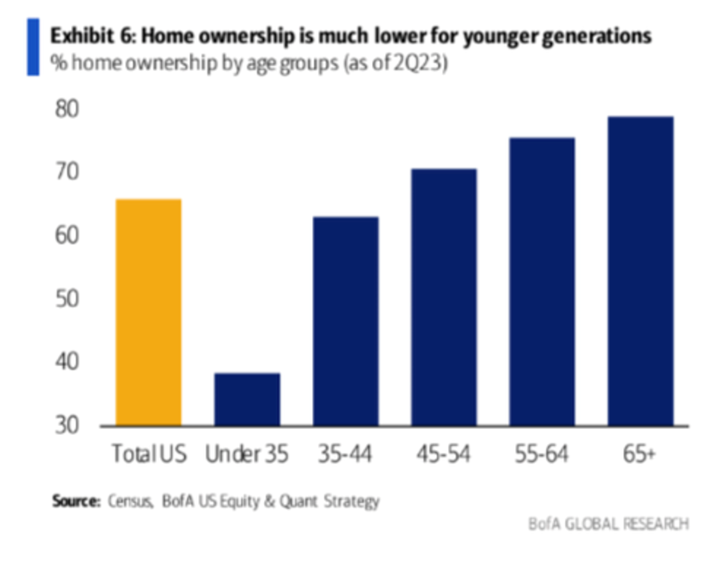

In contrast, millennials have been the largest generation to incur the most mortgage debt in the housing mania after 2021. These young folks sparked bidding wars nationwide while taking on new mortgage debt with homes at record-high prices.

Younger generations have 'gotten the short end of the stick' regarding homeownership. These kids will have to get used to a life of renting.

In my “Headline Roundup’ newscast, which I broadcast live every Monday at Noon Eastern time, I recently quoted a rather shocking statistic along these lines.

In my “Headline Roundup’ newscast, which I broadcast live every Monday at Noon Eastern time, I recently quoted a rather shocking statistic along these lines.

The statistic was related to the distribution of wealth in the United States.

Studying history, it’s difficult to refute that currency creation from thin air greatly contributes to the wealth gap or wealth inequality.

On the newscast, I referenced an article published on “Bloomberg” that reported the wealthiest .1% of the population holds about 12% of the total wealth while the poorest 50% of the population owns less than 6% of existing assets.

There is lots of additional evidence that the easy money policies of the Federal Reserve have caused the poorest Americans to struggle.

According to “Forbes” (Source: https://www.forbes.com/sites/forbesfinancecouncil/2023/10/24/americans-now-have-1-trillion-in-credit-card-debt-heres-why/?sh=268c506765a1), credit card debt is now at an all-time high and is up more than 25% since calendar year 2020. Not surprisingly, given the inflation we’ve experienced over the past few years, Americans are using credit cards for routine purchases and necessities to a greater extent than ever before.

This from the “Forbes” article:

In research conducted by Credit One Bank’s data team, we observed customers with a credit score above 550 significantly increased credit card spending from 2019 to 2022. Spending was consistently up 50% or more across major categories, including groceries, restaurants, fast food, and service stations. There was an even greater outlier in heavy-up spending—credit card usage at self-serving fuel pumps.

With credit card use increasing for spending on necessities, it’s not shocking that home affordability is now at the lowest level seen since the 1980’s. This from the “Zero Hedge” article quoted above:

Soaring interest rates and elevated home prices have sparked the worst housing affordability in generations. With that, so goes the 'American Dream'.

Soaring interest rates and elevated home prices have sparked the worst housing affordability in generations. With that, so goes the 'American Dream'.

(See chart, right.)

While the Fed continues to state that they will be resolute in fighting inflation, I have my doubts.

With every day that passes, we are moving closer to a debt crisis that is simply inevitable.

US Government debt is now more than 120% of Gross Domestic Product, and interest rates are rising. Sometime soon, it is my belief that the Federal Reserve will be forced to pivot, reverse course, and begin currency creation once again.

While this is my opinion, it’s hard to argue with the math behind the opinion. $34 trillion in debt at 5% interest (the current approximate yield on various maturity US Treasuries) is $1.7 trillion annually in interest on the debt!

At current interest rates (which have not subdued inflation, only slowed the rate of inflation), that creates a financial predicament that cannot be solved via tax increases (there is not enough money that exists) or by cutting spending without immediately creating a deflationary depression.

That means the Fed will do the only thing left to do: create currency.

What will that mean for you?

In my view, you’ll experience inflation in things you buy and deflation or a price decline in things that you own as the economy contracts.

That’s stagflation, the worst of economic outcomes.

If you’ve not yet explored how Revenue Sourcing may help you survive such an outcome, the time to do so may be running short.

The radio program this week features an interview that I conducted with the founder and Chairman of Matterhorn Capital, Mr. Egon von Greyerz.

Egon explains the looming problem with derivatives and his forecast for more currency creation by world central banks moving ahead.

We also talk about what he is recommending to his clients presently.

It’s an information-packed program that you can listen to now by clicking on the "Podcast" tab above, or you can find it on your favorite podcast app at Your RLA.

“Before you react, think. Before you spend, earn. Before you criticize, wait. Before you quit, try.”

-Ernest Hemmingway

Comments