Weekly Market Update by Retirement Lifestyle Advocates

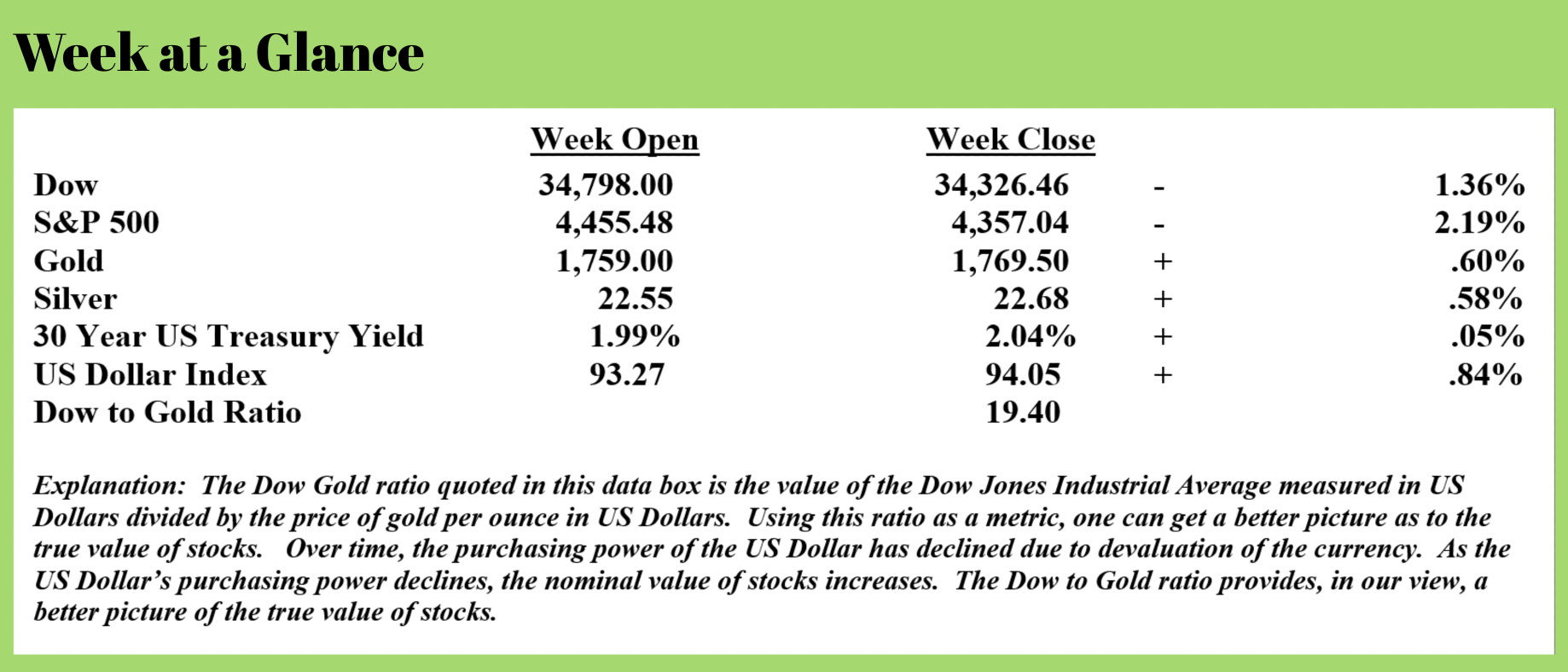

Stocks, by my analysis, weakened even more last week. The first four trading days of the week were negative followed by a nice rally on Friday. Despite the rally, technicals in the stock market are breaking down by my measure.

4 of the 11 sectors that comprise the S&P 500 turned negative over the past month. For many months prior, all 11 market sectors have had positive momentum. Longer-term charts have been pointing to a potential downturn for the past couple of months and given current price action, we may be on the brink of a more major decline.

There is no shortage of market or economic news to share with you. Each week, I look for the one or two stories that are most likely to affect you or to be of interest to you. This week, I will begin with a story that at best suggests that there are lax rules on trading on insider information at the Fed, by Fed members, and at worst confirms the level of corruption that many have suspected for a very long time.

If you missed the story, two members of the Federal Reserve Board have resigned after their trading activities were revealed in an article in “The Wall Street Journal”. This from “The New York Post” on September 27 (Source: https://nypost.com/2021/09/27/dallas-boston-fed-presidents-announce-resignations-following-controversial-stock-trades/):

It was a “Fed letter day” as two regional Federal Reserve presidents announced early retirements following controversial stock trades that were exposed in news reports.

Monday morning, Boston Fed President Eric Rosengren announced he would retire nine months earlier than expected, citing health reasons. Hours later, Dallas Fed President Robert Kaplan said he would retire, acknowledging his recent trading activities had become a “distraction.”

Earlier this month, filings reported in the Wall Street Journal revealed that Kaplan executed multi-million dollar trades throughout 2020. Kaplan, a former Goldman Sachs executive owns millions of dollars worth of stock in major companies including Apple, Amazon, Facebook, Delta Airlines, and Tesla.

Kaplan will step down on Oct. 8, but defended his record in a statement, “During my tenure, I have adhered to all Federal Reserve ethical standards and policies.” Rosengren will retire Thursday. Both men are 64.

Following the disclosure that Kaplan and Rosengren had been actively trading while serving at the Federal Reserve, both men vowed to sell their stock by Sept. 30 and move their money to passive investment vehicles. Despite the pledge to end any controversial trades, both men still faced criticism for perceived conflicts of interest: shaping policy the monetary policy they could benefit from.

“While my personal saving and investment transactions have complied with the Federal Reserve’s ethics rules, I have decided to address even the appearance of any conflict of interest by taking the following steps,” Rosengren said in a statement earlier this month. Rosengren’s trades had been smaller than Kaplan — in the range of tens of thousands and hundreds of thousands.

Here are a couple of Federal Reserve Bank Presidents making stock trades while making monetary policy decisions. While the two men predictably stated that everything they did was within the rules when one considers what former Dallas Federal Reserve Bank President Richard Fisher revealed in a CNBC interview in 2016 after he’d left the post of President. (Source: www.cnbc.com/2016/01/06/dont-blame-china-for-the-market-sell-off-commentary.html)

“I spent 10 years (through last March) as a participant in the deliberations of the Federal Open Market Committee, setting monetary policy for the U.S. The purpose of zero interest rates engineered by the FOMC, together with the massive asset purchases of Treasuries and agency securities known as quantitative easing, was to create a wealth effect for the real economy by jump-starting the bond and equity markets.”

“The impact we had expected for the economy and for the markets was achieved. By February of 2009, the Fed had purchased over $1 trillion in securities. With interest rates throughout the yield curve moving in the direction of eventually resting at the lowest levels in 239 years of history, the stock market reacted: It bottomed in the first week of March of 2009 and then rose dramatically through 2014. The addition to a third round of QE, which had the Fed buying $85 billion per month of securities to ultimately expand its balance sheet to over $4.5 trillion, juiced the markets.”

It’s interesting that Mr. Kaplan succeeded Mr. Fisher as President of the Dallas Federal Reserve in 2015. (There was an interim President for 6 months between the tenures of Fisher and Kaplan)

Fisher freely admitted that the Federal Reserve’s objective, while he was President of the Dallas Fed, was to jump-start the bond and equity markets. Given that stocks have risen to all-time highs since Mr. Fisher left his post and interest rates have fallen to all-time lows, is there any reason to think that the Fed quit “jump-starting the bond and equity markets”?

Something smells fishy?

And, does anyone else think it’s interesting that both men agreed to sell their stock by September 30 only after they got caught?

Ryan McMaken wrote a piece3 that was published on Mises Wire commenting on this topic (Source: https://mises.org/wire/youll-be-shocked-learn-theres-corruption-fed). Here are some brief excerpts although I would encourage you to read the entire article.

Fed Chairman Jerome Powell has decided the Fed ought to “review” its ethics policies after it was revealed that high-ranking personnel at the Fed were actively trading stocks even as the Fed was busy pulling the levers on monetary policy.

Specifically, Dallas Fed President Robert Kaplan made numerous trades worth $1 million or more last year. Meanwhile, Boston Fed President Eric Rosengren last year was making large trades in real estate investment trusts, possibly in the six-figure range.1

The problem here is obvious to any normal person who watches the Fed.

The Fed is not just an instrument of monetary policy, but a regulator of financial institutions. The Fed regulates bank holding companies, foreign banks working in the US, hundreds of state member banks, and other institutions as well. This gives Fed policymakers an enormous amount of control over the fortunes of many financial institutions.

Moreover, Fed policy can be—and, these days usually is—instrumental in pushing up stock prices and real estate prices through monetary inflation. Since the Great Recession—and arguably since the late 1980s, with the “Greenspan put”—the Fed has been instrumental in subsidizing stock prices through an implied promise that the Fed will rush to the rescue if financial markets face any real risk of falling prices. Since the Great Recession especially, the Fed’s unconventional monetary policy has meant the Fed has sucked up trillions of dollars in bonds and mortgage debt. This means both a direct subsidy of real estate investments and also—as Fed asset purchases push down interest rates—a flight to yield in the stock market.

Not surprisingly, we can see a clear correlation between the Fed’s easy money policy and a supercharged stock market.

The information available to these regulators and policymakers also provides an enormous amount of insider information not available to outsiders. So, perhaps, Fed officials should divest themselves of their stock and real estate portfolios, at the very least?

For Rosengren and Kaplan, however, this is crazy talk, since both men insisted their actions were “consistent with their respective bank’s code of conduct policies.” This may very well be true, although this only illustrates how the Federal Reserve System is soft on potential corruption within the ranks of its leadership.

After all, Rosengren and Kaplan only offered to sell their holdings after a public scandal broke out.

The position of Kaplan and Rosengren is typical for government officials—which is what Fed officials essentially are. This is also common in Congress: what matters is finding loopholes allowing the official to maximize his personal wealth, capitalizing on his ability to affect regulations and conditions that affect the prices of his investments. All that matters is that the lawyers say it’s okay.

It’s not surprising, of course, that Congress is chock-full of millionaires. The Fed’s boards aren’t exactly populated by “regular folk.”

And this may be significant in helping us understand how Fed policy has been so lopsided in favoring the ultrawealthy while imposing price inflation and a higher cost of living on people of more ordinary means. Fed policy has been extremely successful from the point of view of billionaires and hedge fund managers holding huge stock portfolios and real estate holdings. The prices just keep going up, and at rates that outpace official price inflation rates.

But for first-time home buyers, and the many millions of American workers who own few stocks? They just face higher prices for housing, education, healthcare, and now even food. Investing is out of the question because ultralow interest rate policy makes traditional, conservative, low-risk investments (like savings accounts) basically worthless.

In the past, I’ve commented on the widening wealth gap is largely attributable to Federal Reserve policy. Here we see firsthand why that is true.

Ron Paul, when he suggested decades ago that we should end the Fed was well ahead of his time.

This week’s radio program is a ‘best of’ program featuring an interview with David Mcalvany of Mcalvany Financial. If you didn't get a chance to listen when it aired last week, listen now by clicking on the "podcast" tab above.

“The depressing thing about tennis is that no matter how good I get, I’ll never be as good as a wall.”

-Mitch Hedberg