Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

I have long held that the economic boom we’ve experienced since the time of the Great Financial Crisis of 15 years ago has been largely the result of the artificial, easy money policies that the Federal Reserve and other central banks around the world have been pursuing.

While there are those who think the central bank will engineer a ‘soft landing’ economically speaking, in my mind, there is zero chance that will be the outcome of the Fed’s policy of increasing interest rates ostensibly to fight inflation.

We are already seeing signs of recession. On a recent RLA Radio program, I offered up my opinion that if it weren’t for massive deficit spending by the US Government, we’d already be in a recession. I’ve offered the rationale for that view here in the pages of “Portfolio Watch” as well.

Take the $2 trillion deficit that the government is running and subtract it from gross domestic product and one has a shrinking economy to the tune of about 8%. When you spend money that you don’t have or earn, that’s debt accumulation. That’s a drag on future production.

While there are many who have shared my view for a while, this view is now becoming more mainstream.

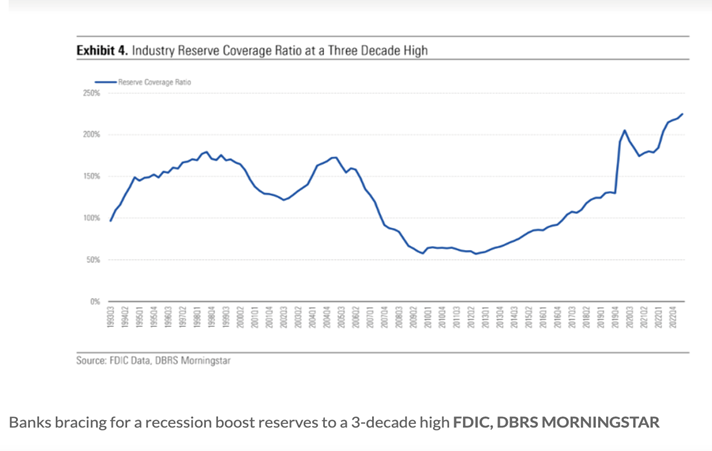

This from “Market Watch” (Source: https://www.marketwatch.com/story/banks-are-bracing-for-a-recession-as-treasury-yields-surge-b7746263):

A look at the banking industry’s reserve levels shows lenders are bracing for credit deterioration and losses to climb in the event of a recession. This chart shows banking reserve coverage as a portion of nonperforming loans at 225% as of the second quarter, the highest in three decades. (See chart below.)

Banks are bracing for recession.

Banks holding US Treasuries in their portfolios have also experienced massive investment losses over the past three years. Any institution or individual holding long-term US Treasury bonds over the past three years have seen declines in the value of those bonds of about 50% due to the Fed’s policy of increasing interest rates.

Rising interest rates are beginning to have another consequence on the business climate as well. “Zombie’ companies that have been just hanging on due to low carrying costs on outstanding debt are now beginning to feel the effects of a higher interest rate environment in earnest. This from “Reuters” about the numbers affecting Europe, the Middle East, and Africa, although the same situation exists worldwide. (Source: https://www.reuters.com/markets/fall-zombies-why-corporate-failures-could-surge-2024-2023-10-06/)

Debt-laden companies across Europe, Middle East and Africa face a $500 billion refinancing scramble in the first half of 2024, a challenge that could kill off many "zombie" businesses even though an expected peak in rates could bring some relief.

Businesses facing rising debt costs after years of low rates will have to compete to secure enough cash in the biggest corporate refinancing rush seen for years, just as banks rein in risk ahead of stricter capital rules.

Analysis by restructuring consultancy Alvarez & Marsal (A&M), shared with Reuters, shows the value of company loans and bonds maturing in the six-month period is higher than any other equivalent period between now and the end of 2025.

A crunch is looming, finance industry experts said, with many weaker, smaller businesses seeking new private loans and public debt deals just as government borrowing costs - which influence loan rates - are soaring globally.

Failure to secure the cash they need at rates they can afford, could lead to insolvencies and layoffs.

“Zero Hedge” reports that business bankruptcy filings are up 61% year-over-year. (Source: https://www.zerohedge.com/markets/chapter-11-filings-businesses-soar-61-so-far-year)

A wide array of U.S. businesses have struggled this year. In the first nine months of 2023, commercial Chapter 11 bankruptcies have soared 61% year over year to 4,553, according to Epiq Bankruptcy, which provides U.S. bankruptcy filing data.

Small business filings in that time rose 41% to 1,419, according to the research released by Epiq and the American Bankruptcy Institute. In all, considering every type of bankruptcy, filings in the commercial sector rose 17% to 18,680.

After recent declines thanks in part to pandemic-era financial support, consumer filings also rose this year, up 17% to 313,458, per the report.

The realities of massive debt levels begin to appear when interest rates move from an artificially low ‘fantasy’ level to a higher, more historically realistic level. This from “The Week”:

High interest rates may soon get higher. CNN reported that JPMorgan Chase CEO Jamie Dimon sent a “stark warning” to Wall Street on Monday that it is possible the Federal Reserve will raise the benchmark rate all the way to 7% — even though most analysts think it will top out under 6%. If his “contrarian” prediction is correct, “you’re going to see a lot of people struggling," Dimon said.

But the new era of high interest rates is already rippling through the economy and government.

The effects are being felt in the housing market: CNBC reported that mortgage demand fell 6% during the last week of September because “mortgage rates just continue to climb higher.” Rate hikes are affecting car buyers: The average monthly payment on a new car is $736 — up $33 from a year ago, per Axios. And they’re being felt in Hollywood: Financial Times noted that entertainment companies are putting an end to the “golden era of cheap streaming” because rates are making TV and movie production more expensive. Expect fewer new shows and higher streaming subscription costs.

Washington isn't immune to the effects, either. The federal government was able to swallow rising deficits over the last 15 years, Eric Levitz argued in Intelligencer, because it could borrow money cheaply. Now, the yield on a 10-year bond is at 4.8%, “its highest level since 2007.” If the rate stays that high, “the implications for the nation’s finances will be profound.” If federal borrowing continues and rates don’t come down, “interest payment will come to consume more than half of federal tax revenue by 2050.”

“Forget the shutdown,” The Economist editorialized. America’s “real fiscal worry” is rising bond costs linked to the Federal Reserve’s decision to keep interest rates “higher for longer” as it tries to rein in inflation. Right now, the Feds spend 2.5% of the country’s gross domestic product servicing the national debt. By 2030, that number will be 3.2%, “equaling an all-time high and more than the cost of defense.” And that might even be a low estimate. It’s clear that American politicians cannot “continue to act as if deficits do not matter.”

“Rising interest rates mean deficits finally matter,” Greg Ip added at The Wall Street Journal. The now-dead era of ultra-low interest rates meant that “we had a blissful 25 years of not having to worry about this problem,” one analyst said.

The bottom line is this – when you borrow to spend, whether you are an individual, a business, or a government, there will always be a day of reckoning. Each day that passes, that day of reckoning gets closer.

If you’ve not yet discovered “Revenue Sourcing as a strategy to plan your financial future and help you prepare for retirement in what will prove to be a very difficult environment, I’d suggest that you do so.

You can begin by checking out the resources at www.RetirementLifestyleAdvocates.com.

The radio program this week features an interview that I conducted with Michael Pento. Michael and I discuss the future of the bond market, stock market and whether or not the ultimate economic outcome will be stagflation.

Jeremy Bolker interviews me about signs the US economy is weakening. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Politics is not a bad profession. If you succeed, there are many rewards; if you disgrace yourself, you can always write a book.”

-Ronald Reagan

Comments