Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

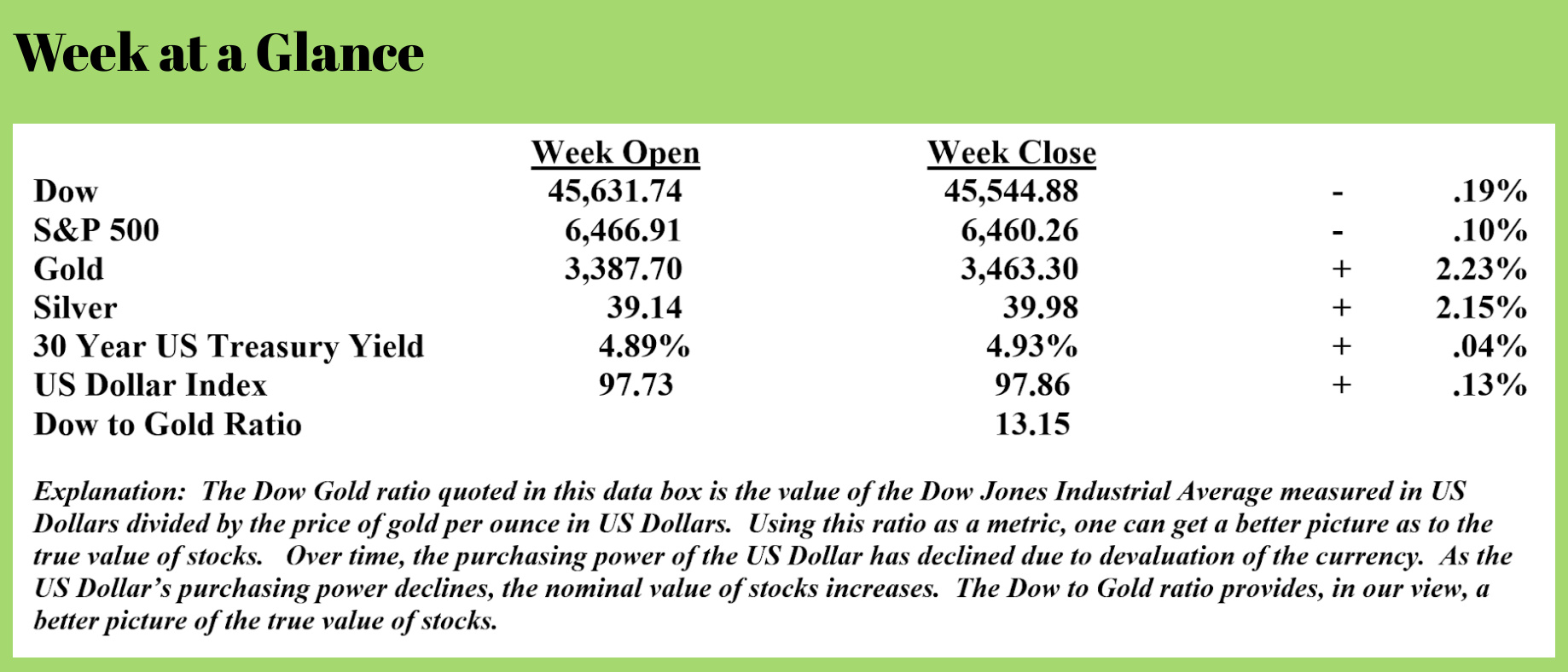

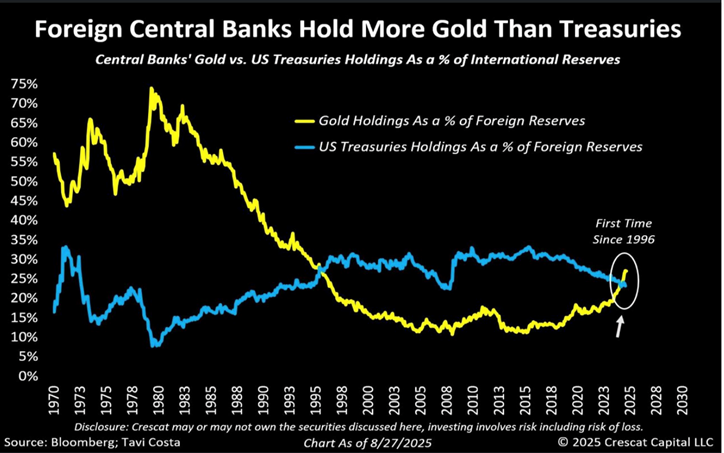

De-Dollarization Continues to Accelerate

While the US Dollar is still the world’s most-used currency, the trend is clear: there is a global move away from the US Dollar. Devaluation and weaponization of the US Dollar have both contributed to this growing trend.

Last week, a new milestone was passed in the de-dollarization trend. Mike Maharrey reports that for the first time since 1996, foreign banks hold more gold than US Dollars. (Source: https://www.moneymetals.com/news/2025/08/28/for-first-time-in-nearly-30-years-foreign-central-banks-hold-more-gold-than-us-treasuries-004301)

For the last thirty years or so, foreign banks were more comfortable holding US Dollars than gold, but now that has changed.

The US Dollar has depreciated year-to-date against the fiat currencies used by the trading partners of the United States, namely the Euro and the Yen, and has also declined against gold as observed by the huge move higher in gold prices this year when gold is priced in US Dollars.

The US Dollar has depreciated year-to-date against the fiat currencies used by the trading partners of the United States, namely the Euro and the Yen, and has also declined against gold as observed by the huge move higher in gold prices this year when gold is priced in US Dollars.

Tavi Costa of Crescot Capital published this chart that illustrates the trend, noting that this is “likely the beginning of one of the most significant global rebalancings we’ve experienced in history.”

In calendar year 2024, foreign banks accumulated 1027 tons of gold, down 91 tons from the all-time high of 1136 tons that the banks accumulated in 2022, and just 6.2 tons lower than in 2023.

For context, foreign bank gold accumulation increased by an average of 473 tons annually between 2010 and 2021! U.S. dollars made up 72% of reserves in 2002 but fell to 57.8% last year.

With the US Government running operating deficits for as far as the eye can see, this trend can only continue to build. Are you in a position to take advantage of it?

“Co-Living” Is The Latest Housing Trend

Co-Living is the newest housing trend, perhaps reflective of the high cost of housing and wages that have not kept pace with those increasing costs.

Co-Living arrangements have tenants renting individual rooms but sharing common areas with other tenants, usually complete strangers.

“Business Insider” reported (Source: https://www.businessinsider.com/co-living-apartments-cheap-rent-fix-housing-crisis-2025-8?mrfcid=2025082968b204b42b0ae901ba51d2ff) that the landlord vets all tenants using background checks and accessing credit scores, so tenants can skip the hassle and potential risk of finding a roommate via an internet ad.

When Jett Jasper recently moved from Hawaii to Washington, DC, he opted for a co-living apartment. He pays $1400 per month and gets a fully furnished room in a five-bedroom apartment with access to the same building amenities as his co-tenants, plus cable, wi-fi, and cleaning every other week.

Housing – Is the Top In?

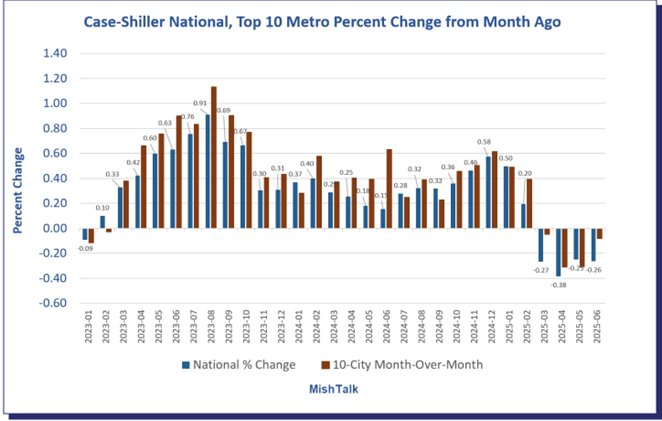

The most widely used index to track the price of residential real estate is the Case-Shiller Housing Index. The Case-Shiller Index tracks the price of housing around the United States and publishes a national number and a top ten metro area number.

Bottom line: both the national Case-Shiller index and the top-ten city Case-Shiller index are down for four consecutive months, signaling that the housing price top is probably in.

Bottom line: both the national Case-Shiller index and the top-ten city Case-Shiller index are down for four consecutive months, signaling that the housing price top is probably in.

This chart published by “Mishtalk” (Source: https://mishtalk.com/economics/case-shiller-home-price-index-drops-fourth-straight-month-top-is-in/) illustrates.

Notice that both the national index and the top ten city index have been declining over the last four months. A one-month or even two-month decline can be an aberration, but four months is likely a trend.

And, in my view, an interest rate cut by the Federal Reserve, which I expect this month, is unlikely to reverse this trend since mortgage rates tend to track the ten-year US Treasury yield rather than the Fed Funds rate. Given the aforementioned deficits, the yield will have to increase, which probably means no relief as far as mortgage interest rates are concerned.

RLA Radio

The RLA radio program this week features a ‘best-of’ interview that I conducted with Mr. Brien Lundin, host of the largest investment conference in the world, The New Orleans Investment Conference.

Mr. Lundin is also the publisher of Gold Newsletter, the oldest gold newsletter in the country, dating back to 1971 when the US Dollar became a fiat currency.

The interview is posted and available now.

Quote of the Week

“If you would be wealthy, think of saving as well as getting.”

-Benjamin Franklin

Comments