Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

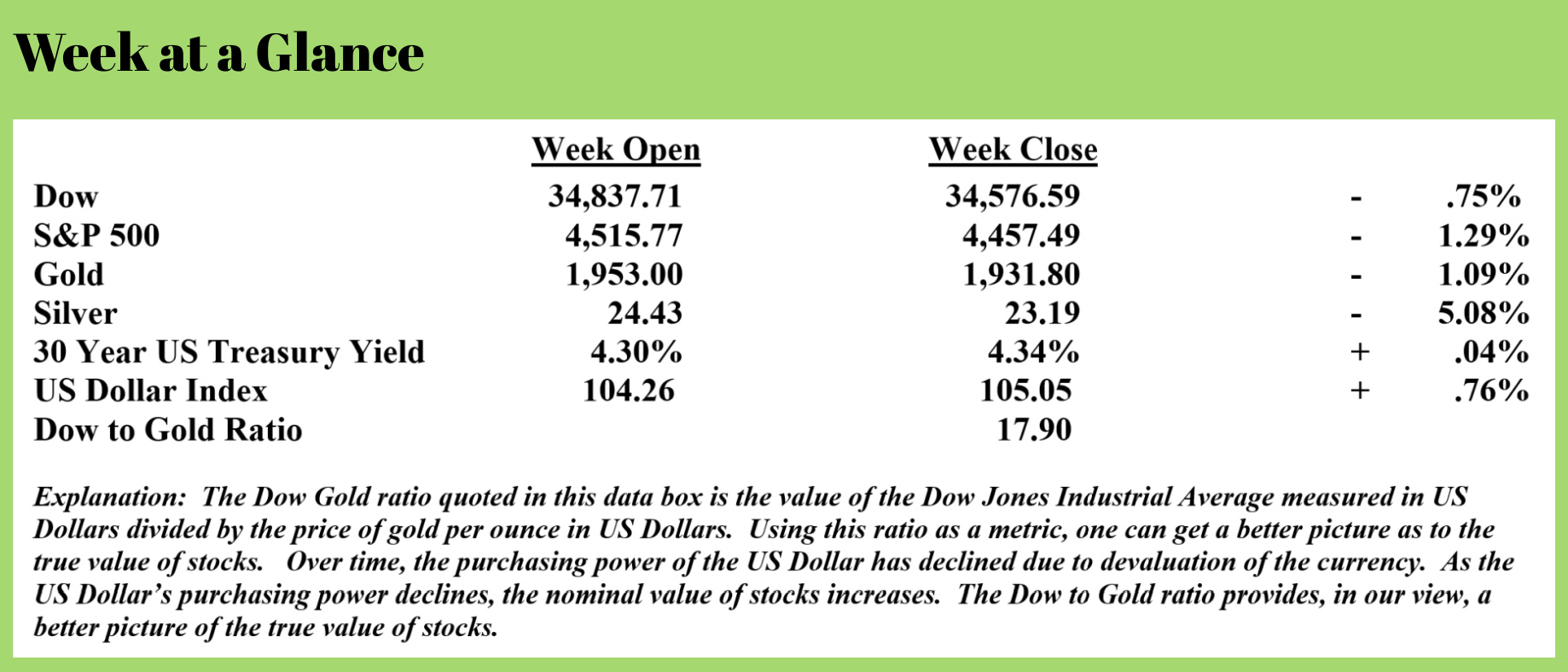

Last week, here in the pages of “Portfolio Watch”, I looked at the undeniable trend that the US Dollar, due to massive currency creation and weaponization, is losing its long-time dominance globally.

This week, I want to expand on that thought.

Dr. Ron Paul, former presidential candidate and past guest on my RLA Radio program, wrote a piece offering his take on this topic. (Source: https://www.zerohedge.com/geopolitical/ron-paul-will-brics-smash-dollar). Here are some excerpts:

Donald Trump’s legal troubles, the possibility that Joe Biden will face an impeachment inquiry, and other stories related to the upcoming presidential election, caused the American media to miss a story of potentially greater significance.

This was the decision of the BRICS (Brazil, Russia, India, China, and South Africa), who formed their alliance to challenge US political and economic dominance, to induct six new countries into their group: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates.

One way the BRICS' hope to achieve its goals is to undermine the foundation of US power: the dollar’s global reserve currency status. Brazilian President Luiz Inacio Lula de Silva called for BRICS nations to create their own currency, while India is pushing to have its trading partners, including Russia, trade in Indian rupees rather than US dollars. China and other BRICS countries have also reportedly taken steps to explore using gold instead of dollars for international trade.

The rejection of the dollar is also being driven in large part by resentment over the “weaponization” of the dollar’s reserve currency status. The US government uses the dollar's reserve currency position in order to force other countries to comply with US sanctions against the latest “designated Hitler.” Sanctions are an act of war, so by forcing other countries to follow US sanctions, the US Government is dragging them into conflicts that are not in their national interests. It was inevitable that the arrogance of our foreign policy elite would eventually cause a backlash. The backlash started last year when the US demanded other countries join in sanctioning Russia, regardless of the effects of those sanctions on their own economies.

The movement to replace, or at least create alternatives to, the dollar is also driven by concern over the long-term effects of the massive US national debt. Despite the claims of both parties that the recent debt ceiling deals showed that Congress and the President were getting serious about fiscal responsibility, the US $33 trillion debt is still poised to grow by as much as $115 trillion over the next 30 years. Congress and the President refuse to cut spending in any area. They can’t even manage to stop shoveling billions into the no-win war in Ukraine, even though this spending is opposed by a clear majority of Americans.

Sadly, it will take a shock like the rejection of the dollar’s reserve currency status and the resulting dollar crisis to force the US government and the people to take steps to kick their addiction to welfare-warfare spending and fiat currency.

This will mean some tough times ahead. However, the economic downturn may not last as long as people expect.

The good news is the crisis could lead to a return to limited constitutional government, a true free-market economy free of corporations and cronyism, a foreign policy based on peace and free trade, and a free-market monetary system.

While I’m not sure the US Dollar is in danger of complete rejection globally in the immediate future, Dr. Paul makes a couple of valid points.

One, there is no denying the US Dollar has been weaponized, and many countries around the world are looking to hedge their bets by looking at US Dollar alternatives.

Two, the spending trajectory of the US Government is totally unsustainable. At some future point, given present levels of deficit spending, the US Dollar will become a shadow of its former self as there is no way to fund deficit spending other than more currency creation.

That future point may be approaching – rapidly.

Over the next year, 31% of all outstanding US Government debt will mature. This from “Invezz”. (Source: https://invezz.com/news/2023/09/08/should-you-sell-the-us-dollar-as-the-deficit-surges-again/):

As such, the US government issues bonds that are sold to domestic and foreign investors. The higher the deficit is, the more bonds must be issued.

For those bonds, the government pays interest.

$7.6 trillion of US debt will mature over the next year, some 31% of all US government debt outstanding. The debt must be rolled over, which was not a problem until now because the funds rate was at very low levels.

Not anymore.

The funds rate rose dramatically from its lower boundary as the Fed fought inflation. And it may rise some more because the Fed is not sure it reached the terminal rate yet.

It means the US interest expense is set to exceed $1 trillion a year. And this is where is becomes a problem for the dollar in the long run.

To afford such large deficits, the US interest rates must come down.

When you put these facts together, you get a conclusion that is mind-boggling.

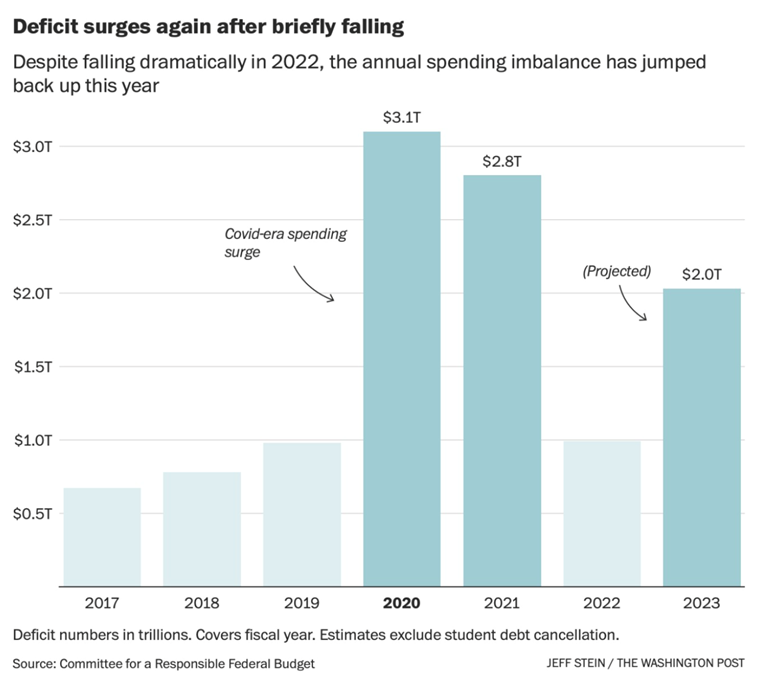

On top of financing a $2 trillion deficit this year (check out this chart, source: https://invezz.com/news/2023/09/08/should-you-sell-the-us-dollar-as-the-deficit-surges-again/), there is another $7.6 trillion in debt that will need to be refinanced.

That’s about $10 trillion in debt that needs to have a buyer.

In 12 months.

Can it be done?

Maybe, but in my view, not without some help from the Federal Reserve.

This could be the time frame where the rubber meets the proverbial road.

A lot of the reporting that I’m seeing about the US economy is that it is resilient and is continuing to grow despite the rising interest rate environment.

This reporting loses sight of one very important point. Government spending is a component of gross domestic product.

That means when the government spends money it doesn’t have, (deficit spending, to the tune of $2 trillion this year), it adds to GDP.

Matthew Piepenburg put it this way in a recent piece that he wrote (Source: https://goldswitzerland.com/rising-gdp-rising-yields-a-major-sign-of-uh-oh/):

GDP is rising because government deficit spending (on everything from yet another preventable yet losing war in the Ukraine to stimmy checks for migrants [“asylum seekers”?] pouring through Texas) is rising well beyond sustainable levels.

Near-term, spending always leads to growth. But when that spending is done on a maxed-out national credit card, the short-term growth (i.e., GDPNow forecasts above) comes at a comical, yet serious price.

Stated otherwise, spending, even deficit spending, has quick benefits; the debt consequences, and economic pains, however, take longer to show their economic (moronic) effects.

But when they do, the sickening results are as mathematical as they are historical.

In other words, the consequences of deficit spending will eventually emerge long after the short-term shot in the arm of unsustainable deficit spending.

The radio program this week features an interview with John Rubino and me. John is the co-author of the book “The Money Bubble: What to Do Before It Pops.”

Jeremy Bolker returns to the program this week as well and interviews me about the current state of the American consumer.

You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Facts are stubborn things, but statistics are more pliable.”

-Mark Twain

Comments