Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

I’ve been offering my opinion since the beginning of the year that the US economy is in recession.

More recently, it’s been confirmed that the US economy did indeed shrink in both the first and second quarter of the year, meeting the technical definition of a recession despite claims to the contrary by some politicians wanting to change the long-accepted definition of recession for political reasons.

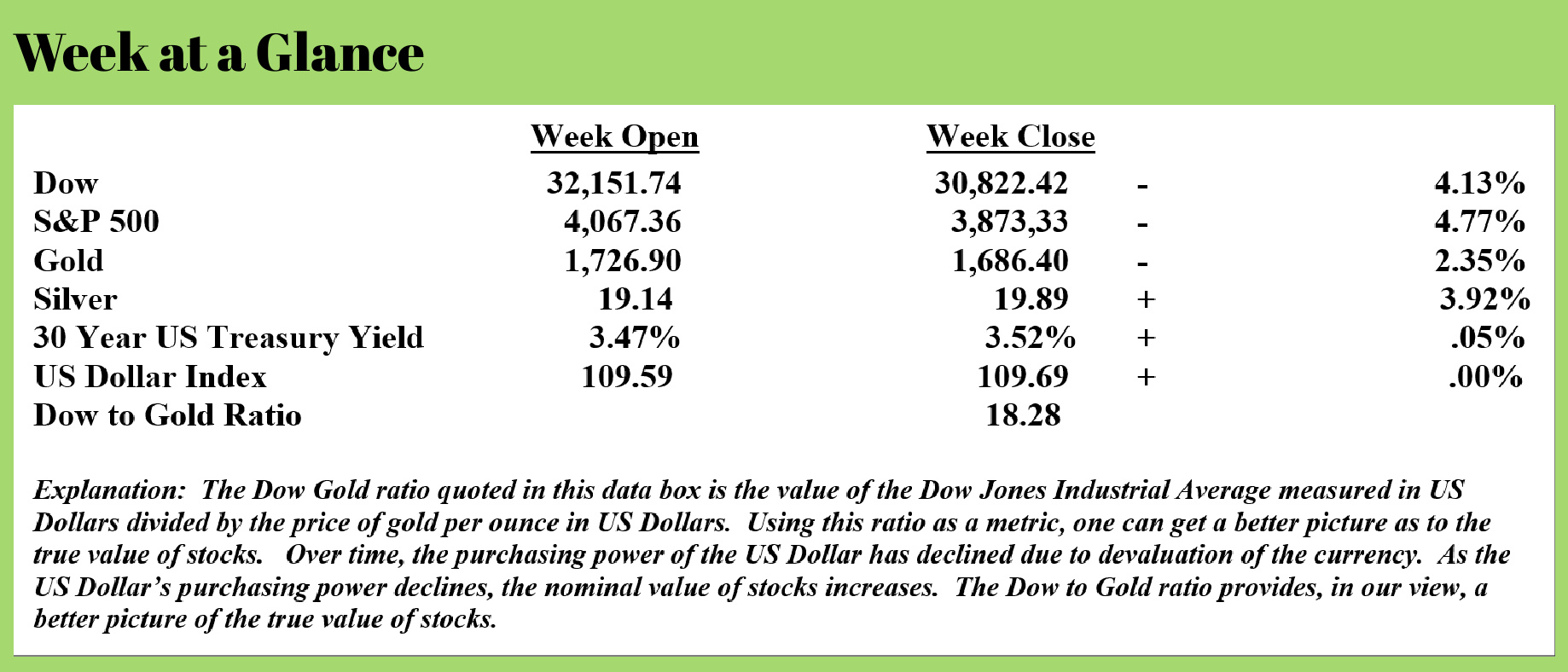

This past week, in addition to stock performance that was, in a word, dismal, other evidence of recession surfaced.

FedEx the shipping company, saw its stock plummet after the company withdrew it's 2023 earning guidance. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/fedex-plunges-2-year-lows-after-withdrawing-earnings-guidance)

Following FedEx's ugly pre-announcement, CEO Raj Subramaniam, went further into the drivers behind his company's decision to pull guidance during an interview with Jim Cramer of CNBC.

“I think so. But you know, these numbers, they don’t portend very well,” Subramaniam said in response to Cramer’s question about whether the economy is “going into a worldwide recession.”

FedEx’s top executive, who took over the role at the beginning of this year, said that declining worldwide cargo volumes were the primary factor in the company’s unsatisfactory performance.

“I’m very disappointed in the results that we just announced here, and you know, the headline really is the macro situation that we’re facing,” Subramaniam said tonight in an interview on CNBC’s Mad Money.

Finally, the CEO said the drop in volumes is far-reaching:

“We are a reflection of everybody else’s business, especially the high-value economy in the world,” he concluded.

As we detailed earlier, in a surprise pre-announcement Thursday after the close, FedEx said it’s withdrawing its fiscal year 2023 earnings forecast as a result of the preliminary 1Q financial performance and expectations for a continued volatile operating environment.

First quarter results were adversely impacted by global volume softness that accelerated in the final weeks of the quarter. FedEx Express results were particularly impacted by macroeconomic weakness in Asia and service challenges in Europe, leading to a revenue shortfall in this segment of approximately $500 million relative to company forecasts. FedEx Ground revenue was approximately $300 million below company forecasts.

Specifically for Q1:

- FedEx prelim 1Q adj EPS $3.44, est. $5.10

- FedEx prelim 1Q Rev. $23.2B, est. $23.54B

- FedEx prelim 1Q Adj. oper income $1.23B, est. $1.74B

As a result of the preliminary first quarter financial performance and expectations for a continued volatile operating environment, FedEx is withdrawing its fiscal year 2023 earnings forecast provided on June 23, 2022.

On top of the FedEx story, in which the CEO of the company was extremely negative, the CEO of Chevron warned that natural gas prices were headed much higher. This story combined with the FedEx story points to the stagflationary recession forecast I have been offering. This from “The Epoch Times” (Source: https://www.theepochtimes.com/chevron-ceo-warns-americans-to-brace-for-higher-natural-gas-prices-this-winter_4729716.html?utm_source=partner&utm_campaign=ZeroHedge)

The chairman and CEO of energy company Chevron has warned Americans to brace for price increases in natural gas this winter.

CEO Mike Wirth made the comments in an interview with CNN on Sept. 13 in which he warned consumers that “there’s certainly a risk that costs will go up” when it comes to natural gas.

“Prices already are very high relative to history and relative to the rest of the world. We’re already seeing this impact being felt in the European economy and I do think it’s likely that Europe goes into a recession,” Wirth said.

Europe has been suffering from an energy squeeze in recent months, driven by its decision to wean itself off fuel from Russia in the wake of its invasion of Ukraine along with chronic shortages and a move by some EU countries to phase out coal.

The outlook for Europe this winter is now looking more strained after Russian state-owned energy corporation Gazprom scrapped plans to restart gas flows through its Nord Stream 1 pipeline to Germany earlier this month.

Following what was expected to be a temporary shutdown for routine maintenance, Gazprom said that it could not safely restart gas deliveries through the key pipeline until an oil leak in a critical turbine was fixed. Officials have not yet stated when gas supplies will resume through the pipeline.

While Worth noted that the situation in the United States would not be as bad as it is in Europe, the CEO stated that natural gas prices could still be “significantly higher” this winter in the former.

Another story about “unretirement” confirms the current state of the US economy. This from “FoxNews” (Source: https://www.fox17online.com/news/some-people-considering-un-retiring-amid-inflation-stock-market-drop)

Unretirement. It’s a concept most have probably not considered, but it’s a reality for many in the current economy. Some retirees are watching inflation rise while the stock market sinks and are reconsidering the plans they made just a short time ago.

Gesher Human Services held a “Returning Retiree Boot Camp” Wednesday in Southfield. Bob Rubin, 81, was one of the attendees.

“I found myself where I once had a great pile of gold, that the gold wasn’t there anymore, and the goose that laid the egg, he left town,” explained Rubin.

Rubin said he’s an expert in the mortgage business and did tremendously well until the mortgage crisis. Now, he is looking for new ways to find gainful employment. He said he showed up at the "Returning Retiree Boot Camp" for insight into how his skills can be best used.

“Are there niches? Are there areas in these desperate times that I can do well?” asked Rubin.

He said he was looking for help reaching out and connecting with those in need of his specialty. He admits, that common online resources just haven’t cut it for him.

“I found that using Indeed and that other such sources does not work for me. People are looking for specific skills. I never worked for anyone. I was an entrepreneur, I had my own business,” Rubin explained.

Tim Parsons, 61, also showed up for the boot camp.

“I recently accepted an early retirement package and haven’t decided if I’m truly going to retire or if I’m going to continue to look for work,” explained Parsons.

He said he has been looking at the stock market and the possibility of a recession and wondering if he would be able to find a job again.

He explained the questions he had been thinking about.

“Whether I could financially afford to officially retire. It’s about two years before my normal plan. Even though my financial advisor says I could, you’re always worried about money,” admitted Parsons

It doesn’t matter if it’s part-time work or full-time work.

“I’m open to either one. You know you got to bridge health care coverage until you’re 65. So, if a part-time job came along with healthcare coverage, I would consider that,” Parsons explained.

Layoffs are intensifying, the last inflation report was not promising, the stock market is reacting negatively and many retirees are thinking about going back to work. Seems to define a stagflationary recession doesn’t it?

This week’s radio program and podcast features an interview with technical analyst Dr, Bob McHugh. Listen in to get Bob’s shocking stock forecast by clicking on the "Podcast" tab at the top of this page.

“Anyone who lives within their means suffers from a lack of imagination.”

-Oscar Wilde

Comments