Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Worldwide debt is at record levels. When the currency creation stops or slows, I expect to see an ugly deflationary environment emerge as the debt is purged from the system.

It doesn’t take an economist to realize that when there is too much debt to be paid, some of it won’t be paid. That means the lenders lose money as it disappears from the financial system.

Reuters reported that global debt levels are now approaching a record $300 trillion. (Source: https://www.msn.com/en-us/money/markets/global-debt-is-fast-approaching-record-24300-trillion-iif/ar-AAOqYWx). It’s perfectly reasonable to assume that much of that debt will never be paid, meaning financial losses for those who hold the debt.

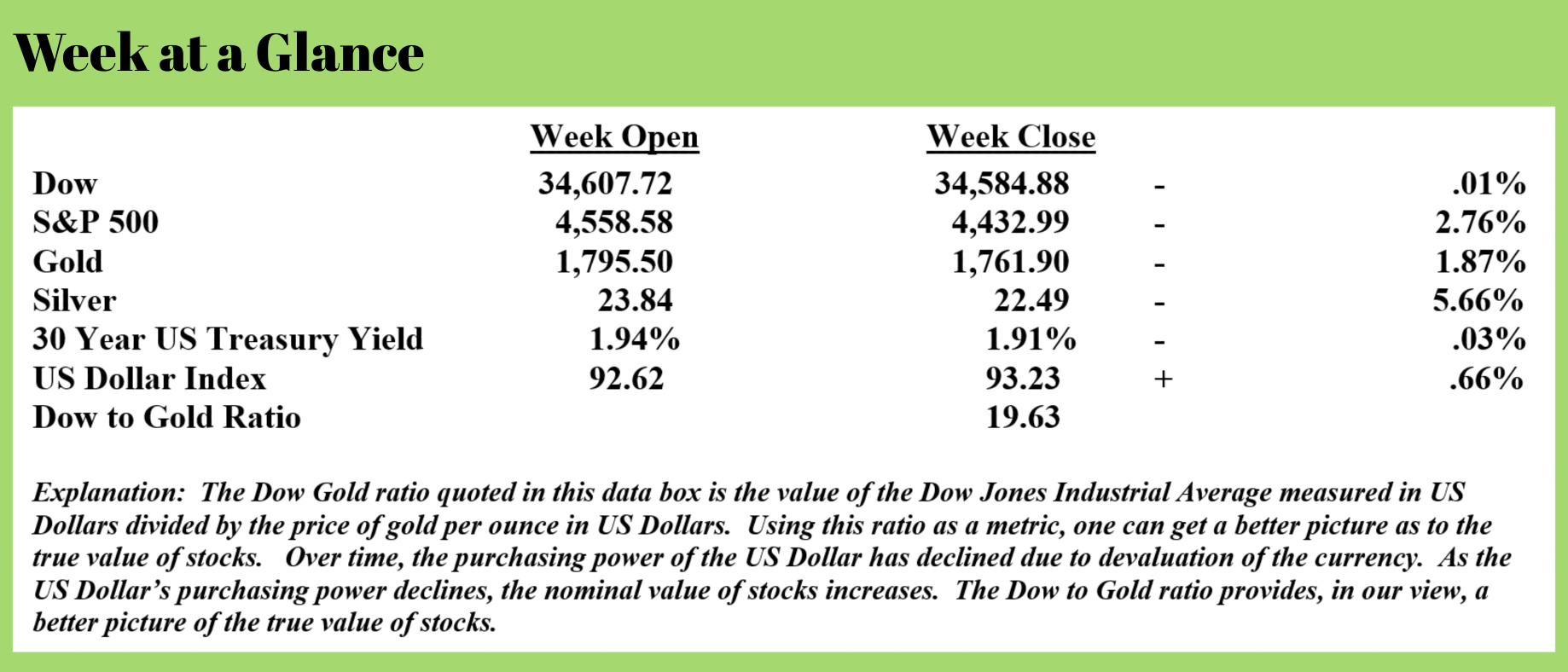

I fully expect to see defaults on debt all around the world in the relatively near future. It may be these debt defaults that further spook equity markets. One big Chinese default may already be spooking stocks as equities had another tough week last week.

Evergrande is a Chinese company that has huge amounts of debt. If you’re not familiar with Evergrande or haven’t heard this story out of China yet, here’s a little background about the company courtesy of Yahoo News (Source: https://news.yahoo.com/evergrande-chinas-fragile-housing-giant-053203700.html):

With a presence in more than 280 cities, Evergrande is one of the largest private companies in China and one of its leading real estate developers.

The firm made its wealth over decades of rapid property development and wealth accumulation as China's reforms opened up the economy.

Its president, Xu Jiayin -- also known as Hui Ka Yan in Cantonese -- was at one point China's richest man but has seen his wealth slashed from $43 billion in 2017 to less than $9 billion now.

What does it do?

While predominantly a real estate firm, in recent years the group has embarked on an all-out diversification.

Outside of property development, it is now best known in China for its football club Guangzhou FC, formerly Guangzhou Evergrande.

The group is also present in the flourishing mineral water and food market, with its Evergrande Spring brand. It has also built children's amusement parks, which it boasted were "bigger" than rival Disney's.

Evergrande has also invested in tourism, digital operations, insurance, and health.

This past week, the big news out of China was that Evergrande had more debt than the company could pay. The company owes more than $300 billion to creditors. This from “Credit Bubble Bulletin” (emphasis added): (Source: https://creditbubblebulletin.blogspot.com/2021/09/weekly-commentary-evergrande-moment.html)

Evergrande owes over $300 billion – to banks and non-bank financial institutions, domestic and international bondholders, suppliers, and apartment buyers. It has bank borrowings of $90 billion, including from Agricultural Bank of China, China Minsheng Banking Corp, and China CITIC Bank Corp (reports have 128 banks with exposure). Thousands of suppliers are on the hook for $100 billion.

It appears an Evergrande debt restructuring is inevitable. From a few decades of close observation, these types of situations generally prove worse than even the more bearish analysts fear. Assume ugly and messy. The presumption all along – by bankers, investors, and apartment purchasers – was that Beijing would never allow the collapse of such a huge player. This fundamental market perception is in serious jeopardy.

Evergrande is the most indebted of a highly levered Chinese developer sector (top three in revenues). It “owns more than 1,300 projects in more than 280 cities.” Evergrande employs 200,000 – and “indirectly helps sustain more than 3.8 million jobs each year.”

Evergrande epitomizes China’s historic Credit Bubble. It has borrowed and spent lavishly, in what history will surely view as a company that operated at the epicenter of an extraordinary Bubble of asset inflation, speculation, and reckless debt-financed malinvestment.

Estimates have Evergrande bondholders receiving 25 cents on the dollar in a restructuring. It borrowed $20 billion in the booming off-shore dollar bond marketplace. As a focal point of the global Bubble in leveraged speculation, China’s offshore debt market has ballooned during this protracted cycle. From the FT (Hudson Lockett and Thomas Hale): “Chinese issuers face their largest-ever wave of dollar bond maturities this year at $118bn, according to Refinitiv. But even that is dwarfed by the Rmb7.8tn ($1.2tn) of onshore debt maturing in 2021. The latter figure could have big repercussions for offshore bondholders, especially if the restructuring of onshore debt is prioritized.”

The restructuring referenced in the article is now happening and investors are not happy. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/enraged-evergrande-investors-go-full-pitchfork-hold-management-hostage-company-offices)

As the collapse of Evergrande reverberates throughout the Chinese economy, pissed-off retail investors have gone from storming the company's headquarters to taking management hostage, according to The Straits Times, citing posts 'making the rounds' on social media.

What we know so far: over 70,000 retail investors forked over vast sums of money, in some cases their entire life savings, after the country's second-largest, 'too big to fail' property developer wooed them with promises of 10%+ annual returns. And while the company most likely is TBTF (as you can read in gory detail here, although Beijing has yet to make an official proclamation), these anxious retail investors may be in more of an "Alive" situation than a Sully Sullenberger landing when it comes to resolving this mess.

After accumulating some 1.97 trillion yuan (US$410 billion) in liabilities, the company - which became the country's largest high-yield dollar bond issuer (16% of all outstanding notes) - sparked protests across the country earlier this week after announcing they were forced to delay payments on up to 40 billion yuan in wealth management products.

As we noted earlier Thursday, in an effort to appease its angry (and very soon, poor) stakeholders, Evergrande plans to let consumers and staff bid on discounted apartments this month as compensation for billions in overdue investment products as the embattled developer seeks to preserve cash, according to people familiar with the matter.

According to Bloomberg, the company will organize an online property event by Sept. 30 for investors who opt for real estate in lieu of cash. The world’s most indebted property developer is pushing the discounted real estate as the preferred of three options for angry investors seeking repayments.

The plan, it would appear, did not go off quite as planned: in response, nearly 100 investors stormed Evergrande's headquarters to demand their money back.

It remains to be seen exactly how this will play out or if the Chinese Government might step in, but this story makes my point; an economy that expands via debt accumulation and currency creation is not a healthy economy. Eventually, excessive debt levels need to be dealt with.

The concern is that this may be a “Lehman Moment” for China. A $300 billion default by Evergrande could affect the banking sector as well as the financial markets.

When economies and the financial system are as fragile as they are presently, a collapse can begin with just one event. I believe we may be at that point presently.

While it is too early to tell how the Evergrande situation will play out, there will be other Evergrande’s given current worldwide debt levels and one of these events will be the straw that breaks the proverbial camels’ back. It will be that event that is the catalyst for the inevitable reversal.

As I’ve discussed here, in my opinion, there are many other reasons that a reversal will have to occur. On top of unmanageable debt levels, there is unsustainable currency creation that has fueled speculation in financial markets and created inflation in the economy. The policy of disincentivizing work has led to supply shortages that will further harm the economy.

Jim Rickards, a past guest on my radio program, wrote a piece this past week titled “No Recovery Until 2045?” (Source: https://dailyreckoning.com/no-recovery-until-2045/)

In the excellent article, Mr. Rickards offers an interesting perspective. He notes that when debt levels get high enough, stimulus efforts fail. He notes that when sovereign debt exceeds 90% of the country’s economic output, the stimulus achieved is less than the new debt added to fund the stimulus. In other words, the greater the debt of a country, the more the return on stimulus investment diminishes.

At the present time, US national debt to GDP exceeds 130%. We are well past the critical 90% mark. The more debt-funded stimulus packages are attempted from this point on, the less effective they will be.

The current economic numbers bear this out; we have inflation and a contracting economy with both inflation and economic contraction likely to increase in the near term.

This week’s radio program features an interview with the founder and publisher of “Trends Journal”, Mr. Gerald Celente. Gerald’s past predictions have proven to be very accurate.

During the interview, Gerald offers his forecast for the US economy and the financial markets. You won’t want to miss this interview, as Gerald is forecasting that the next economic downturn will rival the 1930’s.

Don’t miss the interview. Click on the "Podcast" tab above to listen in now.

“To argue with a person who has renounced the use of reason is like administering medicine to the dead.”

-Thomas Paine