Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

A Historically Reliable Recession Indicator and What It’s Telling Us Now

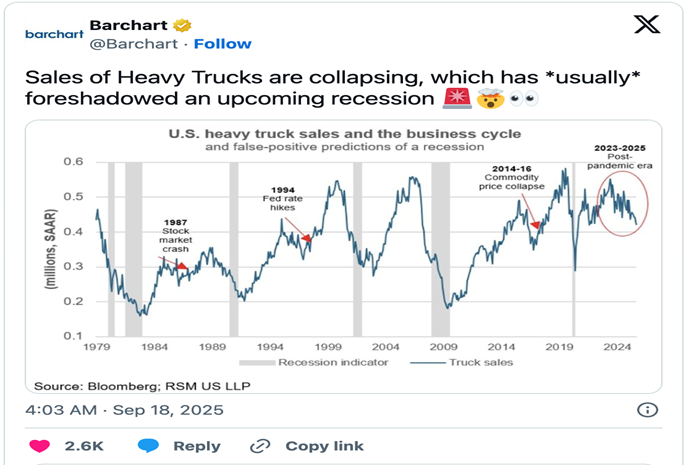

A historically reliable recession indicator – sales of heavy trucks – is now signaling recession, as noted by the chart.

Notice from the chart that heavy truck sales are falling, and while not at the same pace (at least yet) as seen at the time of the financial crisis, there has still been a significant decline.

Credit Scores Now Falling at Fastest Rate Since the Great Financial Crisis

Credit scores are now falling at the fastest pace since the Great Financial Crisis (Source: https://www.cnn.com/2025/09/16/economy/debt-credit-score-student-loans).

This is not all that surprising since Americans have been accumulating more debt. As I’ve reported here numerous times, credit card debt defaults are up, auto loan delinquencies are up, and student loan defaults are also up now that the Department of Education has resumed the collection of student loans earlier this year.

The resumed collection of student loan debts disproportionately impacts younger Americans more than older Americans since younger Americans tend to have more student loan debt than older Americans.

Between February and April of this year, more than 6 million consumers had a student loan delinquency added to their credit file, according to FICO. That puts the student loan delinquency rate at an eye-popping 29% among the 21 million student loan borrowers.

Argentina and the Inflation-Deflation Cycle

In my book “New Retirement Rules”, I detail the inflation followed by deflation cycle that has repeated itself frequently throughout history when easy money policies have been pursued.

Thomas Jefferson, one of the nation’s founding fathers, warned of putting bankers in charge of currency creation when he said, “If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the very continent their fathers conquered.”

In the “New Retirement Rules” book, I discuss three times in US history when this cycle has existed. The pattern is always the same: easy money policies or currency creation, followed by a period of what seems like prosperity, but it’s actually a prosperity illusion. Then, inflation emerges and ultimately, because of the debt that accumulates during the currency creation part of the cycle, deflation emerges.

Technically defined, inflation is an expansion of the currency supply, and deflation is defined as a contraction of the currency supply. When deflation appears, asset prices fall, and economic contraction begins.

The country of Argentina elected Javier Milei as its 59th president in 2023, with Milei taking office in December 2023. Milei ran a colorful campaign that resonated with voters since Argentina was suffering from annual inflation of more than 200% year-over-year. Milei appeared on the campaign trail with a chainsaw to illustrate the message central to his campaign - cut government spending to get inflation under control.

Milei was right about his message. Government deficit spending needs to be funded via borrowing or via currency creation. A 10% government operating deficit will cause 10% inflation.

Within nine weeks of taking office, Milei balanced the country’s budget. It was not without pain.

Since government spending is a part of gross domestic product, when government spending is reduced, so is gross domestic product. In plain terms, that means the economy contracts.

It also sets the stage for deflation to set in.

And it did.

Now that deflation has taken hold, Milei’s political opposition is digging in its heels. This is from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/milei-admits-market-panic-mode-argentine-capital-exodus-accelerates):

In the past few days, Milei’s rivals in the lower house of Congress ratcheted up their pushback against his austerity agenda. They rejected two controversial vetoes on education and health-care spending. The Senate is seen as even more hostile to the administration, meaning the higher spending will likely pass. The votes led to further slides in the country’s assets as they spell trouble for the second half of Milei’s term.

Deflation is brutal.

The problem for Argentina (and any other country) is that more spending funded by currency creation or borrowing merely kicks the proverbial can down the road.

RLA Radio

The RLA radio program this week features an interview that I did with Mr. Karl Deninger. The interview is posted and available now by clicking on the "Podcast" tab at the top of the page.

Quote of the Week

“Laugh at yourself first. Before anyone else can.”

-Elsa Maxwell

Comments