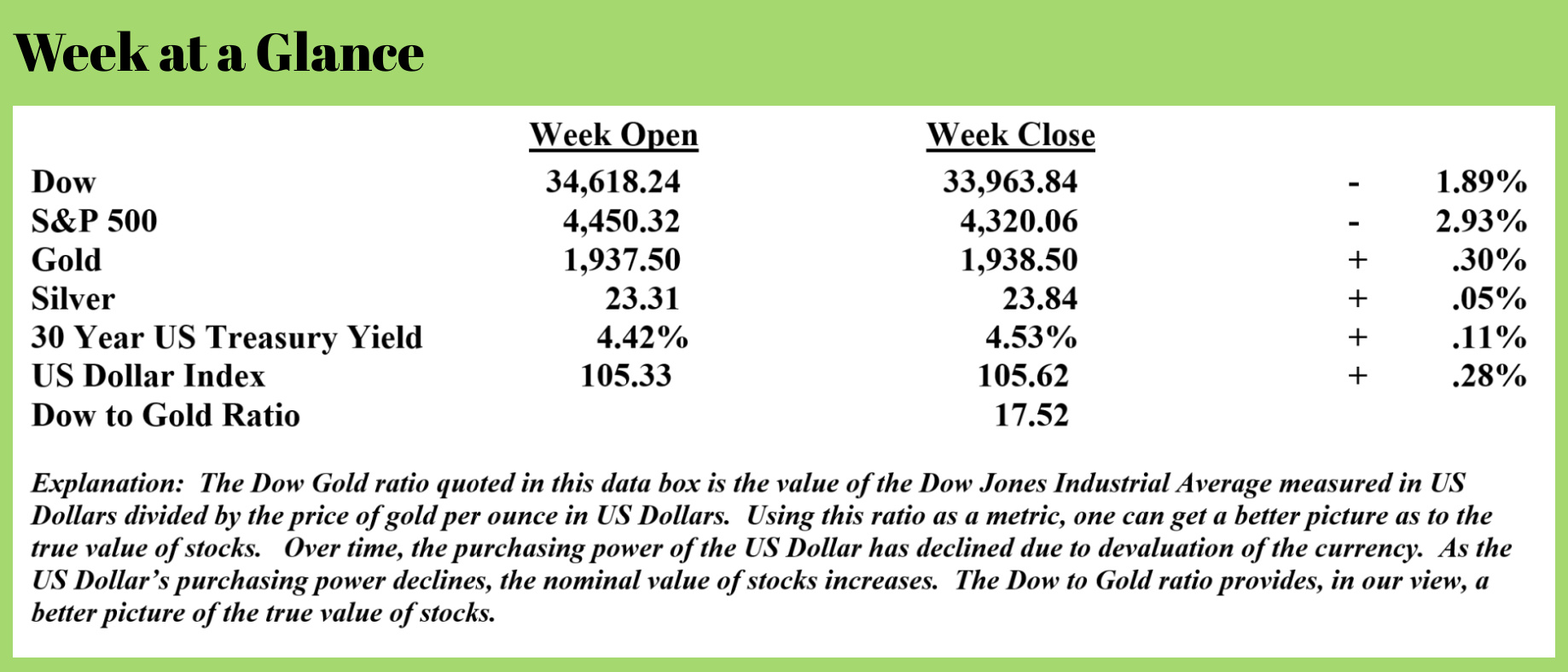

Weekly Market Update by Retirement Lifestyle Advocates

In the “Positions” newsletter for paid subscribers, we have been noting that stocks may be in the early stages of a classic, Elliott Wave three down.

Elliott Wave theory notes that markets tend to move in waves: three waves in the primary price trend and two counter-trend waves.

The chart I created and published here illustrates what may be happening with stocks. The price chart is a weekly chart of an exchange-traded fund that tracks the price movement of the Standard and Poor’s 500.

The blue line on the chart outlines the initial wave one down from December 2021 to October 2022. Countertrend wave two began in October of 2022 and continued through July of 2023. Now, it seems that wave three down may be beginning. If so, expect a potentially large decline, as wave threes tend to be the most powerful.

There are other signs that stocks are ready for a large decline, too.

In past issues of “Portfolio Watch”, I’ve discussed how overvalued stocks may be based on the “Buffett Indicator” a measure of stock values compared to economic output.

Another fundamental measure of stock valuations is earnings per share, which is directly correlated to corporate profits. Charles Hugh Smith wrote an interesting op-ed piece this past week regarding corporate profits. (Source: https://charleshughsmith.blogspot.com/2023/09/six-reasons-why-corporate-profits-will.html)

Smith contends that corporate profits are poised to decline, and the result could be a decline in stocks by 2/3rds. Smith’s reasoning on corporate profits is hard to argue with.

Here are some excerpts from his article and my comments:

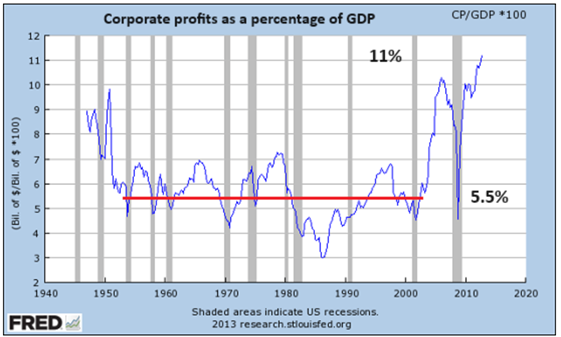

Reversion to the mean: profits that are double the historical average as a percentage of Gross Domestic Product (GDP) are highly likely not to be a sustainable New Normal. The far more likely track is a reversion to the historical average, which is about 50% below corporate profits' current 12% of GDP. Permanently elevated plateaus of stock valuations and corporate profits are both compelling chimera. (see chart)

Smith notes that historically speaking, corporate profits are about 6% of gross domestic product (economic output). They are now 12% - hardly sustainable.

Smith notes that historically speaking, corporate profits are about 6% of gross domestic product (economic output). They are now 12% - hardly sustainable.

The Boost phase of Globalization has ended. The era of hyper-globalization is clearly visible on the charts of corporate profits and corporate profits as a percentage of GDP: right after China was accepted into the WTO in 2001, US corporate profits skyrocketed in both nominal dollars and as a percentage of the US economy (GDP).

Globalization's boost phase that sent corporate profits into orbit has rounded the S-Curve and is now in the stagnation/decline phase.

The initial advantage of globalization has now diminished.

Quality and durability have been gutted, and there's no more profit to pluck from buying lower-quality components and inputs, as the cheapest, lowest-quality components and inputs have already been standardized.

Hyper-globalization provided the ideal cover for the systemic collapse of quality and durability. This corporate institutionalization of planned obsolescence, abysmal quality, and shrinkflation all boosted profits enormously, but there's nothing left at the bottom of the barrel; corporations have licked the profitable slop of planned obsolescence, abysmal quality, and shrinkflation clean.

Anyone who purchased household appliances 30 years ago as well as currently knows the truth of planned obsolescence first-hand.

Hyper-financialization has also entered the decay-collapse phase. Hyper-financialization drove corporate profits in two ways:

A. As borrowing costs dropped to unprecedented lows, corporations could borrow vast sums at near-zero rates to scoop up other companies with positive cash flow, gut the quality and staff, and scoop up the resulting cost reductions as profits.

B. Consumers could borrow vast sums at low rates to buy products that they would not have been able to afford at historically average interest rates. For example, with 1.9% (or even zero) financing, new autos and trucks became more affordable. With demand strong, corporations could keep prices high and reap the gains of stronger sales.

Now that zero-interest rate policy (ZIRP) has ended its disruptive reign, the tailwinds of zero rates have reversed into the headwinds of structurally higher rates.

Higher interest rates are taking a toll. This past week, I spoke with someone who has been a long-time, very successful mortgage broker who just left the business because there is little business to be had.

The asymmetric distribution of the economy's output favoring corporations at the expense of labor is finally shifting. After 45 years of capital skimming $50 trillion from labor, rising rates of disability, unfavorable demographics, systemic healthcare inflation and social dynamics are pushing labor costs higher.

One of the initial benefits of globalization was wage arbitrage. Those benefits are now evaporating.

Debt saturation. Corporate profits soared from $800 billion annually to $3.5 trillion in 2022 on the tailwinds of public and private debt skyrocketing from $30 billion in 2000 to $95 trillion today. With the era of zero cost of debt over, we've entered an era of debt saturation: households, government, and enterprises can no longer afford to take on more debt without triggering unintended consequences or slashing discretionary spending to service the higher costs of new and existing debts.

Since growth depends on the ceaseless expansion of debt and the discretionary spending it enables, growth reverses along with discretionary spending. Corporations will find it impossible to keep prices at nosebleed levels as consumer demand plummets while costs remain sticky.

Debt accumulation makes everything seem prosperous for a period of time, but eventually, the proverbial rooster comes home to roost.

Rather than being the New Normal, corporations skimming 11% of GDP as profits was a one-time outlier resulting from the one-time boost of hyper-financialization, hyper-globalization, and ZIRP. US GDP is around $26 trillion, according to the Bureau of Economic Analysis (BEA). Corporate profits sagged a bit to $3.2 trillion in Q1 2023, roughly 12.3% of GDP.

Should profits decline to 5% of GDP ($1.3 trillion), this would be in the middle of the historic range. In a real recession, they could dip to 3% of GDP ($800 billion). At 5% of GDP ($1.3 trillion), corporations would still be making money, but not at rates that would justify today's absurdly overvalued stock valuations.

Should profits decline to 5% of GDP ($1.3 trillion), this would be in the middle of the historic range. In a real recession, they could dip to 3% of GDP ($800 billion). At 5% of GDP ($1.3 trillion), corporations would still be making money, but not at rates that would justify today's absurdly overvalued stock valuations.

The $2 trillion haircut equates to a 2/3 decline. Should stock valuations track this same decline in profits, it's entirely reasonable to expect the stock market to lose 2/3 of its valuation premium--a premium based not on anything remotely sustainable but on a one-off of hyper-financialization, hyper-globalization, and zero interest rates.

There's nothing wrong with a 5% of GDP run-rate for corporate profits. That's still a very healthy return. It's only a disaster in a highly distorted funhouse whose players have lost touch with reality.

The time frame through which we have all lived over the past 15 years has been largely artificial, and the prosperity we experienced wasn’t prosperity at all – rather, it was a prosperity illusion.

Now, debt levels in the private sector, when measured as a percentage of GDP, are higher than at the onset of the Great Depression. In my view, there cannot be a happy ending ahead.

Rather, the consequences of decades of easy money policies and debt accumulation are now emerging.

This will eventually lead to deflation, likely the most severe deflation in more than a century. The only question in my mind is if the Fed will be able to inflate the bubble one more time.

I doubt it.

The best course of action is to make a plan to weather both inflation and deflation.

As I’ve noted previously, the US Government is tasked with having to refinance $7.6 trillion in debt over the next twelve months while financing a $2 trillion deficit.

I don’t believe this can happen without massive new currency creation.

My best guess is that this leads to a stagflationary outcome – rising consumer prices and a shrinking economy.

If you haven’t yet taken steps to protect yourself, the time to do so is now.

We could be on the brink of the next wave down.

The radio program this week features a special report interview that Jeremy Bolker did with me. Jeremy gets my forecast on stocks, bonds, and precious metals, as well as the US economy.

The show is available to listen to now by clicking on the "Podcast" tab at the top of this page.

“There is no justification for taking away individual’s freedoms under the guise of public safety.”

-Thomas Jefferson

Comments