Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

The Real Reason Gold Has Made a Huge Move Up This Year

At our retirement, tax, and investment planning events, I often discuss the fact that, despite the price of gold now pushing $4,000 per ounce, up from $35 per ounce in the 1970s, gold is not more valuable.

At our retirement, tax, and investment planning events, I often discuss the fact that, despite the price of gold now pushing $4,000 per ounce, up from $35 per ounce in the 1970s, gold is not more valuable.

While that seems very contrarian, when you ponder this thought, it makes perfect sense. An ounce of gold doesn’t make more jewelry than it did 50 years ago, nor does an ounce of gold allow for a larger coin to be minted presently than in the 1970s. An ounce of gold hasn’t changed in thousands of years.

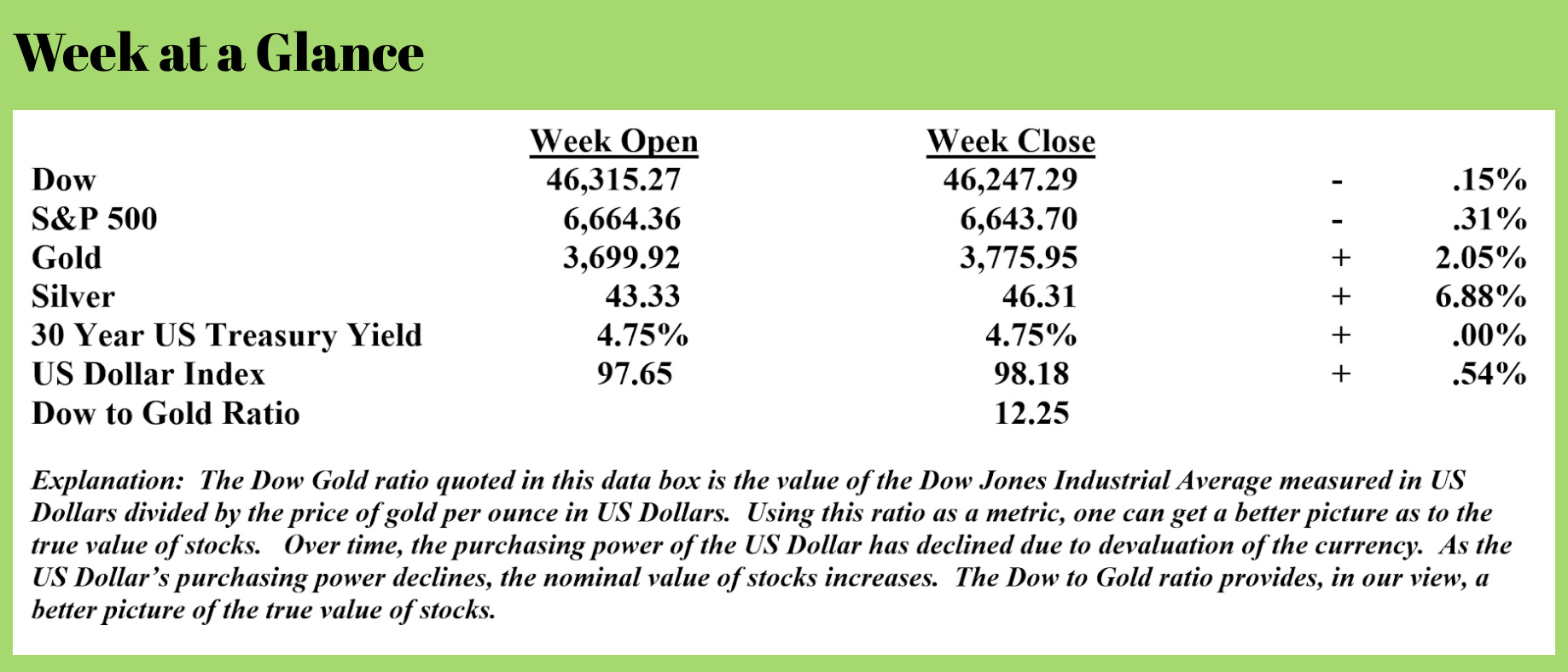

The increasing price of gold in nearly every currency is simply a reflection of how quickly the world’s fiat currencies are losing purchasing power. The chart above, published by Jesse Columbo (Source: https://thebubblebubble.substack.com/p/gold-isnt-going-up-your-money-is), illustrates.

Since 2007, gold has increased in price by about 450% on average, depending on which fiat currency one uses to price the yellow metal. As Columbo points out in his excellent piece, since 2007, gold priced in Swiss Francs is up about 270%, but priced in British pounds, it’s up about 748%!

Since 2007, gold has increased in price by about 450% on average, depending on which fiat currency one uses to price the yellow metal. As Columbo points out in his excellent piece, since 2007, gold priced in Swiss Francs is up about 270%, but priced in British pounds, it’s up about 748%!

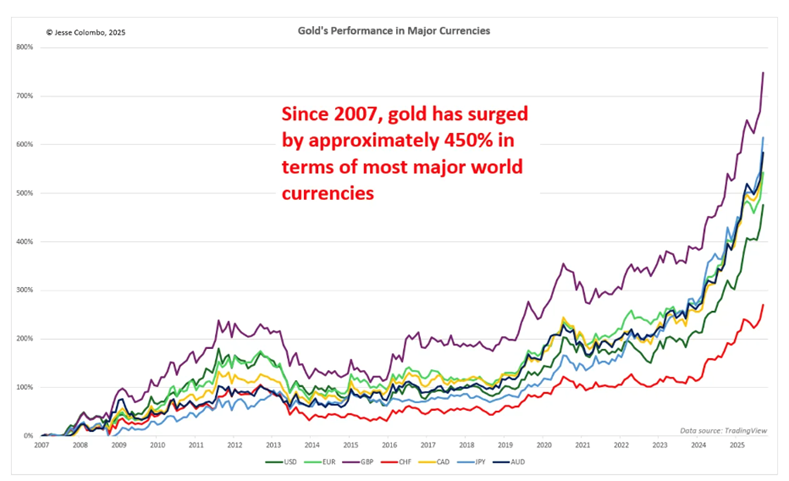

Columbo then points out via another chart that since 2007, major currencies have lost about 85% of their purchasing power relative to gold.

Currency devaluation is accelerating; a trend that I believe will continue simply because the Federal Reserve is painted into the proverbial corner.

The Hamstrung Fed

As you undoubtedly know by now, the Federal Reserve, the central bank of the United States, recently cut the Fed Funds rate by .25%.

I suggested that would happen by the end of the year earlier this year, and I fully expect another .5% to .75% in cuts before the dawn of 2026.

Why?

The Fed is hamstrung.

As Peter St. Onge so articulately explained in a recent piece (Source: https://www.profstonge.com/p/debt-has-castrated-the-fed), fiscal dominance will now dictate Fed policy and tax policy moving ahead in time. Fiscal dominance is a term used when debt levels get so large that debt levels determine policies.

This means central banks cannot raise interest rates and governments can’t cut taxes. This is already happening.

Japan’s Prime Minister recently announced that debt levels in that country are so large, they can never again cut taxes. (Source: https://www.profstonge.com/p/japans-debt-markets-implode)

While Japan’s debt problem is extreme, nearly every country in the world is on the same path. The British Government just announced a tax increase. This tax increase comes on the heels of another tax hike that was the biggest in a generation. The British Government, desperate to sell bonds to finance debt and deficit spending, is trying to persuade investors that the country can afford to run a deficit of 5% of the country’s economic output.

Lest you think this is only an overseas problem, the United States is presently running a larger deficit than the British at 6% of gross domestic product.

This fiscal dominance condition that is now affecting much of the world means two outcomes are now a near certainty.

One, future tax rates will almost certainly have to be higher than they are today.

If you haven’t yet incorporated tax reduction planning into your overall financial plan, now is the time to move. The recent passage of OBBBA (the One Big Beautiful Bill Act) made the lower income tax rates that were set to expire at the end of this year permanent.

While using the word ‘permanent’ to describe any tax rate or tax law is laughable, it’s my view that we have a 4 to 5-year window to achieve potentially significant tax savings, especially if you have retirement accounts or are higher-income.

Two, it’s also a near certainty that central banks around the world and the Federal Reserve here in the US will be forced to further reduce interest rates and once again engage in quantitative easing as they become the buyers of last resort of government debt.

That means in addition to tax planning, you might seriously consider portfolio changes that may allow you to prosper in an inflationary environment. It’s becoming increasingly obvious that central banks will be powerless to control surging inflation.

RLA Radio

The RLA radio program this week features an interview that I did with Mr. Doug Casey of Casey Research. I chat with Doug about the current economic environment and his recent book “The Preparation”. Regarding the book, if you know a college-age student, I strongly encourage you to check out this interview. The podcast is posted and available now by clicking on the "Podcast" tab at the top of this page.

Quote of the Week

“The nice thing about being a celebrity is that when you bore people, they think it’s their fault.”

-Henry Kissinger

Comments