Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

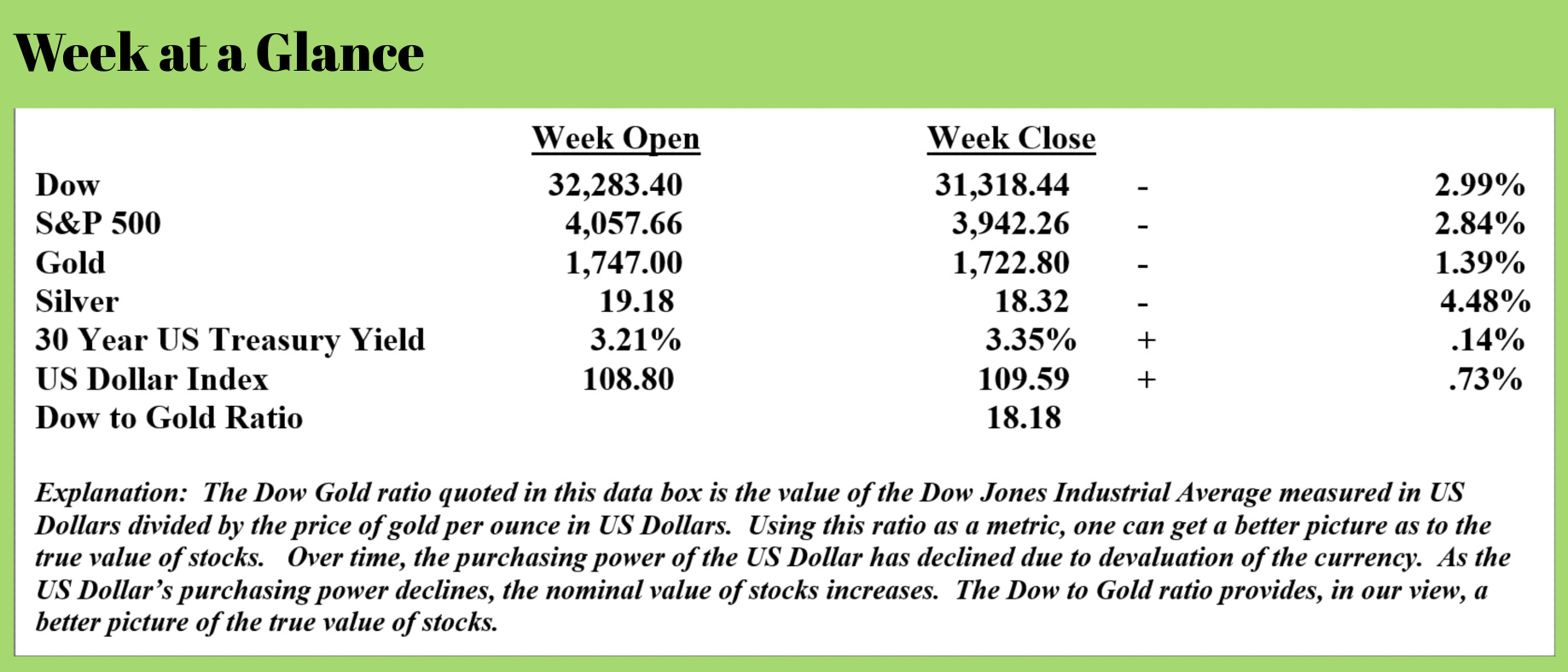

All markets had a tough week last week. Historically speaking, stocks, US Treasuries, and precious metals are not typically correlated, but you wouldn’t know that looking at the performance of these asset classes year-to-date.

I expect that this is an aberration of sorts and more typical inversely correlated performance will once again resume in the relatively near future.

In my view, the worldwide economy is transitioning to a deeper recession. There are many signs that point to this.

The reality is that working Americans and those in the middle and lower economic classes worldwide are struggling. The data bears this out.

This from “The Epoch Times” (Source: https://www.theepochtimes.com/average-credit-card-debt-soars-by-13-percent-largest-increase-since-1999_4706178.html) (Emphasis added):

The average credit card debt held by households in the United States surged by 13 percent in the second quarter, the largest increase in such debt since 1999, according to an Aug. 30 report from the Federal Reserve Bank of New York.

More consumers are increasingly relying on credit amid sky-high inflation in order to pay their bills.

Credit card balances increased by $46 billion from last year, becoming the second-biggest source of overall debt last quarter, though it is below pre-pandemic levels.

Meanwhile, the current credit card interest rate is now at a record high of 17.96 percent, according to Bankrate, a financial advice website.

Total American household debt rose by $312 billion from the second quarter of 2021 for a total of $16.15 trillion at the end of June 2022.

This is a 2 percent rise from the year-ago quarter, largely due to a jump in mortgage rates, and car loan and credit card balances, caused by40-year high inflation, said Joelle Scally, a New York Fed analyst, in a statement.

The Federal Reserve is attempting to fight inflation by raising interest rates, causing fears that its aggressive moves may encourage a bad recession, as the economy recovers from the pandemic.

“The second quarter of 2022 showed robust increases in mortgage, auto loan, and credit card balances, driven in part by rising prices,” said Scally, who reviews microeconomic data at the central bank branch.

Household debt balances are about $2 trillion higher than they were at the end of 2019, before the start of the pandemic, as the price of goods and services have skyrocketed.

Household debt is increasing at a time when debt levels are already near historical highs. Desperate consumers are not only increasingly using existing credit card accounts but also opening new accounts to attempt to keep their liquidity options open in an increasingly challenging economic environment. This from “Schiff Gold” (Source: https://schiffgold.com/key-gold-news/record-consumer-debt-levels-continue-to-climb/) (Emphasis added):

Not only are credit card balances growing; consumers are trying to find ways to borrow even more. According to Fed data, Americans opened 233 million new credit card accounts in the second quarter of this year. That was the largest number of new accounts opened in a single quarter since 2008 – the beginning of the Great Recession.

Aggregate limits on credit card accounts increased by $100 billion in Q2 and now stand at $4.22 trillion. That reflects the largest increase in more than 10 years.

Rising interest rates are bad news for Americans depending on credit to pay their bills. With interest rates rising, Americans are paying more in interest charges every month, and many will see minimum payments rise. Average annual percentage rates (APR) currently stand at just over 17.42%. That’s up from 16.6% just two months ago. Analysts say they may well rise above 18% by the end of the year, breaking the record high of 17.87% set in April 2019. With every Federal Reserve interest rate increase, the cost of borrowing will go up, putting a further squeeze on American consumers.

Non-revolving credit also surged in June, increasing by $25.4 billion, an 8.8% year-on-year jump. This includes auto loans and student loans. Total non-revolving credit now stands at $3.502 trillion.

Payments on existing debt are rising due to higher interest rates while inflation erodes the purchasing power of the dollar, creating the perfect economic storm.

Case in point, Americans have not opened this many new credit card accounts since 2008, which was the last time a Federal Reserve induced assets bubble burst and thrust the nation into a recession.

The restaurant industry offers a snapshot of changing consumer behavior in light of inflation and the economic slowdown. Traditional, full-service restaurants are seeing business decline, while fast food restaurants are seeing an increase in business. This from “Zero Hedge” (Source: https://www.zerohedge.com/personal-finance/uncertain-times-americans-stick-fast-food) (Emphasis added):

U.S. fast food and other limited service restaurants did not only get through the pandemic better than the restaurant industry as a whole - in high inflation times, affordable fast food has also been seeing steadily growing sales while other restaurant types could not uphold their post-pandemic growth trajectory.

In fact, as Statista's Katharina Buchholz details below, in June, the latest month on record with the Census Bureau, quick service restaurant sales grew by 14.4 percent, while those of other restaurants were down to 9.2 percent year-over-year.

Sales of limited-service restaurants - which were well equipped for pandemic lifestyles due to their emphasis on take-out and drive-thru experiences - did not dip as much in the pandemic as those of regular restaurants did.

However, by spring of 2021, other restaurant sales had once more overtaken fast food sales and stayed on a higher growth trajectory after leaving pandemic effects behind. In June, however, other restaurant sales slipped by almost $1.7 billion compared to May, while limited-service restaurant sales only decrease by $150 million.

According to Bloomberg, drive-thru services have been aiding fast food chains as they stayed popular beyond the pandemic. In February, U.S. drive-thru sales were 20 percent higher than they had been in the same month two years earlier.

Industry publication QSR is even speaking of a "golden age of fast food" as sales and restaurant numbers are expanding in the sector, while also acknowledging headwinds like the hiring crunch, inflation

The decline in the sales numbers of full-service restaurants in June of this year is simply staggering. More evidence that inflation is taking a toll on the budgets of Americans.

Inflation and energy policy have seen utility costs rocket higher along with food and other consumer staples. Record numbers of Americans are now behind on utility bills. This from “Fox News” (Source: https://www.msn.com/en-us/news/us/more-than-20-million-us-households-are-behind-on-utility-bills/ar-AA119HlP) (Emphasis added):

New data indicates a staggering number of American households are currently behind on making utility payments due mainly to soaring energy costs, sparking fears that mass power shutoffs are on the horizon.

The National Energy Assistance Directors Association says more than 20 million U.S. families are behind on their utility bills, numbers NEADA executive director Mark Wolfe believes are "historic."

The NEADA chief told FOX Business what is even more alarming is the surge in the collective amount owed, which sat at roughly $8.1 billion at the end of 2019 and has now skyrocketed to around $16 billion. The average delinquent bill climbed from $403 to $792.

A primary driver behind the utility debt is a surge in energy prices. The cost of natural gas – used to power homes so folks can keep cool in the summer and warm in the winter – was up 30.5% year-over-year in July, according to the Labor Department.

While energy is in high demand in the summer, experts say heating bills this winter will bring more pain.

Andrew Lipow, president of energy consulting firm Lipow Oil Associates wrote this week that "the consumer is going to pay more for their heating bills this winter," adding that "whether they use natural gas or home heating oil, most will have sticker shock."

He went on to note that "natural gas futures prices are now more than double what they were a year ago."

Regardless of what you call it, a recession is here in my view. And the data suggests it will get worse before it gets better.

This week’s radio program and podcast features an interview with multiple-time best-selling author and economist, Harry Dent. Harry is a renowned expert in economic forecasting based on demographics.

On this week's show, I get Harry’s forecast for stocks, bonds, and the economy moving ahead. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Strong reasons make strong actions.”

-William Shakespeare

Comments