Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Are Global Government Bond Markets Signaling Imminent Trouble?

It’s no secret that the higher the loan risk, the higher the interest rate on the loan.

If your credit score is 800, you’ll pay a lower interest rate on a loan than if your credit score is 600.

Loans to governments work the same way. The higher the perceived risk, the higher the interest rate an investor will demand for loaning a government money via purchases of government bonds.

With that explanation serving as context, look at what is currently happening in global bond markets. In short, longer-term bond yields are moving steadily higher around the globe as governments become less creditworthy.

In the UK, 30-year bond yields are at a twenty-seven-year high of 5.7%. The UK pays about 70 basis points more to finance debt for thirty years than the United States. U.S. thirty-year bonds, now yielding about 5% are at an eighteen-year high. (Source: https://finance.yahoo.com/news/bond-markets-show-world-flirting-060000042.html)

The country of Japan, which only began issuing thirty-year bonds in 1999, now finds itself paying all-time high borrowing costs on the thirty-year bond of 3.2%. Germany’s thirty-year borrowing costs are up too, standing at a fourteen-year high of 4.4%.

Globally, as credit risk increases, so do interest rates. Don’t expect a rate cut by the Federal Reserve to meaningfully impact this trend. And it may be wise to avoid investments that will decline as interest rates continue to increase.

Gold Now the Preferred Reserve Asset

As sovereign credit risk increases, central banks around the globe are continuing to take predictable steps to protect themselves. As I have been reporting here for some time, central banks have been accumulating gold and dumping US Treasuries.

Last week, “Financial Express” reported that central banks now hold more reserves in gold than in U.S. dollar-denominated assets for the first time since 1996. (Source: https://www.financialexpress.com/market/gold-pulse/central-banks-now-hold-more-gold-than-us-treasuries-for-the-first-time-in-30-years/3962153/)

According to the “Financial Express” piece, central banks now hold 36,344 tons of gold as of May 2025. According to the World Gold Council, global central banks bought 1,082 tons of gold in 2022, 1037 tons of gold in 2023, and a record 1,180 tons in 2024.

Gold accumulation by central banks at this pace marks a huge increase from the 400-500 tons of gold purchases annually over the previous decade.

Perhaps even more interesting is the fact that central banks are still interested in adding to their gold holdings. The World Gold Council’s central bank gold reserves survey, which was recently released, found that 43% of central bankers around the world plan to increase their gold holdings over the next 12 months.

I expect the rally in gold and silver to continue over the long term, although a pullback or period of consolidation here would not be surprising given the performance of precious metals priced in fiat currencies so far this year.

More Evidence of the Wealth Gap

I’ve long commented on how the policies of the Federal Reserve over the past 15 years or so have exacerbated the wealth gap in the United States. As the affluent have somewhat benefited from the inflation these policies have created since real estate and stocks have appreciated (at least nominally), those with no assets or few assets have found it more difficult to make ends meet. One only needs to observe the much lower level of personal savings and much higher levels of credit card debt to verify this trend.

Now, in another sign that lower-income and middle-income Americans are feeling the effects of these policies, the amusement park company Six Flags is closing parks and facing possible bankruptcy.

Six Flags merged with the amusement company Cedar Fair less than one year ago. Yet, despite the merger, the company has racked up $500 million in debt and seen revenue fall by $100 million in the second quarter alone. (Source: https://www.zerohedge.com/markets/six-flags-faces-bankruptcy-fears-after-500m-debt-and-park-closures). Attendance at parks in the second quarter of this year was down 9% and sales of season passes fell by 8%. Two parks have already been shuttered, and California’s Great America is closing in 2027.

Dennis Speigal of International Theme Park Services suggested that ‘the whole company needs to be reimagined’ and that ‘bankruptcy is not out of the question’.

When the merger with Cedar Fair was announced last year, executives forecast 6% attendance gains in 2025. As noted above, that has not happened. Instead, attendance fell by 9%.

Earlier this year, McDonald’s restaurants announced that same-store sales fell 3.6% in the first quarter, the worst three-month decline since 2020. (Source: https://www.nbcnews.com/business/business-news/mcdonalds-us-sales-drop-pandemic-middle-income-consumers-pull-back-rcna204032)

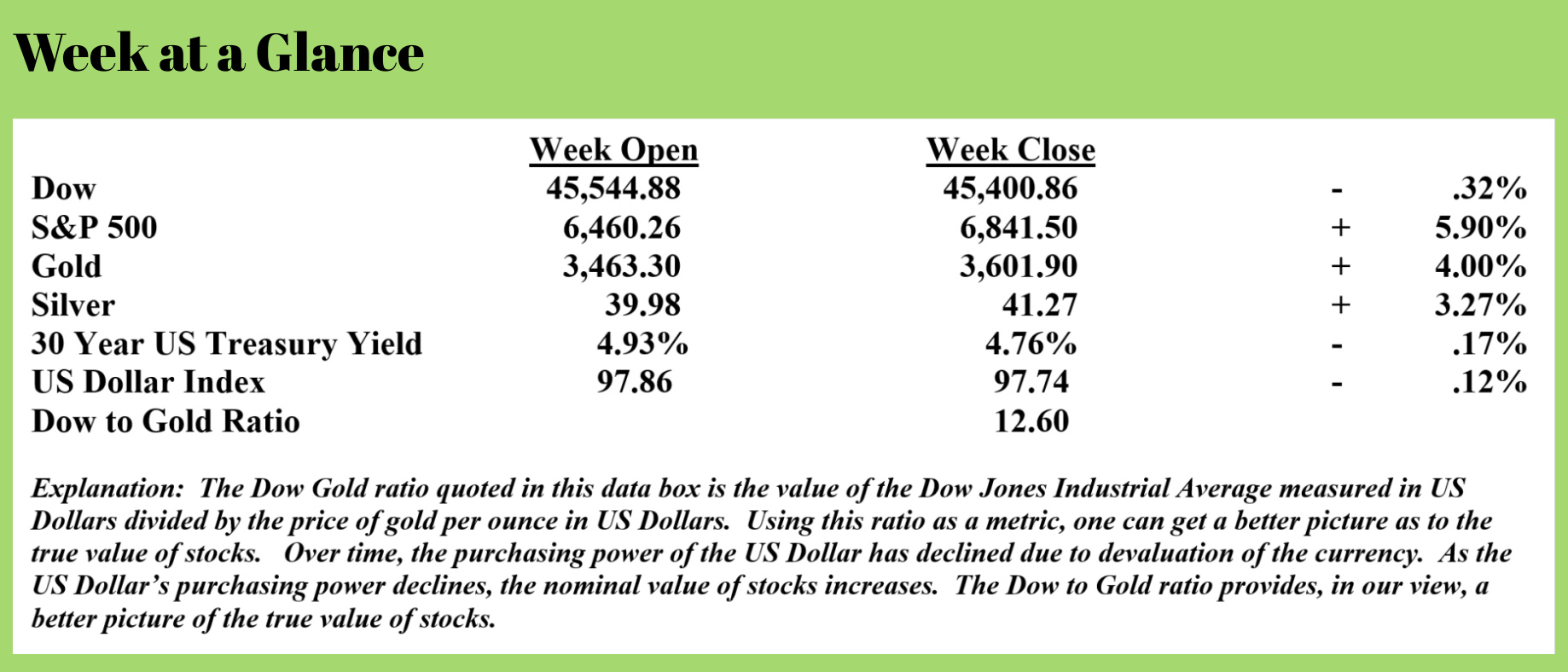

When investing, it’s going to be important to keep this accelerating trend in mind. While the broad stock market is still rallying, the higher prices in stocks have more to do with currency devaluation than anything else.

RLA Radio

The RLA radio program this week features a ‘best-of’ interview that I conducted with Mr. Michael Pento, host of the popular “Mid-Week Reality Check” podcast.

The interview is posted and available now by clicking on the "Podcast" tab above.

Quote of the Week

“Money frees you from doing things you dislike. Since I dislike doing nearly everything, money is handy.”

-Groucho Marx

Comments