Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The economic news continues to concern.

As anyone who has been a long-term reader of “Portfolio Watch” knows, when the Federal Reserve began quantitative easing programs, a.k.a. currency creation, I suggested we would ultimately have inflation followed by deflation or should the Fed be tempered in its approach to currency creation, we could move directly to a deflationary environment.

Technically speaking, inflation is an expansion of the money supply while deflation is a contraction of the money supply. Since all currency presently is debt, when debt levels reach unsustainable levels, the money supply contracts.

Since shortly after the time of the financial crisis, the Federal Reserve has been engaged in currency creation. When studying history, one discovers that currency creation initially results in prosperity. A better term to use to describe this prosperity is prosperity illusion since currency creation doesn’t solve the debt excess problem; instead, it temporarily masks the effects of too much debt on the economy.

History teaches us that eventually, the debt excesses become the dominant economic force and because the central bankers and policymakers have only one response to the recessionary impact of debt excesses, they resort to more currency creation.

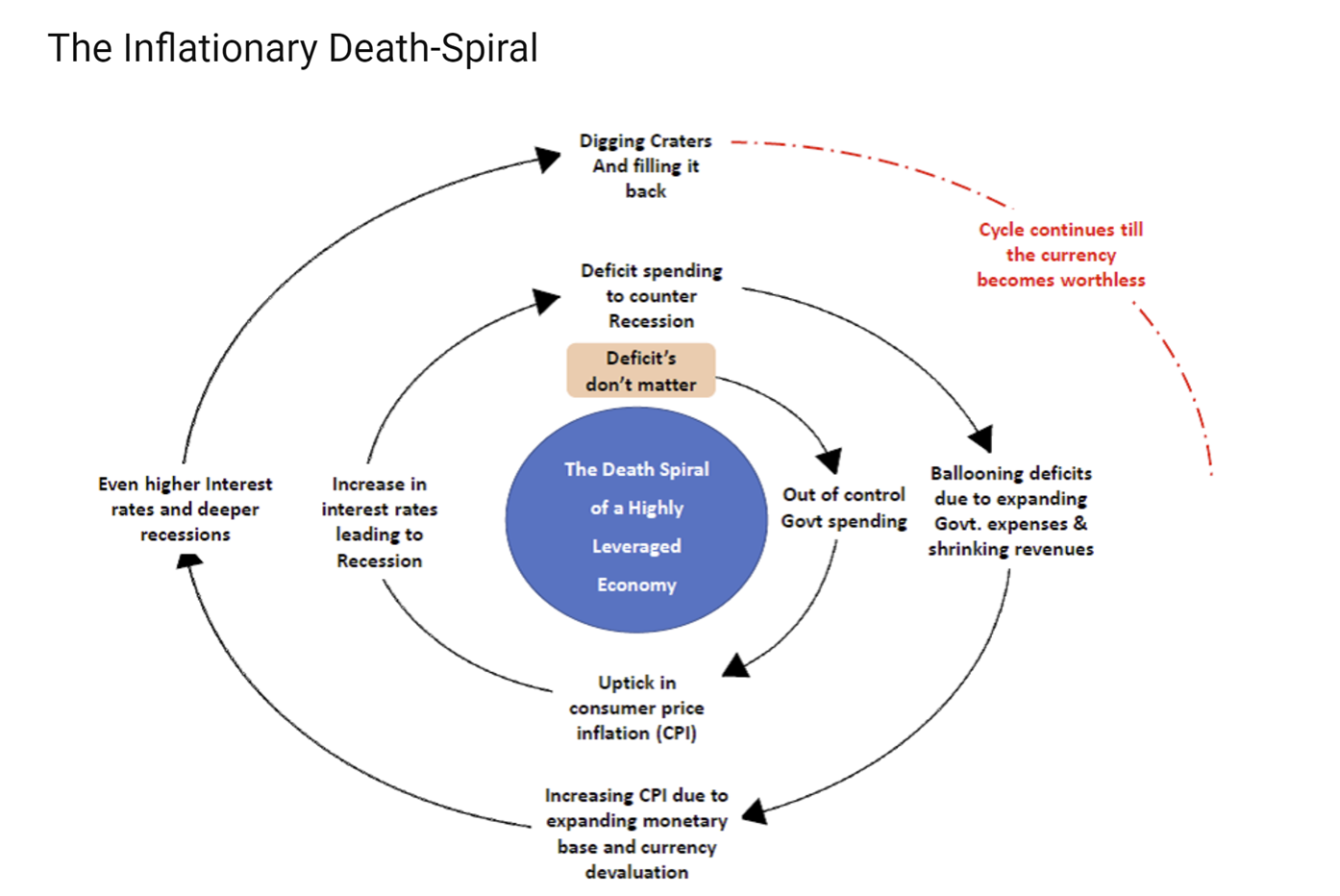

This is the beginning of something that I wrote about last week – the inflationary death spiral.

If you missed last week’s issue of “Portfolio Watch”, you can read it at www.RetirementLifestyleAdvocates.com.

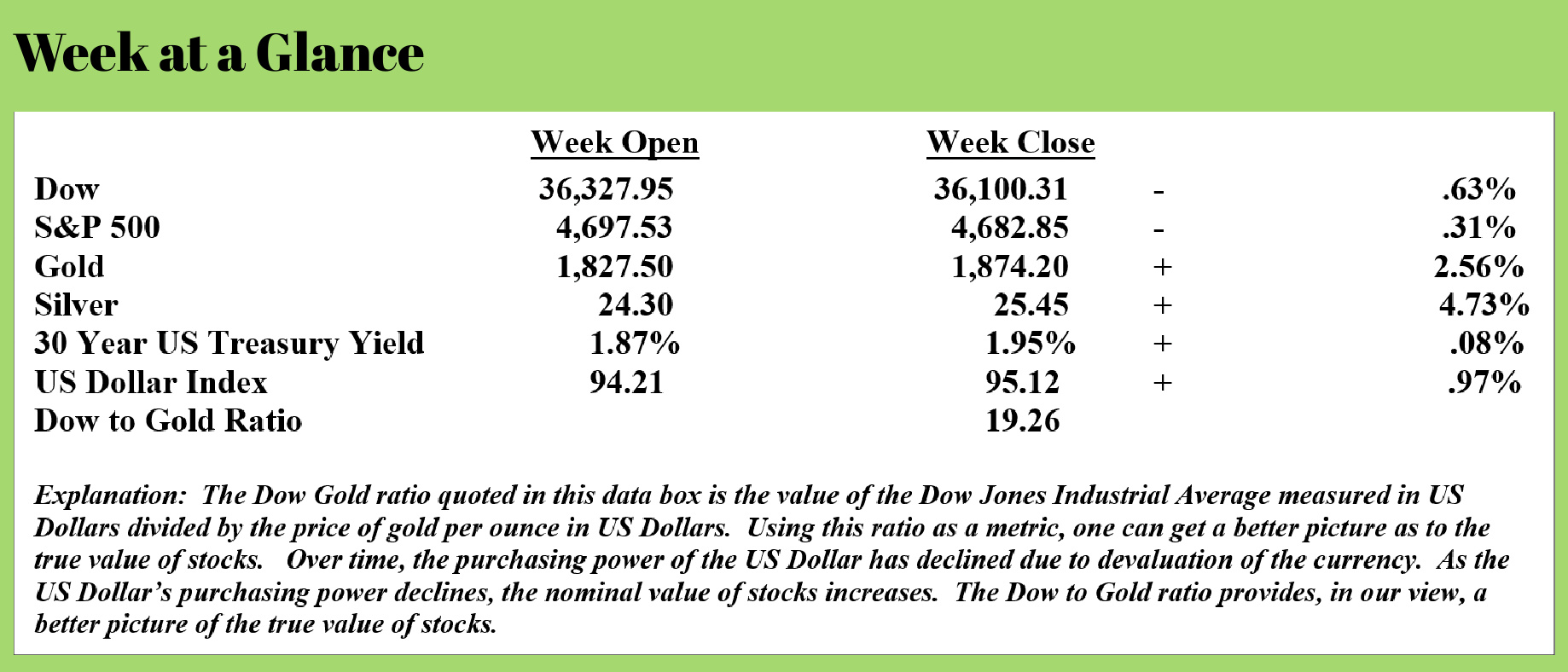

For reference, I am reproducing the inflationary death spiral chart here again.

Notice from the chart, that the death spiral begins in earnest when the politicians began to promote the rhetoric that deficits don’t matter.

Obviously, with the proponents of the non-sensical Modern Monetary Theory are gaining in number and while their collective voice is getting louder, this theory is being advanced because any theory based on sound economics would require that government spending deficits be eliminated, and reliable currency being adopted.

Massive deficit spending with existing debt levels automatically eliminates the adoption of reliable, sound money. Policymakers have two choices – one, act responsibly when it comes to finances or two, promote a theory that validates your collective irresponsible behavior.

The current crop of policymakers has chosen the latter.

But, as the inflationary death spiral illustrates, eventually, this theory will be proven to be erroneous as inflation accelerates in earnest.

For context, let’s review the first few stages of the inflationary death spiral.

One, the politicians and policymakers advance the theory that deficits don’t matter. Two, government spending picks up speed and rises far faster than tax revenues. The increasing deficit is funded via more currency creation. Three, consumer price inflation kicks in. Four, interest rates begin to rise in response which throws the economy into recession.

I believe that is where we now find ourselves as interest rates began to increase last week and I believe that the economy is already in a recession although not officially. While its highly doubtful that interest rates will rise from here in a straight line, over time, interest rates will move higher exacerbating the economic difficulties.

The response to recession will be more currency creation…..and the cycle continues.

Michael Snyder penned a terrific piece last week that brilliantly describes where we find ourselves economically speaking currently. (Source: http://themostimportantnews.com/archives/they-have-lost-control-and-now-the-dollar-is-going-to-die)

Michael begins with some context:

All throughout history, there have been many governments that have given in to the temptation to create money at an exponential rate, and it has ended badly every single time.

So, our leaders should have known better.

But it is just so tempting because pumping out money like crazy always seems to work out just great at first. For example, when the Weimar Republic first started wildly creating money it created an economic boom, but we all know how that experiment turned out in the end.

He then continues by discussing some of the recent economic news beginning with consumer price inflation.

Very painful inflation is here, and on Wednesday we learned that prices have been rising at the fastest pace in more than 30 years…

The consumer price index, which is a basket of products ranging from gasoline and health care to groceries and rents, rose 6.2% from a year ago, the most since December 1990. That compared with the 5.9% Dow Jones estimate.

On a monthly basis, the CPI increased 0.9% against the 0.6% estimate.

If inflation continues to rise at about 1 percent a month, it won’t be too long before we are well into double digits on a yearly basis.

Of course, I don’t actually put too much faith in the inflation numbers that the government gives us, because the way inflation is calculated has been changed more than two dozen times since 1980.

And every time the definition of inflation has been changed, the goal has been to make inflation appear to be lower.

According to John Williams of shadowstats.com, if inflation was still calculated the way it was back in 1980, the official rate of inflation would be close to 15 percent right now.

This is a real national crisis, and it isn’t going away any time soon.

One of the factors that is driving up the overall rate of inflation is the price of gasoline. If you can believe it, the price of gas is almost 50 percent higher than it was last year at this time…

Gasoline prices last month shot up nearly 50% from the same month a year ago, putting them at levels last seen in 2014. Grocery prices climbed 5.4%, with pork prices up 14.1% from a year ago, the biggest increase since 1990.

Prices for new vehicles jumped 9.8% in October, the largest rise since 1975, while prices for furniture and bedding leapt by the most since 1951. Prices for tires and sports equipment rose by the most since the early 1980s.

Even Joe Biden is using the term “exceedingly high” to describe the current state of gasoline prices.

Other forms of energy are also becoming a lot more expensive…

The price of electricity in October increased 6.5% from the same month a year ago while consumer expenses paid to utilities for gas went up 28%, according to numbers released Wednesday by the U.S. Bureau of Labor Statistics. Fuel oil rose 59%, and costs for propane, kerosene and firewood jumped by about 35%, the data show.

It is going to cost you a lot more money to heat your home this winter.

Price increases are occurring while real wages are declining. More from Michael’s piece:

The Labor Department’s own numbers show that real average hourly earnings are going down…

The Labor Department reported Friday that average hourly earnings increased 0.4% in October, about in line with estimates. That was the good news.

However, the department reported Wednesday that top-line inflation for the month increased 0.9%, far more than what had been expected. That was the bad news – very bad news, in fact.

That’s because it meant that all told, real average hourly earnings when accounting for inflation, actually decreased 0.5% for the month.

What this means is that our standard of living is going down.

Americans are increasingly resorting to taking on more debt to make ends meet. Household debt is now more than $15 trillion, a record high while credit card usage is increasing, and debit card usage is declining.

The death spiral is in full swing.

This week’s radio program is an interview with Mr. John Rubino, co-author of the book “The Money Bubble”. The book was published 10 years ago and perfectly forecasts exactly where we find ourselves today.

You won’t want to miss this interview with John. Click the "Podcast" tab at the top of this page to listen now.

“You know who must be very secure in their masculinity? Male ladybugs.”

-Jay Leno